MARKET SUMMARY 10-27-2021

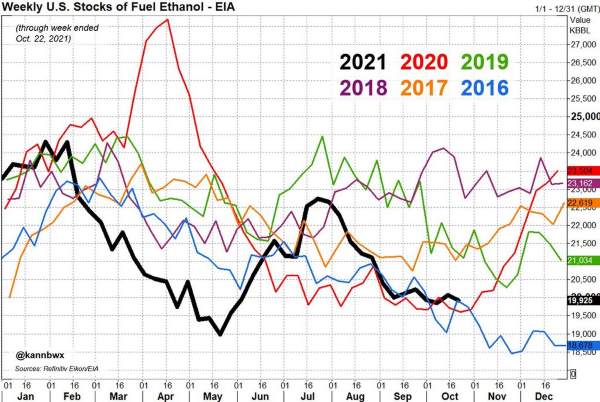

U.S. ethanol production over the past week was just short of an all-time high, and the strongest in 4 years. Last week, ethanol production was 1.106 million bpd, as the industry had near-record production for the second week in a row. Strong price strength and demand for the finished product have boosted profit margins for ethanol producers. The addition of fresh corn supplies available has only fueled the production surge. The most friendly part of the ethanol report is the overall decreasing stocks. Last week, ethanol stocks dropped under 20 million barrels. This low stocks total shows that the strong production surge is being matched by the demand for ethanol overall. This combination of factors should be supportive of ongoing strength in overall ethanol production.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures traded quietly with little change, until after the pause session when futures erupted to gain just under 20 cents, before finally closing 13-3/4 cents firmer in Dec. It was reported that funds were aggressively buying once futures pushed through the 100-day moving average (5.53), as continued growing concern over the cost and availability of fertilizer and inputs mount. Short covering erupted with Dec futures reaching a high of 5.63-1/4, up 19-3/4, before settling 5.57-3/4 its highest close since August 19.

Although overbought according to some technical indicators, the near-term trend remains higher with the next upside target at 5.80, an objective from an inverted head and shoulder formation. Crude oil and ethanol stocks continue to run below year-ago levels and with strong ethanol margins, the search for corn is on. Farmers remain light sellers. Our bias on this is due to a lack of need for cash (for now) and are busy harvesting and putting corn in the bin – they are not ready to take it out yet. Wet weather will slow harvest in parts again today, yet next week’s cooler and drier outlook suggests farmers will make good progress by the end of the first week in November.

SOYBEAN HIGHLIGHTS: Soybean futures again rallied but failed to hold strong gains finishing 1 to 2-1/4 cents firmer. Nov reached a high of 12.57-1/2, up 19.5 cents, and then turned negative losing 5 or more cents. Firmer meal was supportive closing 3.00 to 4.00 higher but was likely the recipient of traders unwinding long soybean oil and short meal spreads, as palm oil futures suffered losses on the overnight session.

Perceptively, the market may have a difficult time getting away from the thought process that carry out on the November report could be between 350 and 400 million bushels, well above the 150 million bushels two months ago. Higher yield expectations and a slow start to the export season suggest upward revisions to supply coupled with decreases in demand, leave the market vulnerable to an upward trend for carryout. Brazil planting continues to move along at an above-average pace which suggests record inventories available to the world market in several months. Yet, the downside is likely limited as farmer selling will be slow in the weeks and months ahead. This is already reflected through firming basis prices. Input costs and availability are also a potential constraint to production.

WHEAT HIGHLIGHTS: Wheat futures settled higher today with support from the rally in corn. Dec Chicago wheat gained 7-1/2 cents, closing at 7.59-3/4 and Jul up 9-3/4 at 7.69-1/4. Dec KC wheat gained 5-1/2 cents, closing at 7.82-3/4 and Jul up 7-3/4 at 7.74-1/2.

Wheat started the day lower but was taken along for the ride as corn exploded. Today it was rumored that the funds were buying corn due to fertilizer concerns, and that seems to have triggered technical buying which spilled over into the other grains. This reversal from yesterday’s downtrend is encouraging and there is talk that North African and Middle Eastern wheat buyers may have had recent payment problems, in part leading to the weakening we saw yesterday. European wheat exports are about 50% ahead of last year – if they keep at the current pace, it would leave them with almost zero ending stocks. Therefore, their exports will need to be reduced. Russian interior prices are currently higher than export prices. Recent private estimates for U.S. wheat carryout have a fairly wide range between 550-640 mb. This compares to the USDA’s 580 mb, but the final number will depend on exports. The USDA currently has the export estimate at 875 mb but they may reduce this if our pace does not pick up. In terms of U.S. weather, HRW areas have received rain today which should move into SRW areas tomorrow. Next week looks colder but drier overall throughout the United States.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.