MARKET SUMMARY 10-27-2022

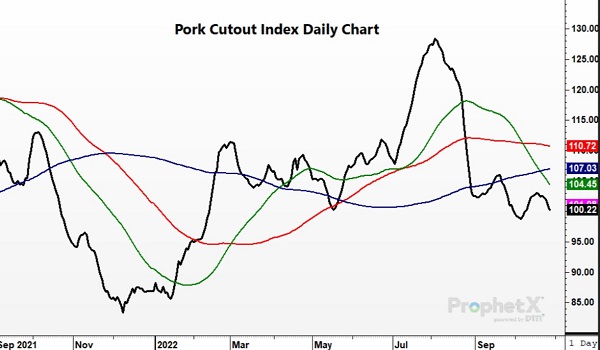

The hog market had a strong price recovery over the past couple of weeks, but saw strong selling pressure on Thursday. One key fundamental area needed to support the hog rally was the pork carcass values. The Pork Cutout Index failed to move higher with the prices of hogs, and has begun to trend lower, ready to challenge the October lows. The Cutout index is a summary of the past 5-days of trade for pork carcasses. When hog futures were hitting contract highs this past summer, the Pork Cutout Index was also placing highs for the year, trading as high as $128.00. Today, the index value was down .76 to 100.22, nearly $20.00 below the high, but hog futures were close to challenging the summer highs again. The demand picture is impacted by the supplies of pork running strong on large slaughter numbers, and the weaker export demand tone. A low cutout value weighs on packer margins, and its impact on the cash market will be felt.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures slid into the close losing 2-3/4 in December to end the session at 6.82-3/4. Exports sales were again disappointing at 10.4 mb, bringing the year-to-date total to 554.9 mb, well below last year’s figure for this same time of 1.107 bb. Perhaps the end user is still expecting a harvest drop in price or could be waiting for the Mississippi water levels to return so transporting grain can be more accurately estimated. December of 2023 lost 1-3/4 to end the session at 6.21-3/4. A rebound in the dollar today may have had traders exiting on strength by mid-morning.

The sideways trading range continues. This could be called a trader’s market where prices rally into resistance and traders sell and prices drop into support and traders buy. The more this continues, the more likely it is to become self-fulfilling. The range is getting tighter and consequently at some point prices will break out but for now the market seems content finding support from smaller crop production estimates and low projected carryout while resistance comes in the form of a high U.S. dollar and a high price. Export sales remained dismal and while it is early in the marketing season if they do not pick up soon, we would not be surprised to see the USDA once again make a cut to exports and consequently a rise projected carryout. Should this occur bulls will be losing their grip.

SOYBEAN HIGHLIGHTS: Soybean futures closed slightly higher after falling into the afternoon before recovering. Bean oil also began to fall at the close, which removed support from the bean market, but meal managed a higher close. China has become stricter in their zero-Covid policy, which has sparked demand concerns, but today’s export sales report was positive for beans. Nov soybeans gained 1/2 cent to end the session at 13.82-1/4, and Jan gained 1/2 at 13.93-1/2.

All three soy products were higher in today’s premarket, but began to fall and form a bottom midday before recovering to close with minimal gains. China’s ongoing zero-Covid policy was likely behind the afternoon dip, as the country has now locked down, at least partially, 28 major cities and over 200 million people in China. This continues to lead to demand concerns, and although there have been no reported flash sales so far this week, China was an active buyer the past two weeks. Last week’s sales were good at 37.7 mb, but a massive number for shipments at 101 mb, way above the weekly amount of 41.7 mb needed. The most bullish factor that has kept beans supported are crush margins, which are record high in the US. US soybean meal is now on par with Argentinian meal, and US exports of meal are catching up with Argentina. Between this and expanding biofuel demand, processors are eager to get their hands on cash beans. Crude oil has rallied over 14 dollars per barrel above the low at the end of September, which has been a steady source of support for bean oil. South America is forecast for more rains over the next week or so as planting continues. Prices remain in a sideways range as strong bullish arguments fight against bearish arguments, keeping prices locked between roughly 13.65 and 14.20 in Jan.

WHEAT HIGHLIGHTS: Wheat futures faded despite early strength and a bullish decline to the Argentine crop. A rise in the US dollar may have added to pressure, but the market remains choppy. Dec Chi lost 2 cents, closing at 8.38-1/2 and Mar down 1-1/2 at 8.58. Dec KC lost 8-1/2 cents, closing at 9.32-1/4 and Mar down 8-3/4 at 9.31-3/4.

Wheat struggled to follow through today. Early gains gave way and by the close, all three US wheat futures classes were in the red. There is still supportive news out there, however. The Rosario Exchange in Argentina lowered their estimate of the wheat crop by another 2 mmt to 13.7 mmt due to drought. There is talk that Argentina may even issue a three month ban on exports (but this has not yet been confirmed). This also comes at a time when Russia is conducting practice drills for firing nuclear missiles. Though these were planned exercises, one would think that given the current atmosphere of tension in that region, it may escalate the war. Along those lines, there is talk that vessels will have 10 days to go into Ukraine, get loaded, and leave, as the deadline for the extension of the export deal is approaching. The upcoming G20 summit on November 15 may act as a forum for Putin to let the world know whether or not the export corridor will be extended or closed. And as we have mentioned previously, eastern Australia is getting too much rain. Their crop is projected to be just shy of record large, but this rain is causing quality concerns. In other news, the USDA reported an increase of 19.6 mb of wheat export sales for 22/23.

CATTLE HIGHLIGHTS: The cattle market came under selling pressure, triggered by profit taking in the lean hog market, despite cash trade and retail values trending higher. Oct live cattle slipped .050 to 151.400 with expiration on Monday, October 31 and Dec lost .150 to 153.425. Feeders were under stronger selling pressure as October hit expiration and a mixed tone in grains. Oct feeders closed their contract life losing .450 to 175.975, and Nov feeders traded .700 lower to 178.125.

A firm cash tone supported the live cattle market as countryside trade began to develop on Thursday. Light trade occurred with $150 catching southern trade, up $2.00 from last week. Trade in the North was also light, but some trade occurred at $240, up $5.00 over last week. Trade is still light and additional trade will take place through the afternoon and into tomorrow. Retail values stay supportive of the cash market and packer margins. At midday, choice carcasses traded .48 higher to 261.34, and select was 3.02 higher to 231.62 on good movement of 72 loads. The strong overall retail tone should allow the packers to keep bids strong for the tightening cash supply. Weekly export sales were released this morning and the USDA reported new sales of 14,100MT for last week, with South Korea, Japan, and China the top buyers of beef last week. Feeder cattle also saw some profit taking on the weakness in the livestock sector and a strong start to the grain markets. As grain prices softened, feeders did find some traction, but were lower on the day. The Feeder Cattle Cash Index slipped .18 to 174.78 and trades at a 3.345 discount to the new lead month, November feeders. Cattle markets saw some profit taking, pressured by overall weakness in the ag markets, especially the lean hogs. Fundamentals are still supportive, but prices may be working sideways for the near-term.

LEAN HOG HIGHLIGHTS: Lean hog futures saw strong selling pressure and long liquidation as a weak retail carcass tone and direct cash trade brought the sellers forward. Dec hogs dropped 3.375 to 85.125, and February hogs fell 2.850 to 88.150.

Dec hogs broke out of the consolidation range to the downside, triggering technical selling. Prices have become oversold, and a potential break was possible. Dec hogs dropped back to support at the 100 and 200-day moving averages. The lack of follow-through in the retail market helped trigger the selling pressure. The Pork Cutout Index failed to rally with hog futures, and that made the rally seem unsupported. The cutout index closed .76 lower to 100.22, challenging the lows for the year, established in early October. At midday, pork carcass values were firmer, gaining 2.00 to 99.74 on a moderate load count of 174 loads. Weekly export sales were nearly half of last week’s totals with new sales of 20,300 MT with Japan, China, and South Korea the top buyers last week of U.S. pork. In the cash market, the national direct morning cash trade was sharply lower, losing 6.66 at midday with a weighted average price at 91.65 and the 5-day rolling average moved up to 94.46. The CME Lean Hog Cash Index traded .34 lower to 94.47. The Cash Index now holds a $9.345 premium to the Dec futures, which should help support the front of the market. Wednesday’s turn higher wound up being a head fake as prices broke lower on Thursday. Pork carcass values haven’t moved the amount needed to help support the hog rally, and that triggered selling on Thursday. Prices will need to hold key support at the 100 and 200-day moving averages.

DAIRY HIGHLIGHTS: The December and January Class III futures fell double digits today to break below the $19.00 mark, closing at 10 and 9-month lows respectively. Spot cheese fell another 4.6250 cents today for a total loss of 13.1250 cents through the four trading days on the week, likely going to be the worst performing week in roughly 17 months if buying does not re-enter that market on Friday. A few of the regional cheese reports have talked about the fact barrels traded to a large premium over blocks put the overall cheese market out of sync and could have a hand in the recent weakness. While the Class IV spot products have been quiet this week, most Class IV milk contracts have been bleeding value with the exception of the October and November futures.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.