MARKET SUMMARY 10-20-2022

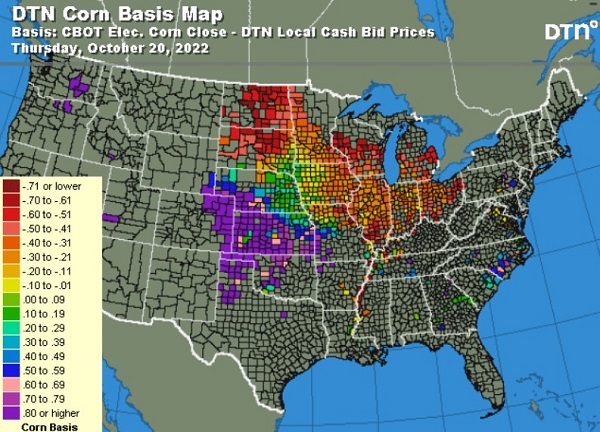

As corn harvest rolls on in the U.S., the market is closely watching the basis being paid for those fresh corn supplies. The basis maps strongly reflect the current issues across the country and its impacts on the cash corn market. The West is very strong, reflecting the poor crop across the region and the demand for feed to provide supplies to the livestock and ethanol industries in that area. The central and eastern U.S. are being pressured by the poor water levels on the Mississippi River and associated watershed as supplies are backing up due to slow grain movement on the river. Going forward, the supplies of available corn nationally are still extremely tight, and the key for the cash market may likely be based on the ability to move bushels from East to West versus South down the river. The national corn basis is trending well above 5-year averages, showing the impact of tight supplies and the need in domestic demand. The corn basis nationally is friendly for the corn market going into the second half of harvest.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures broke a four-day losing streak, picking up 5-3/4 cents in December to close at 6.84. December 2023 added 4-1/2 cents to end the session at 6.25. Strength in soybeans and a weaker dollar during the morning hours provide support, as did firmer energy prices. Lackluster export sales and harvest are keeping rally potential in check.

Export sales at 16.1 mb were disappointing and continue to run behind a weekly pace needed to meet USDA projections. Year-to-date sales at 544.5 mb are only 47.8 percent of the same figure from a year ago for this same time (1.137 bb). The current USDA estimate for expected sales during the 2022/2023 season is 2.150 bb. This figure has been reduced in each of the last two USDA reports. Today’s futures gains put December corn almost dead in the middle of the sideways trading range for the last 6 weeks. In a time of slow exports and high U.S. dollar, coupled with harvest pressure, bulls have a legitimate argument that prices are holding together well. Yet, we’d argue against becoming too optimistic at this time. The calendar tells us there is not enough weather concerns to push prices for the next couple of months. View rallies as opportunities to make catch up sales. Overhead resistance at 7.00 December will likely keep prices in check. If futures break under 6.75 a return to 6.50 is the next target price.

SOYBEAN HIGHLIGHTS: Soybean futures closed higher today following solid export sales numbers and another reported sale of soybeans to China. Crude oil finished slightly higher, while bean oil fell to profit taking and bean meal rose. Nov soybeans gained 19 cents to end the session at 13.91-1/2, and Jan gained 17-1/2 at 14.00.

Renewed interest in US soybeans propped up the soy complex today and has been the missing piece to send prices higher. Domestic demand has been strong, supplies have been tight, but the US needed to see more soybeans being exported to really support this market. Private exporters reported the sales of 12.2 mb of soybeans to China during the 22/23 marketing year, and 7.6 mb to unknown destinations. China has clearly been looking for beans and has turned back to the US in addition to Brazil, as soybeans in China are at extremely inflated prices at the equivalent of $21.00 per bushel. Today’s export sales report confirmed this, showing that 88.8 mb of beans had been sold as of the week ending Oct 13, with another 69.7 mb shipped. Out of the 88.8 mb, 66 mb are going to China to provide the biggest one-week total sale since a year ago. Total sales commitments are now 5% above a year ago at 1.122 billion bushels. Bean meal finally had a positive day with basis improving and a solid export sales number of 542,000 mt. Bean oil was higher for most of the day before fading into the close, but it remains near contract highs as demand for bean oil as biodiesel ramps up in the US. Soybean basis near the PNW has gotten as good as 2.75 over futures, while basis near the river sees tightening basis with the ongoing low water levels. In Brazil, 25% of the crop has been planted with a higher percentage in Mato Grosso, fueled by favorable weather and good rains that may even creep into bone dry Argentina. Jan beans closed right at the 14-dollar mark with the next area to watch at the 50-day moving average around 14.20.

WHEAT HIGHLIGHTS: Wheat futures reversed trend today to close in the green. Correction from an oversold situation may have triggered some buying interest, as the market remains supported by tight supply. Dec Chi gained 8 cents, closing at 8.49-1/4 and Mar up 8-1/2 at 8.68. Dec KC gained 8 cents, closing at 9.49-3/4 and Mar up 8-1/4 at 9.48.

Wheat had modest gains across the board after a relatively narrow daily range of roughly 20 cents (seeing as the daily limit for Chi and KC contracts is 70 cents). Daily stochastics are showing a turnround in momentum in the oversold region. The K & D lines there are close to a potential buy crossover signal, though it has not yet occurred. Upside potential may be limited, however, by the elevated US dollar and economic concerns. As far as weather is concerned, there are chances for rain over the next two weeks in parts of eastern Kansas, eastern Texas, Oklahoma, and into the delta. This may offer some relief to the drought-stricken areas, but will not be enough to reverse course. The rains may also help short term navigation on the Mississippi River, as water levels in some parts are very low. Globally, Argentina should see some good rains, which will help to ease their dry conditions. Argentina’s Rosario Exchange lowered their wheat crop estimated to 15 mmt (vs the USDA at 17.5 mmt) and due to that dryness. Elsewhere in the southern hemisphere, eastern Australia has been getting too much rain, which is lowering the quality of their wheat. The ultimate direction of the wheat market will depend a lot upon what happens in the Black Sea. Will the Ukraine export deal be renewed or halted? That is still up in the air and is increasing volatility in the marketplace. Russian wheat prices are still cheaper than the US, which is reflected in poor export sales results. The USDA reported an increase of only 6.0 mb of wheat export sales for 22/23 and 0.8 mb for 23/24.

CATTLE HIGHLIGHTS: The cattle market traded mixed with the market showing front end strength tied to the strong cash market tone this week and supported by friendly retail carcass tone. Oct live cattle gained 0.425 to 149.775, closing with a new contract high for the fourth straight day, and Dec added .325 to 151.675. Feeders saw some profit taking with a firmer grain market tone, as Nov feeders traded .525 lower to 177.550.

December live cattle prices are looking to challenge the contract high close at its highest point since April 21. The strong cash trade helped provide the support for the fourth straight day. Cash trade saw additional development with $148 trade in Kansas, up $2 from last week and $1 higher than Wednesday’s southern deals. Northern trade was completed with $152 trade in Nebraska, $2-3 higher than last week. Business is likely wrapped up for the week with the exception of some clean-up trade. Beef cutouts were higher on Monday, showing a strengthening trend. Choice carcasses traded .93 higher to 254.32 and select added .21 to 222.40 on light demand of 79 loads. Weekly exports sales on Thursday morning posted new sales of 16,600MT for last week, with South Korea, Japan, and China as the top buyers of U.S. beef last week. Today’s estimated slaughter totaled 128,000 head, 1,000 more than last week, but 6,000 above a year ago. Feeders saw some profit taking as stronger grain prices limited feeder prices on Thursday. The Feeder Cattle Cash Index was 0.74 lower to 172.77, which is still a limiting factor on the front-end contracts, especially October, as expiration nears on 10/27 and the premium of futures to the index. Friday is bringing the next round of cattle on feed numbers. Expectations for the report are expected to show that total cattle on feed as of Oct 1 at 99.1%, placements last month at 96.2% and marketings at 103.9% of last year’s levels. As usual, the placement numbers may be the driver in cattle prices for the longer-term. The cattle market has rallied aggressively, and is looking to challenge contact highs, technical and fundamental picture look supportive in the short-term. Price could stay choppy to end the week before the Cattle of Feed report on Friday afternoon.

LEAN HOG HIGHLIGHTS: Lean hog futures traded higher with the exception of the December contact as a strong export sales report helped push the market higher overall. Dec hogs slipped .350 to 87.025, but Feb added .100 to 89.100. The strength of the market was in the summer months on the day.

Dec hogs, after nearly gaining $7.00 over the past three sessions, saw some profit taking on Thursday, as the market was lacking some key information. The USDA was unable to report direct cash hog trade and retail values on the midday due to “packer submission issues”, but the market was supported by a strong week of exports sales. USDA weekly export sales showed new sales of 40,800 MT last week. Mexico, Japan, and Australia were the top buyers of U.S> pork last week. In additions, pork shipments last week were 28,200 MT, with Mexico taking the bulk of those supplies. In the past couple of sessions, hog futures have been trading above the key 100 and 200-day moving averages for the first time since September, reflecting an improved technical picture in the hog market. Price action today was positive, as December hogs consolidated and finished the session at the top of the range, and deferred futures back tested and held that moving average support. The Lean Hog Cash Index traded .01 on Wednesday to 93.20 and is still at a $6.175 premium to the futures. Prices have had a strong recovery and the chart looks supported on the prospects of demand and an improved technical picture, but the hog market will still need to have the cash market strength going forward to support the rally.

DAIRY HIGHLIGHTS: November Class III futures closed down a penny after trading to a daily high of $21.76, a 46 cent jump from yesterday’s close that could not be sustained. Class IV action ended mixed in today’s action with November futures up a dime. The spot market was characterized by light volume and little movement, but powder continues to be the anchor as it has fallen 6.50 cents on the week so far to its lowest level in a year. This puts Class IV futures in a tug-of-war with butter continuing to hang near its recent all-time high. This afternoon’s September Milk Production report was bearish with production up 1.5% YoY, this on top of a 0.5% increase in July and a 1.7% jump in August to round out the third quarter.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.