MARKET SUMMARY 10-21-2021

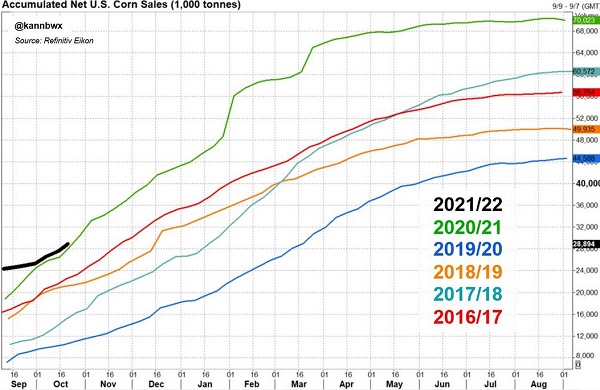

U.S. corn export sales for the 2021-22 marketing year are off to a god pace, slightly above last year. The weekly USDA export report posted good sales last week at 1.273 MMT (50.1 mb), running ahead of last week and the 4-week average. This puts total accumulated sales at 28.9 MMT as of Oct 14, which is just above last year. The tight overall Brazil corn supplies bought buyers into the market, looking for U.S. corn bushels, getting the 2021-22 program off to a good strong start. The weekly total represents 46% of the estimated total by the USDA for the marketing year, versus 48% last year. The corn market is cautious that the demand pace may slip, and the market needs to see the sales pace growing at a consistent pace heading into the end of the year. If the sale pace were to slow, the adjustments of adding additional bushels into the supply/demand tables will challenge prices going higher.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures closed lower, giving up 5 to 7 cents after strong gains yesterday. Export sales at 50.1 mb were termed supportive, but were likely already factored into yesterday’s firm price action. Commodities, in general, sunk today on what may be termed a risk off session where corn dropped in sympathy sharply lower soybean and wheat prices as well as lower energy and equities.

Higher input costs for the year ahead will likely keep farmer selling light. Due to tight inventory coming into the harvest, farmers will be patient waiting for basis levels to improve, higher futures, or both. Year-to-date export sales are 1.1375 bb, a solid pace and above last year’s level at this same time, (1.115.5 mb). Though today was an off day with there not being much new news and that could be a problem with trying to sustain a near term uptrend. Typically, at this time of the year, other than harvest there isn’t a whole lot the market can factor into price movement. Ironically big picture perspectives are creating dynamic potentials for price and will likely suggest the market will move on perception. That is, corn prices could be well supported anticipated more soybean acres even though the planting season is several months away.

SOYBEAN HIGHLIGHTS: Soybean futures, despite the highest export sales figure this week in nearly a year, slumped losing more than 20 cents. November led today’s losses, closing at 12.24, down 21-1/2 cents. A downward reversal in crude oil and likely traders exiting longs after four higher closes, coupled with a “buy the rumor sell the fact” export sales event, had prices on the defensive. November 2022 dropped 19 cents after running into over-head resistance at the 50-day moving average at 12.48 to finish the session at 12.29-3/4.

Export sales at 105.8 mb were supportive and outstanding. Yet, the way the market behaved today one has to believe that stronger prices the previous four sessions had this already factored in so the market was buying the rumor and sold the fact. Soybean oil was off today in sympathy with weaker palm oil. Planting progress continues to move along swiftly in South America but expectations for continued dry weather concerns could have the market on edge soon. Year to date export sales are 1.075 billion. This compares to 1.666 billion at this same time a year ago. A continued decline to the Brazilian real is making beans more attractive, yet near term needs likely going to be met from the US. Basis levels, in parts are firming continuing to suggest light farmer selling and/or strong end user buying.

WHEAT HIGHLIGHTS: Wheat futures, along with most commodities, settled back today on profit-taking and long liquidation. Dec Chicago wheat lost 8 cents, closing at 7.41-1/4 and July down 6 at 7.46-3/4. Dec KC wheat lost 12 cents, closing at 7.47-3/4 and July down 11-1/4 at 7.47-1/2.

Days like today don’t always have a good explanation; yesterday’s momentum in the grains did not carry through and the wheat complex was no exception. Pressuring wheat today was the lower trade in corn and soybeans, as well as long liquidation. Even the recent shining star in wheat, the Minneapolis contract, showed losses of 4-7 cents in the front months. Paris milling wheat futures also set back today after new highs yesterday. Despite an off-day, news for wheat remains mostly bullish. Matif wheat futures are at 9-year highs. China’s winter wheat seeding is lagging due to wet weather at 26% complete vs 53% average. The managed funds are estimated to now be modestly long Chi wheat (about 2,000 contracts). In other world news, Ukraine raised their wheat export number to 25 mmt vs the USDA’s 23 mmt. Russian wheat prices are also at 14-week highs and their export tax may reach $70 per metric ton within a month. On today’s export sales report, the USDA reported an increase of 13.3 mb of wheat export sales – this is below the pace needed to meet their goal of 875 mb.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.