MARKET SUMMARY 11-10-2022

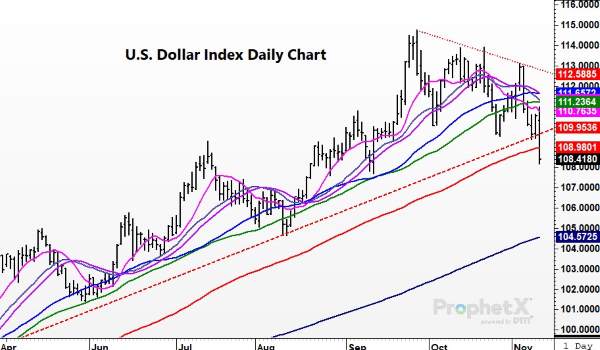

The U.S. Dollar Index broke aggressively lower on Wednesday as CPI inflation data was reported lower than expected. This morning, CPI data or consumer price index, which is a measure of inflation, was at 7.7% for the month of October, compared to last year, and a 0.4% increase from last month. While still seeing inflation climbing, this number was below expectations. The better-than-expected print caused the U.S. Dollar Index to drop over 2 full basis points, trading at its lowest point since September. On charts, the dollar index traded below the 100-day moving average for the first time since June of 2021. With inflation possibly cooling, the market is anticipating a possible slowing of interest rate hikes, that have supported the dollar and pressured the markets in general. The dollar chart has been weak recently and trending lower. The weak technical picture and lower trade should help support commodity prices overall if the trend continues.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures lost ground again today as they have all week with Dec finishing lower for the fourth day in a row and seven of the last eight sessions. This is despite a plunge in the U.S. dollar. Dec corn closed 11-1/4 cents lower at 6.52-1/4 and Dec 2023 lost 6-1/2 to end the session at 6.07-3/4. Sharp gains in the equity markets may have money managers ditching commodities and buying stocks. Investing in long corn futures has not paid dividends as of late. As an example, if corn futures were bought and held since the end of August the position is behind. Some very prominent buy signals on equity index charts since August have developed likely enticing investors to be buyers. Mexico continues to indicate they will not be buying any corn that is GMO in 2023 is another negative cloud as is mostly good weather in South America.

Export sales remain dismally slow with today’s figure at 10.4 mb. The total so far this marketing year is 580 mb compared to 1.263 bb a year ago same time. Other stories that have a negative slant are Argentina, again pegging the peso to the U.S. to an exchange rate of 200 pesos per dollar, a move that should encourage farmer selling and exports of soybeans. Yesterday’s supply and demand report indicated beef production is anticipated to be down 2.1 billion pounds or 7.3%. This suggests less feed. Overall, today’s poor finish, poor export sales, and technical selling were too much for the market to handle. In addition, a close below the 200-day moving average likely sent a signal to traders to exit longs. Lastly, droughty conditions persist, however, fall field work is ahead of schedule and if there is a time to have a drought it is in the fall.

SOYBEAN HIGHLIGHTS: Soybean futures closed lower today along with meal, but bean oil managed a positive close. Bullish CPI data released this morning gave equity markets a huge boost, but it seems likely that funds were moving out of commodities and into the stock market causing today’s low prices. Nov soybeans lost 29-1/4 cents to end the session at 14.30-1/2, and Jan lost 29 cents at 14.23.

Today was risk-off in commodities for traders which saw them pouring into the stock market following this morning’s CPI data, which saw consumer prices rising 0.4% in October, below expectations and a sign that inflation is easing. This caused the U.S. Dollar Index to break sharply lower which would normally be a bullish factor for grain prices. Instead, there was a significant sell-off in grains and an even more significant jump in stocks in which the S&P 500 gained over 5%, and the Dow gained over 1,000 points. Jan soybeans were overbought and perhaps due for a correction but the fundamental picture has not really changed with the strength of domestic demand and the tight ending stocks. Despite such a sharp sell-off in beans and meal, bean oil closed higher which shows how real the demand for bean oil as biofuel is becoming. Crush margins are still historically high prompting processors to buy cash beans, and U.S. ending stocks for 22/23 are just 220 mb. Yesterday’s WASDE report was essentially neutral for beans as U.S. production was increased but global carryout estimates fell. Combined with domestic demand, export business has remained alive with 29.2 mb of US beans sold for export last week with China as the top buyer. Jan beans remain in an uptrend but closed below their 200-day moving average, and now sit above the 50-day moving average.

WHEAT HIGHLIGHTS: Wheat futures posted losses today as the market again took on a risk-off posture. Dec Chi lost 3 cents, closing at 8.03-1/2 and Mar down 2 at 8.25-3/4. Dec KC lost 4-3/4 cents, closing at 9.25-1/4 and Mar down 5-1/4 at 9.21-1/2.

Money flow appeared to move out of commodities today and into financial markets. Grains were down but as of this writing the Dow is up over 1,000 points and the U.S. Dollar Index is sharply lower. CPI data this morning, while still high, came in lower than expected. Wheat traded somewhat erratically today, crossing both sides of steady several times. It could not hold onto gains however and finished lower across all three U.S. futures classes and Paris milling futures were down too. Though it is still up in the air right now, many are now leaning towards an extension of the Ukraine export corridor. Russia and Ukraine will meet in Geneva on Friday to discuss an extension of the deal. In the Southern Hemisphere, Argentina said their wheat crop is only 11.8 mmt compared to the USDA’s 15.5 mmt. U.S. wheat exports remain sluggish as domestic prices remain at a premium to other world exporters. The USDA reported an increase of 11.8 mb of wheat export sales for 22/23. There are a couple other news items worth mentioning that, while not a direct impact to wheat, will impact the markets overall. First, Argentina may have another soy dollar policy in December. In other words, they may again offer a more favorable exchange rate to farmers for soybeans. Second, the president of Mexico has said that starting in 2024 the country will no longer import U.S. GMO corn.

CATTLE HIGHLIGHTS: Live cattle futures saw good buying support as cash trade bids improved from Wednesday, and favorable moves in outside markets brought buyers into the cattle complex. Dec finished gained 1.500 to 153.075 and Feb cattle added 0.875 to 155.025. In feeders, Nov feeders gained 0.900 to 178.625, and Jan feeders jumped 2.050 to 181.700.

The cash market saw additional business on Thursday, with southern bids holding $150, but northern bids firmed to $153 to catch most business. These totals were mostly steady to firmer than last week’s totals. Trade will likely be wrapped for the week, with the exception of some cleanup trade on Friday. The cash tone stays optimistic, and Dec futures pulled in line with the cash market. In outside markets, a lighter-than-expected CPI data print triggered a strong move in equity markets and a sharp selloff in the dollar index, which was also supportive of prices. Retail values were mixed at midday as choice carcasses lost 0.17 to 264.50 but select trade was 3.35 higher to 238.57 on light movement of 59 loads. The USDA announced weekly export sales for last week, and new sales on the books totaled 13,700MT with South Korea, Japan, and Taiwan as the top buyers of U.S. beef last week. Feeders finished higher, supported by strong selling in grain markets and a positive trading day in the live cattle market. Feeder prices jumped on an improved technical picture, breaking out of the most recent price ranges. The Feeder Cattle Index traded 0.79 lower to 175.51. The cash index is currently at a discount to the Nov futures, which could be limiting the buying strength with Nov expiration on 11/17. Cash trade is still the key for price support and the path overall, and it had an impact today. The strong supportive move in outside markets has turned charts more technically friendly. Cattle markets will be looking for more buying support to end the week.

LEAN HOG HIGHLIGHTS: Lean hog futures finished moderately lower on the session, as cash markets and retail values fail to support the big picture in the market. Dec hogs lost 0.400 closing at 84.875 and Feb was 0.325 lower to 88.825.

Dec hogs seemed to be tied to the 200-day moving average, trading on both sides of this technical point since mid-October. Rallies seem limited by the cash and retail market, but buyers seem to step in and support the market around weakness. The concern is for a potential break in either direction. The spread between Dec and Feb jumped 1.050 during the trading session. Retail values found some support again at midday, as pork carcasses traded 2.70 higher to 96.82. The load count was 150 loads. The Pork Carcass Index is still trending lower, losing 0.45 to 96.80, and trading at its lowest point since February. The Pork Cutout Index is on a similar path to last year as index values dropped, hitting a low in early December. Weekly export sales were soft at 10,800 MT for the week. Mexico, South Korea, and China were the top buyers of pork last week. Direct cash trade on Thursday was soft, losing 3.54. The direct trade averaged 84.21, and a 5-day rolling average of 85.53. The Lean Hog Index traded 0.82 lower to 89.46. The cash index holds a 4.585 premium to the futures which failed to provide support for the front-month contract. The estimated hog slaughter today was 490,000 head, up 1,000 from last week and 13,000 over last year, keeping pork supplies comfortable in the near term. The hog market is choppy, looking for direction as the slaughter total remains strong keeping plenty of product available.

DAIRY HIGHLIGHTS: Class III futures took a small breather from its recent run up, while Class IV saw nice gains in the front month November contracts. Cheese, butter, and whey futures were all mostly down on the day, while powder futures saw nice gains in the future months. These products had better fortune in the spot trade as their was active purchasing that brought prices higher and are helping to support milk’s recent gains. Spot cheese prices were up 5 cents on average with blocks up 7 cents and barrels up 3 cents on four total loads traded. Spot butter traded three loads, spot whey and powder traded 2 loads each, while all three products saw minimal gains. Next week will be slow for fundamental news and reports show holiday ordering starting to wane; these two factors could try to pressure prices lower on the path of least resistance.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.