MARKET SUMMARY 10-4-2022

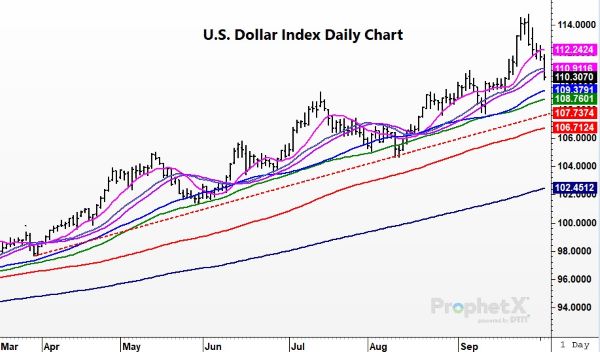

The US dollar index has posted a reversal in recent trade, which has been a boost to the markets overall to start October. After reaching new 20-year highs recently, the U.S. dollar index has turned back lower. The dollar has seen strength as a currency trade against weaker global currencies and a tightening U.S. monetary supply. The strong dollar move has been a limit on both commodity and equity markets through the month of September. Speculation that the Fed may need to back off on interest rate hikes and profit taking has helped push the dollar index lower, closing at its lowest point in two weeks on Tuesday. Currencies have a tendency to trend in direction, and additional weakness in the dollar index is possible as prices look to find support. This continued pullback should help support markets overall in the near term.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures eked out gains for the second session in a row and finished well off the daily high for the second consecutive session. December gained 2-1/4 cents to close at 6.83, and December of 2022 added 4 cents to end the day at 6.19. Firmer soybeans, a sharp drop in the dollar, higher energy prices and mixed harvest results provided support today. December however, finished well off the high of 6.91-1/2 indicating either an increase of farmer selling, speculative selling or both.

The corn market continues to trend in a sideway pattern for five weeks with a low of 6.47-1/4 on August 26 and a high of 6.99-1/2 established on September 12, a USDA report day. The last two USDA reports have been supportive, which is holding price in a mostly tight pattern. However, harvest pressure is mounting with 20% of the crop off the field as of Sunday as reported on the crop progress figures released yesterday. Harvest will push into high gear this week and the weeks ahead. This year, however, harvest is behind last year’s pace of 27%. In conversation it appears dry down has been slow as of late, perhaps a reflection of a late planted crop and less than ideal summer weather for many. The technical picture is neutral near term with a bias for higher on the macro front due to smaller supplies as noted last week and confirmation of mixed harvest results.

SOYBEAN HIGHLIGHTS: Soybean futures closed higher today as the US Dollar fell, harvest progress was released, and OPEC will likely announce that they are cutting oil production at their meeting tomorrow. Nov soybeans gained 9-1/2 cents to end the session at 13.83-1/2, and Jan gained 9-1/2 to 13.93-1/2.

Soybeans continued to slowly regain losses following Friday’s USDA report and a further drop in the US dollar supported crude oil and the grains today. The rising US dollar has put the US at even more of a disadvantage for exports compared to cheaper soybeans out of South America, which China recently gladly scooped up. Crude oil gained nearly 3 dollars as tomorrow OPEC is scheduled to meet and is expected to cut oil production by roughly 1 million barrels per day. Supply issues regarding crude oil create more demand for soybean oil as biofuel and bean oil was higher today as a result. Malaysian palm oil futures also gained 5.5% today adding to the support. Soybean meal was the only soy product that closed lower today, but board crush is still strong at 2.21 per bushel. The August Census crush came out at 175 million bushels, just shy of the 175.4 mb estimate. Crop progress was released and showed that 22% of the bean crop has been harvested compared to just 8% last week, and 25% on average. 81% of the crop is dropping leaves compared to 63% a week ago and 75% on average. Brazil is currently planting with frequent rains and good conditions, but Argentina is still struggling with drought with two thirds of the crop area too dry. Nov soybeans are oversold but have a gap lower that needs to be watched at 13.49.

WHEAT HIGHLIGHTS: Wheat futures ended with a mostly lower close as a mix of profit taking and a lack of news were unsupportive. Dec Chi lost 9 cents, closing at 9.03 and Mar down 9-1/2 at 9.15-1/2. Dec KC was unchanged at 9.88-3/4 and Mar down 3/4 at 9.84-3/4.

Fresh news has been scarce, and with the bull needing to be kept fed, wheat has struggled to rally so far this week. Along with weaker US futures, Paris milling wheat futures were lower again today (but remain above the 100-day moving average). Wheat traders are still trying to figure out global weather conditions as well. Parts of Russia are perhaps too wet, but European conditions are improving, and the US southern Plains are dry. In general, US Plains soil moisture levels are low, and the corridor from the US winter wheat areas into the Delta are drier than normal, with not much rain forecasted. Ultimately, end users may need to come in and buy wheat from the US if the export corridor in Ukraine is closed or because of slowed Russian exports. Increased sanctions and difficulty with companies getting insurance and freight for vessels in and out of Russia may reduce these exports. In the southern Hemisphere, Argentina remains dry and there is concern about their wheat crop and the impact that dryness could have overall. Yesterday afternoon the USDA said winter wheat planting is 40% complete, compared to 45% last year (and 15% is emerged vs 17% average).

CATTLE HIGHLIGHTS: Cattle futures saw choppy market trade on Tuesday to finish with mixed live cattle trade and lower feeder cattle markets. Oct live cattle were down 0.125 at 144.200, and Dec slipped 0.525 to 147.500. Oct feeder cattle were weak, losing 0.875 and closing at 174.650.

Trade was choppy and two-sided on the day in the live cattle market, supported by a weakening US dollar index and strong outside market. October option expiration is on 10/7 with first notice day for October futures on 10/10, which could keep the market choppy into next week. Cash trade was still undeveloped to start the week. Expectations will be for steady to higher trade, as cattle number available may start to tighten. Early asking prices in the southern are targeting higher trade at $145, but bids are still undefined. Retail values have softened but are still supportive of price. Midday retail values were firmer again on Tuesday with Choice carcasses adding 2.88 to 248.82 and Select trading 0.15 higher to 221.56. The load count was light at 52 midday loads. Choice/Select spread remains wide at 27.36 at midday, reflecting a still strong product demand for higher grading beef, which should be reflected in a stronger cash market for the week. Feeder consolidated at the bottom of the recent price weakness and were limited by a firmer grain market on Tuesday. The Feeder index was 0.02 lower to 175.44, relatively in line with the October futures. Feeder charts are at a crossroads, and price movement may be directed by the actions of grains. Grain prices rally, feeders will likely push to new lows, if grain prices fall back, feeders will likely get some buying support. The cattle market is not out of the woods by any thought that a low is in place. The same pressures that weighed on the market as still present, and prices could easily push to new lows. Overall rangebound trade in the front-end look like a stronger possibility.

LEAN HOG HIGHLIGHTS: Lean hog futures saw sellers come back in a strong way on Wednesday, pushing prices to new near-term lows. The hog market may be reaching a value, and with a projected tight supply picture longer-term, this brought buying support into the market.

Hog prices were hoping to build a bottom, but prices broke through to the low side as Tuesday trade developed. This may well have been the washout trade, breaking longs in the markets. Other than poor price action, fundamental factors were relatively supportive of prices on the day, meaning the selloff was truly technical in nature. The cash market is still a concern, and that pressured the October futures as well. Morning direct hog trade was 3.14 higher to an average of 85.81, and a 5-day rolling average of 86.55. The lean hog index traded 0.58 lower to 94.33 and holds a 7.330 premium to the October futures, which could stay supportive of the market on the front end. Pork retail values closed soft on Monday, and that led to a quiet midday trade, gaining 0.05 to 99.98 on light demand of 196 loads. Pork carcass values trading back below $100.00 is concerning as demand issues and heavier supplies of slaughter hogs will limit any upside in this market. Estimated Hog slaughter for today was 487,000 head, trending nearly 4,000 head above week and 8,000 head over last year. The hog market is still dealing with plentiful supplies of hogs in the front-end, and that has kept pressure on the market, still trying to validate a low.

DAIRY HIGHLIGHTS: October Class III futures garnered 6 cents on its final day as the second month contract, closing at $22.26, while the soon-to-be second month November contract gained 42 cents to trade to $21.80. The solidified move over $22.00 by the October contract after multiple failures is a positive sign and spot cheese is up 3 cents for the week so far. Class IV action was pretty quiet as its premium over the Class III futures continues to narrow. The fundamental news today was mixed as the Global Dairy Trade auction was negative with the index dropping 3.50%, but the Dairy Products Production report was neutral to bearish on Class III and bullish on Class IV.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.