MARKET SUMMARY 10-25-2022

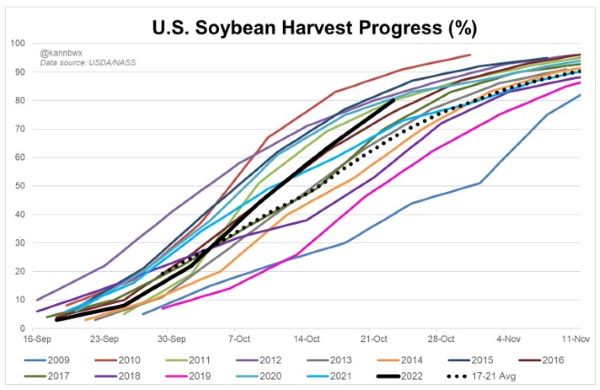

The U.S. soybean harvest pace is running at the fastest in recent history. As of Sunday, the USDA stated that 80% of the soybean crop is harvested, above trade expectations and 13% above the 5-year average. The speed of this year’s harvest has been supported by dry weather and warm temperature across the Grain Belt, allowing producers to push through the harvest of this year’s soybean crop. The dry conditions in the western Corn Belt have allowed some states to rapidly advance the harvest pace as the states of Nebraska, Minnesota, North Dakota, South Dakota and Iowa are over 85% complete. The strong harvest pace is friendly the market prices, as the expected soybean supplies that needed to be moved are likely into the market pipeline, and hedge pressure may be more limited. With harvest wrapping up, the key will still be the demand to move those freshly harvested bushels.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures moved higher today, gaining 4-3/4 cents in December to close at 6.86-1/4. December of 2023 added 3-1/4 to end the day at 6.25-3/4. The market continues to tread water, trading in a tight range of about 10 cents in recent sessions. Firmer soybean prices and lack of farmer selling is supportive to price today as was steady to firmer energy and a weaker dollar. Rain pushing through some the Midwest could be helpful to low river levels, yet it does not appear it will be a big help.

As time progresses and fall wears on, bigger fundamental factors are looming larger and larger. Rains are desperately needed to change the course of an ever-growing drought map. Yet will it be too dry for fall fertilizer? Will fertilizer be readily available? Will the low water in the river jeopardize exports? All are questions that only time will answer. Prices are historically high, which implies they are vulnerable to a break – perhaps for a good reason or perhaps just because they can go down. There are many players in the futures market, with some having more influences at any given time. Managed money is aggressively net long corn for this time of year. Maybe this is a sign of tight supplies and expectations for higher prices, or, perhaps, a market that is primed to drop as money suddenly decides to leave. Bottom line, be prepared and strategically position yourself whether prices go up or down.

SOYBEAN HIGHLIGHTS: Soybean futures closed higher today, along with meal and bean oil, as demand for feed and beans to process continue to strengthen. Yesterday’s export inspections were excellent, and soybeans are being shipped out of nearly every available port in the US to meet global demand. Nov soybeans gained 10 cents to end the session at 13.82, and Jan gained 11 at 13.92-1/4.

The soy complex rallied today, and soybeans were able to take back a good chunk of yesterday’s losses. Domestic crush demand is incredibly strong with crush margins at their highest levels on record at nearly 3.70 based on January futures. This strong domestic demand is a key element to higher prices as bearish factors like the mess on the Mississippi River put downward pressure on the markets. Some rain has fallen in the area and there is some forecast, but not enough to right the water levels and get barges moving freely again. Last week’s export inspections were massive with 80 mb of the 106 mb total headed to China, and the bulk of beans moving out of the Pacific Northwest. There have been no new flash sales reported this week, but sales are still ahead of last year’s China’s January through September soybean imports were recorded at 69.04 million metric tons which is down 6.6% from a year ago, but China’s demand for US beans is still there. Soybean harvest has been pegged at 80% complete compared to the five-year average at 67%. Some rains are falling from Oklahoma into Illinois and into the Great Lakes, and yesterday the Northern Plains got some rain as well. Yesterday’s news that China’s XI Jinping has ensured another 5-year term initially rattled the market, but soy prices have climbed back. Brazilian forecasts are favorable in the short term with potential dryness in the future. January beans remain rangebound between 13.65 and 14.20 with a gap lower at 13.57.

WHEAT HIGHLIGHTS: Wheat futures struggled today as the Ukraine export deal remains questionable and Australia’s crop may be getting larger. Dec Chi lost 4 cents, closing at 8.34-3/4 and Mar down 4 at 8.54-1/4. Dec KC lost 3-1/2 cents, closing at 9.34-1/2 and Mar down 3 at 9.34.

A poor finish in the wheat market is certainly discouraging, but the silver lining is that they did not close on the lows of the day. Wheat was able to recover somewhat after the US Dollar Index took a turn for the worse. The USDA has said that winter wheat is now 79% planted, in line with the average of 78%. But only 49% is emerged compared to an average of 56%. This may signify the dryness in the southern plains. In fact, despite the recent rains in Kansas and Oklahoma, most HRW area remain dry. Elsewhere, the Ukraine corridor deal is still in limbo, though the Turkish president is feeling that the agreement will be renewed. Others question this, however, as Russia may require more sanctions to be lifted first. Along those same lines, Russia is said to be intentionally slowing the inspection of grain vessels in Istanbul. On a bearish note and adding to pressure in the market is the fact that the Ag Attaché in Australia is estimating their wheat crop at 34 mmt. This is 1 mmt greater than the USDA’s projection and within throwing distance of a record crop.

CATTLE HIGHLIGHTS: The cattle market took a pause after the recent strong rally as grain prices saw some strength and the cattle market waited for the development of cash trade this week. Oct live cattle gained 0.075 to 151.675, closing with a new contract high for the seventh straight day, and Dec slipped 0.825 to 153.300. Feeders were mostly lower with the exception of the front month with expiration on the 27th. Nov feeders traded 1.225 lower to 177.925.

December cattle posted a new contract high early in the session, before turning lower on the day. This could be a sign of consolidation, or a loss of momentum after a strong rally. Seasonal cattle prices are strong into the October Live cattle expiration, which is on Monday Oct. 31. Cash trade was still undeveloped on Tuesday, but expectations are for cash trade to trend higher week over week. Southern asking prices are $152, with undefined bids. Show lists are tighter this week as overall supplies are looking to tighten. That optimism is supported by a strong tone in the retail market. Beef retail values have jumped in the last two days. At midday Tuesday, Choice carcasses traded 3.95 higher to 261.87 and Select was 1.79 higher to 227.40 on light movement of 52 loads. This gave Choice carcasses over a $10.00 jump with Monday and Tuesday’s midday trade. The Choice/Select spread remains strong at 34.47 in a window this spread typically tightens. The strong retail tone should allow the packer to keep bids strong for the tightening cash supply. Feeder cattle were pressured by the stronger grain market tone, setting up some profit taking. and strong live cattle market to add to its gains. The feeder cattle cash index gained 1.23 to 174.85 but is still trading at a discount to the October futures with expiration on the 27th. In the near term, the fundamentals are still pointing higher as the cattle market is trending to new highs or poise to challenge those highs, but the market may be ready for a pause and wait for a strong cash confirmation.

LEAN HOG HIGHLIGHTS: Lean hog futures stayed in consolidation trade at the top of the most recent rally, as the market is looking for news to move prices. Dec hogs gained.525 to 88.450, and February hogs added 0.225 to 90.675.

Dec hogs are back testing support above the most recent break out point, watching for better signals from the cash and retail markets for this week. Chinese pork prices remain strong, helping support the idea of possible improved pork demand on the export market. After a strong run higher last week, some caution maybe be better than bad in an over-heated market and this price consolidation is helping cool the market’s strength. In the cash market, the national direct morning cash trade was higher gaining 4.20 at midday with a weight average price at 90.08 and the 5-day rolling average moved up to 92.38. The CME Lean Hog Cash Index traded 0.62 higher to 94.67. The cash index still holds a $6.220 premium to the Dec futures, helping support the front of the market. Retail values were softer at midday with carcasses losing 2.84 to 99.09 on moderate demand of 234 loads as buyers seemed to step into the market on the weakness. Most of the retail weakness came from a 15.80 drop in pork belly prices. The hog chart looks supported on the prospects of demand and an improved technical picture; the trend stays currently higher, despite the consolidation tone to start the week. Dec hogs look poised to challenge the contract highs.

DAIRY HIGHLIGHTS: Spot cheese fell 3.75 cents today to close at its lowest level in about six weeks, dragging Class III futures down as the November contract fell to $20.85. Both the December and January contracts hit their lowest point in nearly 10 months. Class IV action was mixed overall with the November contract giving up a dime while spot butter also fell 3.75 cents to $3.1525/lb. The dairy market has been without any groundbreaking news for weeks now, and volume in both milk futures and the spot market has dried up, leading to a “path of least resistance is lower” scenario.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.