MARKET SUMMARY 10-26-2021

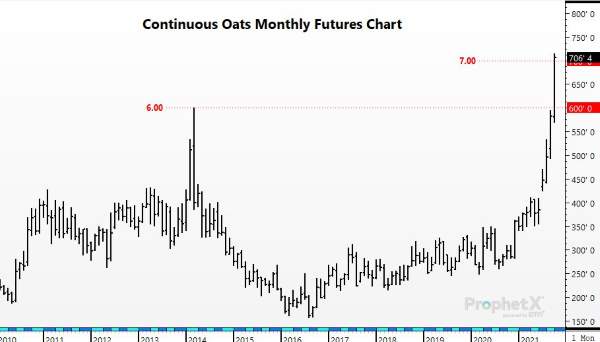

The oat market hit another historical price that crossed the $7.00/bushel level for the first time in history. It is well known that the oat marker and spring wheat market price rallies are being fueled by the overall tight supply picture from this summer’s difficult growing weather. Earlier in the week, spring wheat raced through the $10.00/bushel barrier, targeting further upside. On Tuesday, oats took the next step to push through the $7.00 mark. The month of October has been explosive in price, as the lead month December contract has gained $1.24 this month, closing on Tuesday at $7.06. Prices for the oat market are now in uncharted territory, and if prices can maintain above this price point, will likely push higher as these two grains are trying to buy acres for the next growing season versus each other. Prices at these levels are more likely speculative driven and will be extremely volatile, open to sharp price moves.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures finished with impressive gains of 4 to 5-3/6 cents after trading near 5 cents lower near mid-day. Firm basis, coupled with strong ethanol margins, and lack of farmer selling had traders on the offensive. Selling wheat and buying corn may also have been a feature in today’s trade as wheat prices tumbled from near double-digit gains to losses of 5 or more cents for Chicago and steady to weaker for Kansas City and Minneapolis. Firmer energy prices were supportive as well.

Harvest at 66% complete is still above the 5-year average, yet will likely slow due to rain this past week and more in the forecast for the next few days. The five-year harvest average is 53% for this same week. The 6–10 day forecast looks cool and dry, suggesting harvest will be in full swing next week. The 100-day moving average acted as overhead resistance today on most futures contracts. An inverted head and shoulders formation suggests Dec corn futures could reach 5.85. Another supportive factor is cattle on feed numbers showing one of the largest on feed numbers in 10 years. Dec 2022 reached a new contract high today of 5.40-3/4.

SOYBEAN HIGHLIGHTS: Soybean futures ended quietly after supportive news pushed prices higher in the mid-morning time slot. Export sale announcements of near 12 mb resulted in a price boost, but it was short lived and not enough to keep futures firmer. Nov futures gained 0-3/4 cent closing at 12.38. Nov 2022 gained 0-1/2 to end the session at 12.34-3/4. Most contracts closed off their highs by about 8 cents, not the healthiest of finishes.

Harvest at 73% is ahead of the 5-year average of 70%. Heavy rains in parts of the Midwest have slowed progress, yet we don’t believe there are any long-lasting negative yield impacts at this time. Weather in southern Brazil and northern Argentina appears to be mostly conducive to planting and early growth, as scattered showers this week are expected. Continued talk of La Nina affecting crops is mostly just that, talk. Until the crop is further along, or rain is hard to come by, we anticipate normal production. This means more supply and limited upside price potential for U.S. soybean prices. Firmer energy prices provide support.

WHEAT HIGHLIGHTS: Wheat futures had a mixed to lower close on profit-taking and meeting with some resistance levels. Dec Chicago wheat lost 7-1/4 cents, closing at 7.52-1/2 and Jul down 3-3/4 at 7.59-1/2. Dec KC wheat lost 1/2 cent, closing at 7.77-1/4 and Jul up 1 at 7.66-3/4.

Wheat trade was two-sided today but ran out of steam by the close. Profit-taking from the recent rally was probably a factor, as was the fact that all three contracts are trading well above moving averages and may be met with some resistance. The USDA reported that 80% of the winter wheat crop is planted, which matches the average. Yesterday afternoon we received the first crop rating for winter wheat, which came in at 46% good to excellent. This compares to 41% at this time last year but was well below some estimates which were as high as 60-70% good to excellent. The biggest drop came from the Pacific Northwest in the white winter category where drought is still a worry. Yesterday’s inspections number came in at 5.2 mb, somewhat of a disappointment. The USDA has an 875 mb export estimate and total wheat inspections for 21/22 are at 348 mb. Matif futures continue to test new highs, and Russian values continue to trend higher. In Russia, domestic wheat prices are higher than export prices, which is limiting farmer selling to export facilities. Paris milling wheat futures again reached new highs and are nearing all-time records.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.