MARKET SUMMARY 10-7-2022

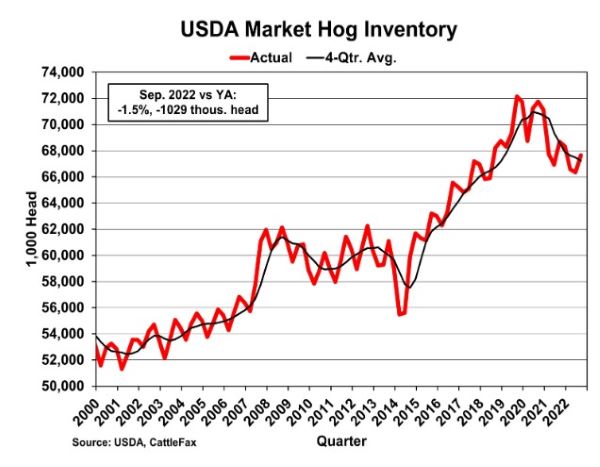

The latest USDA Quarterly Hogs and Pigs Report showed another decrease in the overall hog herd, making it the second straight year of year-over-year contraction. The hog herd was down 1.4% from last year, and market hogs was 1.5% lower. Since 2020, the hog herd is down 4% in the past couple of years. The hog market hasn’t seen the impact of the tighter supplies, as hog weights have trended higher year-over-year, compensating for the lack of hogs. In addition, pork exports had trended well under last year’s levels, adding to a plentiful supply picture. Despite relatively steady production, the hog herd is still looking to remain tight in the near future, which should be supportive overall the livestock markets.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures recovered most of yesterday’s losses, gaining 7-3/4 cents in December to close at 6.83-3/4. December lost 8-1/2 yesterday. Another strong day in energies provided support as did a lack of farmer selling. Crude oil shot through the 92.00 mark gaining near 4.00 on the day trading at its highest level since late August. December 2023 added 3-3/4 to end the session at 6.24-1/2. For the week, Dec corn added 5-3/4 while Dec 2023 added 7-3/4.

There are three big factors in the market this week: harvest pressure, higher energy prices, and dry weather affecting the Mississippi and therefore basis. Additionally, escalation to the Ukraine/Russia war and a hawkish (rising interest rate) mood from the federal reserve were also noted. Harvest pressure is likely holding prices in check. Although we have argued farmer selling is light, there is still selling during the harvest season. Those who may be finding yield better than expected may also be selling extra inventory. A lack of carry suggests paying for commercial storage is not necessarily attractive. Sinking basis levels due to barges grounded on the Mississippi is also a factor this week, mostly affecting cash. Export sales were slow on this week’s sales report suggesting buyers are still waiting for harvest pressure, buying only what is needed, or both. Prices remain high historically. World supplies should be confirmed as sung on next week’s USDA report. The escalation in the war suggests the agreement to maintain export out of Ukraine is in jeopardy when the agreement ends on November 22. Wording this week from Federal reserve members suggest another rate hike likely, maybe 0-3/4%. The implication of rising interest rates is the dollar will continue upward. The dollar finished higher three consecutive sessions.

SOYBEAN HIGHLIGHTS: Soybean futures closed higher today due to concerns that incoming sub-freezing temperatures would damage yields to late planted crops. Another bullish factor is higher crude oil which is up over four dollars a barrel. Nov soybeans gained 9 cents to end the session at 13.67, and Jan gained 8-3/4 to 13.79-1/4.

The soy complex closed higher across the board today and was mainly led higher by temperatures this weekend that are forecast to be subfreezing across the Midwest and may harm yields for late planted crops. The other bullish factor came as a big jump in crude oil prices, which are now above 92 dollars a barrel and continue to rise despite the continuously rising US Dollar. OPEC’s announcement to cut oil production by 2 million barrels per day will have significant impacts on the price of crude, and as a result, the soy complex. December soybean oil had the largest percentage gain among the soy products on the week closing up 5.04 at 66.60, and December palm oil was strong as well, gaining 12% on the week. A bearish concern is the sharp drop in soymeal cash prices in Illinois of 116, but soybean crush premiums remain strong at 3.16 today. The low water levels on the Mississippi River are a remaining concern for moving both corn and soybeans as many barges are struggling to pass in the shallow water. Thursday’s Grain Transportation Report from the USDA showed 139,250 tons of beans being moved by barge in the week ending Oct 1, up from the previous week but down 13% from a year ago. Exports need to pick up for prices to move higher and China has been purchasing cheaper beans from South America with Brazil poised to have a record crop. Nov beans are still trending lower near their Bottom of their Bollinger Band and remain oversold.

WHEAT HIGHLIGHTS: Wheat futures posted small gains today, reflective of a lack of big news this week. Dec Chi gained 1-1/4 cents, closing at 8.80-1/4 and Mar up 2-1/4 at 8.95. Dec KC gained 3-3/4 cents, closing at 9.68-3/4 and Mar up 3-3/4 at 9.66-1/4.

It was a quiet close for the wheat market, but the weekly close was a bit more disappointing with Dec Chi losing 41-1/4 cents and Dec KC down 22-3/4. The upward trend on the weekly charts is still intact, however. And Dec Paris milling wheat futures did manage to finish the week above the 100-day moving average, despite a weekly loss of 8.75 Euros. In general, harvest pressure is creeping in on corn and soybeans and that may end up pressuring wheat by association. Looking at the big picture, there are concerns about the state of the economy which are weighing on most markets. Additionally, there was talk this week of grain barges having issues navigating the Mississippi River due to low water levels. While not a lot of wheat is shipped on the Mississippi, it represents a wider issue which will likely still impact wheat futures for some time to come – drought. The southern Plains have been lacking rain (to say the least) with not much more in the forecast, and dryness is also delaying some of the winter wheat plantings for next year. Also on the minds of traders is the war; Ukraine has retaken some ground in the annexed areas, leaving many to wonder what Putin’s next move will be. The export corridor is set to expire on November 22, raising more questions about what lies ahead for both countries. On a final note, next week Wednesday will be the monthly supply and demand report. In general, the market seems to be looking for lower wheat carryout numbers, but there is always room for surprises.

CATTLE HIGHLIGHTS: It was a quiet day in the live cattle market as most of the news was priced in for the week, but feeder saw grain market strength return, pushing prices lower to end the week. Oct live cattle were unchanged at 145.325, but Dec gained 0.175 to 148.050. Oct feeder cattle traded 1.000 lower to 174.725. For the week, October live cattle were 2.050 higher and December added 1.000. October feeders finished the week up slightly, gaining 0.550.

With cash trade mostly complete for the week, live cattle futures were looking for direction on Friday. The bulk of business was done for the week in cash trade, and most trade was mark at $144, up $1 from last week. Some isolated trade was higher in different regions of cattle country. Northern dress trade was also firmer wit $230 catching most trade, $1 higher than last week as well. Today’s slaughter totaled 127,000 head, even with last week, but 6,000 head greater than a year ago as front-end supplies still are comfortable, but packers are still bidding up for higher grading beef. Retail values were mixed at midday with Choice carcasses trading 0.19 higher to 247.55 and Select was 1.67 higher to 218.66. The Choice/Select spread moved to 28.89, reflecting that demand for higher grades of beef. The load count was moderate at 83 midday loads. Choice beef carcasses trended higher on the week, gaining nearly $4.00 from last Friday’s close. In feeders, prices still held some gains on the week, but the firmer corn market pressured the feeder complex on Friday afternoon. Next week could be volatile for feeders with the USDA Crop Production numbers on Wednesday, which could trigger a move in the corn market. If supplies remain tight and the market has a bullish reaction, feeder prices will likely be the opposite of that trade. The Feeder cash index traded .77 lower to 174.92 and mostly in line with the October futures. October options for live cattle expired on Friday, and first notice day for October futures is on Monday, which could keep the market choppy the next few days. October futures are trying to build a trend higher led by the stronger cash, and December is trying to build a base above the recent low.

LEAN HOG HIGHLIGHTS: Lean hog futures mixed trade to end the week. Prices consolidated near the top of this week’s gains as value buying lifted hog futures this week off early week lows. Oct hogs gained 0.575 to close at 92.950, but Dec was down 0.625 at 77.150. For the week, October hogs gained 3.725 and December added 0.925 after two strong weeks trading lower.

Weekly gains put reversal into the weekly chart, which have improved the technical picture. There are still fundamental issues for the hog market to work through; the turn higher on the week could open the door for additional buying support. The cash hog market is still struggle with direct morning trade 1.68 lower to 87.64 and a 5-day average of 87.83. The lean hog index traded softer on Friday losing 0.16 to 92.77. The gap from the index to the October futures are trading in line with each other, but December looks undervalued with a 15.620 discount to the futures. Slaughter pace has been running strong with estimated slaughter at 2.558 million head this week, 71,000 above last week. Hog slaughter is running nearly 3% under last year, but heavier pork carcass weights have kept production stable and export demand has been soft, building pork supplies. Pork retail values were higher, gaining 1.76 at midday to 103.17 on light demand of 166 loads. Hog supplies stay ample, and there is still plenty of animals for the packers to pursue. The technical picture did improve this week with the higher weekly closes. The market could see additional value buying and short covering to start the week next week.

DAIRY HIGHLIGHTS: In this week’s dairy trade, contracts continued to push steadily higher. There remains a strong amount of demand for both butter and cheese in the spot trade, which is supporting higher prices. October is now the front month for both Class III and IV milk. October Class III settled this week up at $22.11, which is up 36c from last week’s close. The US spot cheese trade was up 4 cents per pound this week on 19 loads traded, blocks settled at $2.0225 and barrels at $2.225, averaging $2.12375. Class IV October futures gained nearly 50 cents on the week to close today at $24.85. Spot butter continues higher with more than 7 cent gains on the week to finish at $3.2175 per pound. News for the week was quiet, but there was a Global Dairy Trade auction on Tuesday that fell 3.50%.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.