MARKET SUMMARY 11-07-2022

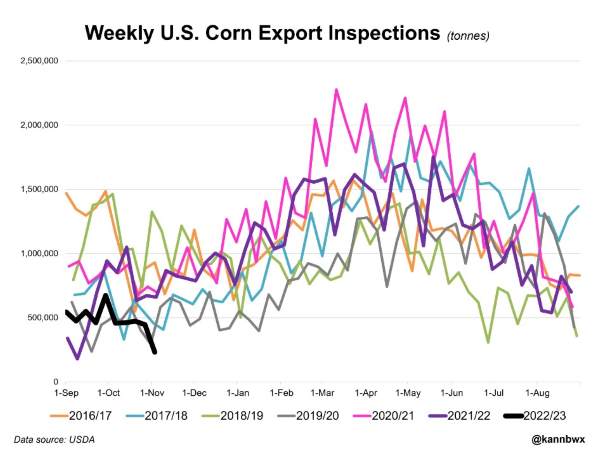

While weekly export inspections for soybeans have been strong to start export season, corn shipments have been very disappointing. On this week’s export inspections report, only 231,000 mt of corn was inspected for shipment. This was below market expectations, half of last week’s totals. Last week was one of the worst weeks on record compared to recent years. The high price for corn and the overall lack of demand globally, as we struggle against cheaper global competition, have been big factors weighing on corn shipments. In addition, priority in this window goes to exporting fresh soybean supplies, and with issues occurring on the Mississippi River slowing transport, the export market has been more focused on soybeans versus corn. Corn export shipments become more aggressive in later months, but exporters will need to see the pace jump significantly to reach USDA export targets for the year.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures finished lower, near the daily low price just like Thursday and Friday, despite a drop in the U.S. dollar. Dec futures lost 5-1/4 cents to end the session at 6.75-3/4 its lowest close since late September. Export inspections continue to run weak with today’s figure of 9.1 mb, confirming export sales are at a very slow pace. Some might argue the world’s need for soybeans is paramount, so importers are focusing on getting beans in the pipeline utilizing shipping capacity that is currently available. While that may be true to a degree, if export sales (and inspections) don’t increase soon expect the USDA to waste little time reducing sale expectations.

Year-to-date, inspections at 445,693 mt trail 659,901 for the same period last year. This drop is 32.5% and is starting to make traders uneasy that both sales and inspections can’t reach projections. Rain delays in parts of the Midwest will slow harvest some, but probably not enough to worry about corn standing for a prolonged amount of time. Supportive news is lacking and harvest pressure, though subsiding, is still there. Expectations are that crop progress will show the crop near 85% complete. The stock market was stronger for the second session in a row and was perhaps viewed as a buy by large traders as compared to corn. Friday’s COT report indicated managed money was long just under 272,000 contracts, the highest level since late spring. The bulls will need positive news soon. Wednesday the USDA will release the monthly WASDE report.

SOYBEAN HIGHLIGHTS: Soybean futures closed lower today following concerns over export demand, China’s announcement of continued strict Covid policies, and some technical resistance which led to profit taking. Meal closed slightly higher while bean oil traded lower. Nov soybeans lost 11-1/2 cents to end the session at 14.40, and Jan lost 12 cents at 14.50-1/4.

Soybeans started strong but faded into the day, and lower crude oil wasn’t a support for bean oil which has been carrying the soy complex. China has announced that they would continue their zero-Covid policy which has forced hundreds of millions of civilians to be put under lockdown, and this policy will continue until 70% of the Chinese population has been vaccinated. This news comes as export demand is already a concern, and China’s October soy imports came in at just 4.14 mmt, down 19% from a year ago. China’s total imports were down 7.4% from a year ago at 73.2 mmt. Domestic demand remains firm thanks to still strong crush margins and the demand for bean oil as biofuel. The U.S. soybean harvest is expected to be 95% complete as of Sunday on this afternoon’s Crop Progress report, and strong basis will likely increase selling. Soybean meal has been lagging behind bean oil as more soybeans are crushed, but bean oil prices remain near contract highs. Last week’s CFTC data showed funds as net buyers of soybeans increasing their net long position by 25,916 contracts to 101,329 contracts. Jan beans managed to close above their 200-day moving average again and are in an uptrend, but are technically overbought.

WHEAT HIGHLIGHTS: Wheat futures traded both sides of neutral but ended with a mixed close. News related to China’s covid policy seemed to put pressure on the grain markets today. Dec Chi lost 2 cents, closing at 8.45-3/4 and Mar down 2-3/4 at 8.64. Dec KC gained 4 cents, closing at 9.57-1/4 and Mar up 3 at 9.53-3/4.

Traders will have a lot of information to chew through this week; midterm elections, the November WASDE, export data, and inflation data may all impact the markets over the coming days. Based on pre-report estimates from the Wall Street Journal, there are not expected to be many changes made, but there is always room for a surprise. From a fundamental point of view, there was an announcement by China that they will have a zero-tolerance covid policy until 70% of their population is vaccinated; some believe this will last through 2023. In any case, this news is offering resistance to the grain markets (especially soybeans) which may have pulled Chi wheat lower by the close. KC and MPLS futures fared better, with both ending in the green. It is evident that there are still supportive factors out there, with the drought in Argentina being one of them. Argentine corn planting is said to be only 23% complete vs 40% average because of this dryness. And though we have touched on the wet conditions in Australia before, it is worth mentioning that as much as 20% of their crop could be downgraded to feed. U.S. winter wheat conditions are also record-low for this time of year, and NOAA long-term forecasts suggest that Mississippi River water levels could remain historically low into spring. And then there is still the ongoing Ukraine war. Russia reportedly wants sanctions lifted from one of their state banks before agreeing to extend the export deal beyond November 19. On a bearish note, exports have been poor. Export inspections for wheat were a dismal 6.7 mb with total inspection now at 361 mb.

CATTLE HIGHLIGHTS: Live cattle futures started the week higher supported by a lower grain market, buying in the hog complex, and continued optimism for strong cash trade. Dec gained 1.400 to 153.050 and Feb cattle were 0.650 higher to 155.025. In feeders, Nov feeders gained 0.400 to 178.225.

Cattle markets saw some buying support to start the week, as a strong hog complex and seasonal trade brought some money flow into the cattle markets. Technically, the cattle market picture improved with the strong price action today, which could see some money flow continue as retailers look to build supplies for the upcoming holiday season. A positive overall cash market tone helps support this market as the supply of animals is looking to tighten into the end of the year. Cash prices were undeveloped, typical on Monday, but expectations are for steady to higher cash trade again this week. The spread between the futures market and cash trade could be a limiting value. Dec and Feb are at a premium to last week’s cash, and that could be a limiting factor. Retail values were firmer at midday as choice carcasses gained 0.59 to 264.34 and select trade 1.94 higher to 233.84 on light movement of 51 loads. The choice/select spread stays supportive at 30.50 between the two, still reflecting the demand for quality retail beef and the current feedlot situation. Total slaughter last week was down 0.1% from the previous week, shaving nearly 11 million pounds out of beef production compared to last week. Feeders saw some price recovery as well, supported by the livestock strength and the weaker grain market tone. Feeder prices may be moving into a range bound trade. The Feeder Cattle Index traded 0.08 lower to 176.91. The cash index is currently at a discount to the Nov futures, which could be limiting the buying strength with Nov expiration on 10/17. Cattle charts look tired and defensive, but the price action today may be the signal for some possible higher into the Thanksgiving window. Cash trade is still the key for price support and the path overall, and those fundamentals supporting the cash market are still friendly.

LEAN HOG HIGHLIGHTS: Lean hog futures saw strong buying and money flow into the markets as prices posted triple-digit gains. Dec hogs gained 4.075 closing at 87.050 and Feb was 2.625 higher to 89.050.

Hog futures jumped on technical buying as money flowed into the hog market and prices pushed back above key moving averages. This improved the technical picture and triggered new buying. The strong price gap between futures and the cash index may have shown the need for more money flow to the upside, despite the lack of fundamental support. Despite the strong move higher, the weak retail market and its lack of support to the cash market will be limiting factors to any sustained hog rally. Like in cattle, seasonal tendencies are for some buying strength as retailers are looking to lock in pork supplies for the holiday market. Retail values have struggled recently, but midday carcass values held firm, gaining 1.92 to 98.64 on movement of 160 loads. The Pork Carcass Index reflects the soft tone, losing 0.92 to 97.16. Overall, the weak retail values will make it difficult for packers to bid for cash hogs. Direct cash trade on Monday stayed weak, losing 1.48 to an average of 82.68, and a 5-day rolling average of 85.80. Dec was likely supported by a strong discount to the Lean Hog Index. The index traded 0.89 lower to 91.45. The cash index holds a 4.400 premium to the futures after today’s strong trade. This provides support for the front-month contract, but cash prices look like they are on a slippery slope, especially given the weak retail market. The hog market quickly turned the technical picture more positive, unfortunately, the fundamental picture is still not cooperating with a potential longer-term rally.

DAIRY HIGHLIGHTS: Between last week Monday and Wednesday, the US spot butter market fell a total of 53c, from $3.14/lb to $2.61/lb. The selling pressure has since quieted down and buyers have been grabbing loads at a discount ever since. Monday’s session saw butter rebound another 9.75c to $2.87/lb on 4 loads traded. The volatile nature of the butter trade, along with a weaker spot powder trade, is keeping the Class IV milk market softer. Class III milk was also a bit softer to start the week, but did rebound strong into the end of last week after earlier selling. The fact that spot cheese closed back over $2.00/lb is a positive. This week of trade for dairy will be quiet on the news front, so expect daily spot trade activity to determine price direction. There is a USDA Supply and Demand report on Wednesday, however.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.