MARKET SUMMARY 11-08-2022

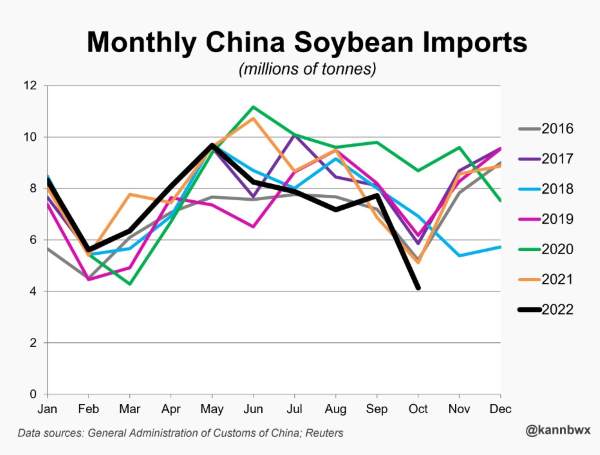

China’s October soybean import totals were very disappointing to the global soybean market. In October, China imported only 4.14 MMT of soybeans, the lowest volume for any month since October 2014. The combination of reduced demand due to concerns regarding the Zero-COVID policy, and logistical issues in moving U.S. soybeans helped reduce the totals. For the calendar year since January, total soybean imports into China have totaled 73.2 MMT, down 7.5% on the year. China’s appetite may be looking to improve in the near future, as soybean meal stock in China is very tight, and prices for soybean meal are near record highs, which may encourage a more aggressive buying and importing tone going into the end of the year.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures had another weak close ending the session down 8-1/4 cents in Dec to close at 6.67-1/2. A lack of bullish news and managed money likely reducing long positions in front of tomorrow’s USDA WASDE report weighed on prices today as did double-digit losses in the wheat market. Dec 2023 lost 4-1/4 to end the session at 6.19-1/4. Harvest is 87% complete.

Tomorrow, the USDA will release the November WASDE report, and the market may have new information to find direction. According to a DTN survey, the average pre-report yield estimate is 171.9 bpa, unchanged from last month. Projected carryout for the 2022/2023 marketing year is forecasted at 1.212 bb up 40 mb. A small reduction in exports is anticipated. Beyond the report, the market may have, in part, been defensive in front of today’s elections. Not that the elections would necessarily impact corn prices, yet it is just another one of the events/uncertainties that could impact the marketplace. Recent rains in parts of the Midwest are highly welcome, yet much more is needed. The most recent drought maps indicate most of the country is struggling with dry conditions. On the one hand, if there is a time of year to be dry, fall is it. On the other, if winter moisture is lacking a spring price rally is likely.

SOYBEAN HIGHLIGHTS: Soybean futures closed lower again today as falling crude oil removed the support that has been keeping bean oil strong. Traders may be on the side today ahead of tomorrow’s WASDE report, and export demand is still a concern, especially with China’s Zero-Covid policy. Nov soybeans gained 4 cents to end the session at 14.44, and Jan lost 3-3/4 cents at 14.46-1/2.

Soybeans had mild losses today with Nov gaining as it approaches expiration, but bean oil was the biggest loser as crude oil fell over 2.50 a barrel. Overall, between the election today and tomorrow’s WASDE report, traders were risk-off today. Tomorrow’s WASDE report could apply some bearish pressure if yields and production are increased. The average trade guess for 22/23 soybean production is 4.315 bb, and 49.8 bpa for yield, both slightly higher guesses than last month’s USDA report. The Dow Jones survey expects soybean ending stocks to rise from 200 mb to 215 mb, but would still be the lowest level in seven years. On the bullish side, there were two flash sales reported this morning with 138,700 tons of soybeans sold to China for 22/23, and 132,000 tons sold to unknown destinations. Export demand is there for now, but there are fears that it drops off in the future. Domestic demand on the other hand is historically strong as crush margins soar. Yesterday’s USDA report showed the value of crushing soybeans in Illinois increased by 52 cents last week to 20.29 per bushel, estimated at 5.70 above the cost of soybeans, a huge incentive for processors to buy cash beans as the growth of demand for renewable diesel continues. Soybean harvest came in at 94% complete in the U.S. as of Sunday. Brazil has more favorable conditions ahead as more rains are forecast this week, with Argentina remaining mostly dry. Jan beans are showing a sell crossover signal in the stochastics but still managed a close above the 200-day moving average today.

WHEAT HIGHLIGHTS: Wheat futures struggled today and finished with double-digit losses. A mix of factors likely played into this, including the elections and pre-report positioning. Dec Chi lost 18 cents, closing at 8.27-3/4 and Mar down 16-1/2 at 8.47-1/2. Dec KC lost 11-1/2 cents, closing at 9.45-3/4 and Mar down 12 at 9.41-3/4.

It turned out to be a sour day in the wheat market with substantial losses across all three U.S. futures classes and Paris milling wheat futures to boot. Today there may have been a lot of positioning ahead of tomorrow’s USDA report, but that is not the only thing on the minds of traders. Today is election day and that has the potential to affect markets in addition to everything else going on in the world right now. While Russia is still offering the world’s cheapest wheat, they are also insisting that sanctions against them be lifted before they agree to an extension of the Ukraine export deal. Here at home, winter wheat is reported to be 92% planted and 73% emerged, both close to average. And while the good to excellent rating for winter wheat was raised 2% to 30%, it is still well below last year’s 45% at this time. Other factors that will affect the market include Australia’s waterlogged crop. Parts of eastern Australia are expected to get another 1-3 inches of rain in these already too-wet areas. And besides all the data received this week, a winter storm will work across the northern Plains and into much of the Midwest, bringing the potential for blizzards and cold temperatures. As for the WASDE report tomorrow? Major changes are not expected, and ending stocks are expected to remain tight. On a final note, as the deadline for the Ukraine export deal is less than two weeks away, much attention is still focused on the Black Sea; winter wheat planting in Ukraine is said to be down 40% or more from last year.

CATTLE HIGHLIGHTS: Live cattle futures were weak on Tuesday, reflecting an overall weak tone in the commodity markets on the day, despite a weak U.S. Dollar Index. The risk of U.S. election results and the USDA WASDE report on Wednesday likely have brought some caution to the market. Dec finished unchanged at 153.050 and Feb cattle were 0.250 lower to 154.775. In feeders, Nov feeders gained 0.050 to 178.275.

A relatively quiet and choppy day in the cattle markets as the news stayed quiet overall, and the market is looking for fundamental news to establish price direction. A positive overall cash market tone helps support this market as the supply of animals is looking to tighten into the end of the year. Cash prices were still undeveloped on Tuesday as bids and asking levels are undefined. Expectations are for steady to higher cash trade again this week, but trade will likely develop later in the week. The spread between the futures market and cash trade could have an impact, as Dec and Feb futures are at a premium to last week’s cash, and that could be a limiting factor. Retail values were firmer at midday as choice carcasses gained 1.21 to 265.76 and select trade was 0.93 higher to 236.85 on light movement of 80 loads. The choice/select spread stays supportive at 28.91 between the two, still reflecting the demand for quality retail beef and the current feedlot situation. Total slaughter on Monday was 123,000 head, down 5,000 from last week, but still up 3,000 versus last year feeders finished mixed supported by the weaker grain market tone. Feeder prices may be moving into a range-bound trade. The Feeder Cattle Index traded 0.08 lower to 176.91. The cash index is currently at a discount to the Nov futures, which could be limiting the buying strength with Nov expiration on 11/17. Not a lot of information in the cattle market to move prices on Tuesday as prices looked for direction. Cash trade is still the key for price support and the path overall, and those fundamentals supporting the cash market are still friendly.

LEAN HOG HIGHLIGHTS: Lean hog futures gave back some of Monday’s gains, as the retail and cash market failed to push the market higher overall. Dec hogs lost 1.475 closing at 85.575 and Feb was 0.550 lower to 88.500.

Front-end hog futures failed to push higher after strong triple-digit gains to start the week. Bear spreading was noticeable in the market as deferred contracts still pushed slightly higher on the day. The weak retail market and its lack of support to the cash market continue to be limiting factors to any sustained hog rally in the nearby contracts. Retail values have struggled recently, and midday carcass values reflected the trend, losing 1.31 to 95.64, down nearly $3.00 from the midday trade on Monday. The load count was improved at 200 loads. The Pork Carcass Index is still trending lower, losing 0.47 to 96.69. Overall, the weak retail values will make it difficult for packers to bid for cash hogs. Direct cash trade on Tuesday was firmer gaining 3.43, but after a weak close of the midday trade, was really only 1.34 above the midday trade on Monday. The direct trade averaged 82.68, and a 5-day rolling average of 85.51. Dec was likely supported by a strong discount to the Lean Hog Index. The index traded 0.57 lower to 90.88. The cash index holds a 5.350 premium to the futures. This provides support for the front-month contract, but cash prices look like they are on a slippery slope, especially given the weak retail market. The hog market tried quickly turn the technical picture more positive with the strength on Monday. Tuesday brought some consolidation; the hog markets is still concerned that the fundamental picture is still not cooperating with a potential longer-term rally.

DAIRY HIGHLIGHTS: Class III futures continue to find strong demand in the marketplace. With little-to-no fundamental reports out yet this week, the move higher is a welcome sign as Class III contracts were at or near calendar year lows at the end of October, and have strongly rebounded. December contracts gained 50 cents on the day; coming all the way up from a low of $18.53 on 10/28 to settle today at $20.97. Each Class III contract from Nov ’22 to Nov ’23 is back over $20, while the ’23 calendar year average is close to 60 cents above last week’s low. Class IV futures were mixed-to-lower today, as the spot and futures butter contracts came under selling pressure. The bounce off the large fall in the spot butter market turned sharply back south today with the session giving up 7 cents per pound, creating an extremely volatile market over the last 10 days. Spot cheese market barely held above $2 per pound after losing a quarter of a penny, spot powder market unchanged at $1.3850, and spot whey gives a penny to close at $0.435.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.