MARKET SUMMARY 11-15-2022

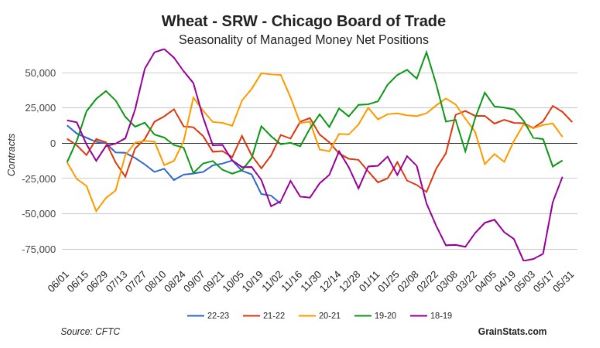

Managed money continues to push their short position in the soft red wheat (SRW) or Chicago wheat market. Last week’s Commitment of Traders Report saw this short position grow to 42,902 contracts. This is the largest short position held since 2020 in that market. Since the invasion of the Ukraine, funds have been selling in the wheat market, and adding to that position on price jump as global wheat prices may have been overvalued. This large short position makes the market volatile to headline risk, as prices digested news of stray missiles hitting Poland in this afternoon trade. Add in weather concerns in some key wheat producing regions, a dropping U.S. dollar index, and the ongoing tension in the Ukraine, who alone said that wheat planting would be off 40% over last year due to the war, the short side of the market could be poised for vulnerability. Regardless, wheat has been a very headline driven market and given the market positioning, this will likely be the case going forward.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures received a shot in the arm today on news that the Ukraine war may escalate beyond its borders. Dec gained 9-1/2 cents to close at 6.66-3/4 and march was up 10 at 6.69-1/4. The Dec 2023 contract gained 7 cents to finish at 6.14-1/4.

It was a relatively quiet day for corn with early weakness, until a reversal occurred in the early afternoon. Breaking news that a Russian missile landed on the Polish side of the border, killed two people, which caused the grain markets to rally. As this situation is still developing, it is difficult to know how it will affect the markets. The initial reaction was strong with corn up almost another dime from where it ended up settling today. Some are speculating that Russia will issue an apology for this incident, and it may blow over. Others however are more concerned of a global conflict as Poland is a NATO member, and their president and prime minister called an emergency meeting after the strike. Aside from this news, the Black Sea export deal expiration date is November 19 and fast approaching. An announcement this week regarding the deal was expected with many thinking that an agreement would be reached – now that seems somewhat less likely. In other news, corn was also helped today by the USDA’s announcement of sales to Mexico. Private exporters reported sales of 230,185 mt of corn for delivery during the 22/23 marketing year. Overall, the US corn export commitment is 54% below a year ago which has contributed to recent weakness. Adding to pressure are South American rains and generally favorable conditions in Brazil (though Argentina is still probably too dry).

SOYBEAN HIGHLIGHTS: Soybean futures reversed from their lows this morning and closed higher along with meal and oil. The gains accelerated this afternoon after news broke that stray Russian missiles struck Poland, killing two civilians. Crude oil spiked to 88.50 but settled back down to a 50-cent gain. Jan soybeans gained 16-3/4 cents to end the session at 14.57-1/4, and March gained 17 cents at 14.61-3/4.

The soy complex was trading quietly earlier without much news to go on until around noon when it was reported that stray missiles from Russia accidentally crossed the Ukrainian border and struck Poland, killing two people. This initial shock caused all grain products to move higher, but by tomorrow when the dust has settled, it will likely have little impact on beans as they aren’t typically sensitive to news regarding the war. Regardless, beans did close at the upper range of their bull pennant formation and technically could be nearing a breakout. Soybean exports have been active, and there was a new sale today to Mexico of 9.6 mb. Last week’s export inspections were decent at 68.3 mb but behind the 4-week average of nearly 100 mb. While soybean exports have been active, they declined last week and that should be watched. Domestic demand has been firm, but export demand needs to remain strong to keep prices supported. NOPA’s October crush came in at 184.5 mb, up from 158.1 mb the previous month as processors take advantage of big crush margins. Yesterday’s CFTC report showed non-commercials as buyers of 2,579 contracts increasing their net long position to 103,908 contracts. Jan beans are in a sideways range but are at the higher end of their bull flag formation.

WHEAT HIGHLIGHTS: Wheat futures in Chi closed about 30 cents off their daily low (and KC 20 cents). This boost came in the form of a Russian missile strike that hit on the Polish side of the border. Dec Chi gained 9-3/4 cents, closing at 8.28-1/4 and Mar up 9-3/4 at 8.48. Dec KC gained 6-3/4 cents, closing at 9.63 and Mar up 4-3/4 at 9.54-1/2.

After breaking news that a Russian missile killed two people in Poland, the wheat market had a quick and strong reaction, reaching a high of 8.43 on the Dec Chi contract. The dust seemed to settle somewhat as by the close both Chi and KC only had single digit gains (but were still well off of daily lows). The repercussions of this may be significant though. Poland is a NATO member nation, and a crisis meeting has been called there by the president and prime minister. Unconfirmed reports suggest that Poland also scrambled fighter jets in response. Much like in corn, traders were anticipating an announcement this week regarding the Black Sea corridor deal, but it is still up in the air at the time of writing. Only time will tell how this scenario plays out. In other wheat related news, good to excellent crop conditions for winter wheat improved 2% from last week to 32% but was at 64% last year at this time. US wheat exports also remain slow though it was reported that Iraq purchased 200,000 mt of US HRS wheat yesterday out of the PNW.

CATTLE HIGHLIGHTS: Live cattle futures were mixed on the session, and feeders saw strong selling pressure as grain prices rebounded on Tuesday. Dec finished 0.300 higher to 151.275, but Feb was up 0.500 to 153.050. Nov feeders, which expire on 11/17, lost 1.275 to 175.675 and Jan feeders led the market lower, losing 2.425 to 177.025.

Live cattle market was holding moderate gains throughout the course of the morning, but geopolitical news triggered a strong price recovery in the grain markets. Reports of two stray Russian missiles landing in Poland and killing two polish citizens caused grain markets to jump higher, bringing selling into the feeder cattle market, pulling down the live cattle market in sympathy. The geopolitical news trumped the fundamentals on the day. In the fundamental news, Retail values were mixed at midday, as Choice carcasses gaining 1.39 to 259.37, but select trade lost 0.36 to 233.85 on light movement of 89 midday loads. Cash trade was still undeveloped as some scattered bids hit the countryside. These have been passed on, as trade will look to develop later in the week. Expectations for the week is steady to higher cash trade with last week. Cash trade will likely be the driver of price this week. Feeders finished sharply lower, influenced by the strong grain markets. The feeder chart saw a technical breakdown, and the weak price action could lead to additional selling pressure, especially if grain markets stay strong. The Feeder Cattle Index traded 0.23 lower to 175.23. The cash index is currently in line with the Nov futures, which may limit the upside in the front month contract with expiration this week on 11/17. The geopolitical still can influence markets, and the headlines triggered a grain rally, leading to a cattle selloff. Charts are weak technically, especially feeders as price may be poised to check lower support levels.

LEAN HOG HIGHLIGHTS: Lean hog futures saw another day of gains as prices finished moderately higher on improved retail demand values. Dec hogs gained 0.450, closing at 85.325 and Feb was 1.100 higher to 90.075.

February hogs are trying to break away from the 200-day moving average, closing at its highest point since the end of October. The strong price action improves the technical picture, which should help support prices. The talk of China looking for additional pork imports has helped support the market, but retail values strength on the day supported prices. Retail values where higher at midday as pork carcasses traded 2.16 higher to 98.74. The load count was 170 loads. The Pork Carcass Index was softer, losing 09 to 95.87. The retail market may be optimistic that prices may be looking for a seasonal bottom. Strength in the retail sector should help cash market prospects. Direct cash trade was higher on Tuesday, gaining 0.91. The direct trade averaged 84.45, and a 5-day rolling average of 85.57. The Lean Hog Index also turned higher adding 02 to 88.65. The cash index holds a 3.325 premium to the futures which failed to provide support for the front-month contract. Prices are trying to push back to the upside, and strong price action today should lead to additional strength. The fundamentals are still the key, especially is retail values have found a seasonal bottom.

DAIRY HIGHLIGHTS: After finding itself sub-$19.00 a couple weeks ago the Class III December contract is knocking on the door of $22.00, a clear resistance point for the continuous second month chart since this summer. Spot cheese finished up for the 11th time in the last 13 trading to move back near its early October peak, and just another half cent higher will push the average to a four-month high. Today’s GDT Auction saw the index 2.40% higher as milk powders led the way, but spot butter remains at a burdensome premium to its GDT counterpart. September butter exports were down significantly from August and that trend may continue if US butter remains that much more expensive on the world scale.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.