MARKET SUMMARY 10-22-2021

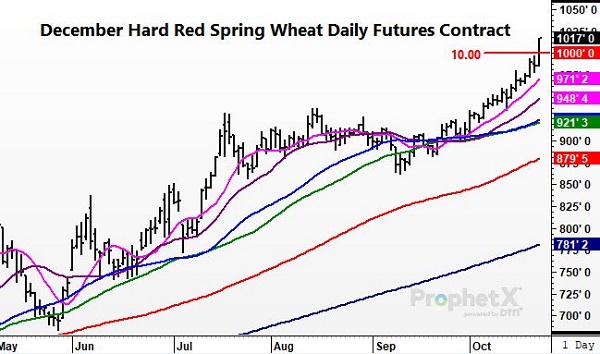

Hard Red Spring wheat prices crossed the $10.00 barrier and the highest prices for the grain since 2012. The HRS wheat crop has been plagued by production issue the entire growing season, and with the smallest crop in years, has seen strong price support. Recent weeks, with the move higher in oat futures, and now recent strength in the other wheat classes, HRS wheat pushed through the $10.00 handle. This was last done in June 2012, where HRS Wheat prices peaked at $10.35 a bushel. It is likely that HRS Wheat could exceed this target, and look towards the 2011 high of $11.20, given the extremely tight supply picture, and the current supportive overall wheat market. Regardless, HRS wheat futures are trading at historic values.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures finished the day and week on a firm note, with December closing 5-3/4 higher for the session, closing at 5.38. For the week, December picked up 12-1/4 over last Friday. Sharply higher wheat prices, a lack farmer selling, strong ethanol and export demand as well as higher crude prices combined to provide support for prices this week.

Today’s close was encouraging. Yesterday, prices slumped into the close but snapped back today and even more impressive it is a Friday close. Traders are willing to buy into the weekend. With some additional rational for the risk off session yesterday, prices weakened on NOAA’s three-month forecast suggesting warmer than usual temperatures in the US. This was counter to La Nina talk of a colder winter. However, today’s recovery, especially in wheat continues to signal that end users are more aggressively covering needs. Because yield results appear to be generally better than expected, corn prices are likely to remain rangebound moving into the later stages of harvest. Attention will soon shift to South America weather, exports, and cost and availability of inputs. We are biased to believe, given the current concerns regarding herbicides, pesticides, and fertilizer a shift to more soybean acres is highly possible. If nothing else, the perception this will occur, will support prices for now.

SOYBEAN HIGHLIGHTS: Soybean futures ended both the day and week uneventfully, with November closing 3-1/2 cents lower at 12.20-1/4. For the week, Nov futures gained 2-3/4 cents. November 2022 gained 1-1/2 cents on the week, but lost 6 cents today, closing at 12.23-3/4. A huge export sales figure this week at over 100 mb was viewed as supportive and a possible turning point for exports signaling end users are more aggressively seeking inventory now that harvest is closing in on completion. Good planting progress in South America kept rally potential in check.

No matter how you slice it, current ag markets are dynamic and factoring several major factors at one time. Surging palm oil and energy prices with a favorable bio-energy environment keeps soybeans well supported. Yet, concern of more acreage in both hemispheres could trump demand as supplies could massively increase. US carryout has already doubled in the last 60 days on yield adjustments from a year ago and higher yield expectations this year. From a perceptive view, growing expectations for more soybean acres due to fertilizer input issues suggest downside risk for 2022 price. Yet, futures are holding together well hitting 12.50 this week and each of the last six months. Nonetheless hold at 30 hedged for 2022 and 20 cash sold.

WHEAT HIGHLIGHTS: Wheat futures traded sharply higher, driven by good demand and tight supply. Dec Chicago wheat gained 14-3/4 cents, closing at 7.56 and July up 9-3/4 at 7.56-1/2. Dec KC wheat gained 26-1/4 cents, closing at 7.74 and July up 14-1/2 at 7.62.

Wheat had a banner day with double digit gains across all three contracts. Minneapolis spring wheat finally managed to not only breach, but rather smash through the ten-dollar mark, with a close 27-3/4 cents higher at $10.13. This has not occurred since July of 2012. Yesterday’s long liquidation appears to be over, which allowed the wheat complex to stretch its legs today. Paris milling wheat futures made new contract highs as well. These rallies come despite total wheat commitments being down 20% from last year. Russian wheat prices have increased for 14 consecutive weeks, and by month end their wheat export tax is expected to be $70 per metric ton. European wheat exports are up 64% from last year, though this is not sustainable, and they will have to slow exports at some point. There has also been talk that Russia may implement a tax on or reduce fertilizer exports, which could impact the wheat crop just as much as corn. This week Japan was reported to have bought about 81,000 mt from the US and Canada, and Turkey bought 300,000 mt tons of wheat from other origins as well. Most wheat buyers in North Africa and the Middle East have low supply and need to buy.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.