MARKET SUMMARY 10-25-2021

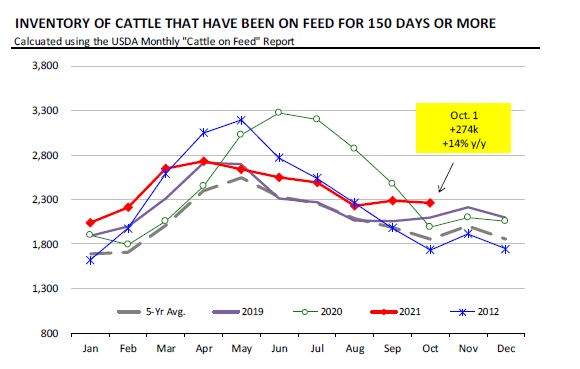

The reduced slaughter pace has had an impact on the front-end supply of the live cattle market. Friday’s Cattle on Feed report was overall friendly, with a miss on the placement numbers being below expectations. For total cattle on feed, running 1% under last year was expected, and may have kept the overall reaction to the report muted. Within the numbers, cattle on feed for more than 150 days was still heavy, pegged at 14% over last year. The slower slaughter pace of around 120,000 head/day has kept the pressure on the front end of the cattle market. With available supplies out there, packers have not had the motivation to bid up in the cash market, limiting upside gains in futures prices. Going forward over the next few weeks, the slaughter pace will be key. If supplies stay comfortable, the cash market will likely stay in a sideways fashion, which will likely limit the upside in the cattle market and keep the bear spread market in place.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures are unchanged in Dec and Mar while gaining 0-3/4 in Sep. Dec closed at 5.38. Export inspections at 21.5 mb were termed disappointing and at the low end of expectations. Support came from higher overnight corn trade in China as well as crude oil reaching new contract highs approaching 85.00. Heavy rains in parts of the Midwest will delay harvest and for some, it will be much more challenging as wet conditions with high winds have knocked weaker stalked plants to the ground.

Open interest has been climbing higher suggesting the trade is more interested in buying even as prices have been moving higher. On Friday’s Commitment of Traders report, funds are net long near 220,000 contracts, off slightly from a few weeks ago, but in line with where funds have been holding a long position since mid-summer. Basis is firming in areas and improving ethanol margins, and talk of feedlots securing inventory is viewed as a positive for price. Fertilizer and input logistics are concerning, yet time is on the side of the marketplace “getting it figured out.” However, markets often move on perception (emotion) and the perception is fewer acres in 2022. Economic concern in China may act as overhead resistance.

SOYBEAN HIGHLIGHTS: Soybean futures closed with double-digit gains as Nov futures lead today’s rally closing at 12.37-1/4. Higher overnight futures in China’s futures market (Dalian Exchange) and rain delays supported futures today, as did crude oil futures trading into new contract highs approaching 85.00. Export Inspections were termed supportive at 77.3 mb.

The most recent COT (Commitment of Traders report) indicated managed money at its lowest level this year with the net long position just under 20,000 contracts. Soybean oil finds support on tight world vegetable supplies, but soymeal remains near its lower price for the season. Expectations for record production out of South America seem to be keeping the market leery and unable to recover anything more than a bounce. Yet, as weather unfolds in Brazil and Argentina the market will respond. The bull argument is alive from a macro perspective, yet economic concerns with the world’s top importer (China) and some thoughts on yield and demand might be slanted negative on the November report keep prices in check. For the new crop, we will continue to make small sales even though harvest is 10 months away. World supplies are expected to increase in 2022.

WHEAT HIGHLIGHTS: Wheat futures closed higher, with carry-through momentum from Friday. Dec Chicago wheat gained 3-1/2 cents, closing at 7.59-1/2 and Jul up 6-3/4 at 7.63-1/4. Dec KC wheat gained 3-3/4 cents, closing at 7.77-3/4 and Jul up 3-3/4 at 7.65-3/4.

Wheat managed to settle in the green, albeit off today’s highs. This was perhaps in part due to the somewhat disappointing export inspections of only 5.2 mb today. The U.S. dollar is also firmer today, offering some resistance to wheat. Minneapolis remains the leader with Dec closing at 10.27, up 14 cents – Minneapolis being above the ten dollar mark has not occurred since 2012. This afternoon we will get the first U.S. crop ratings for winter wheat, which are expected to be high at around 65-70% good to excellent. Drought remains a concern in U.S. HRW crop areas, but the SRW areas have good soil moisture with more rains forecast for this week. In China, 900,000 mt of wheat from their reserves were auctioned off last week. Paris milling wheat futures continue to make new highs. Russian wheat prices continue to rally as they increase their export tax. U.S. weather will be something to keep an eye on as well – wet conditions may interrupt winter wheat plantings.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.