MARKET SUMMARY 11-16-2021

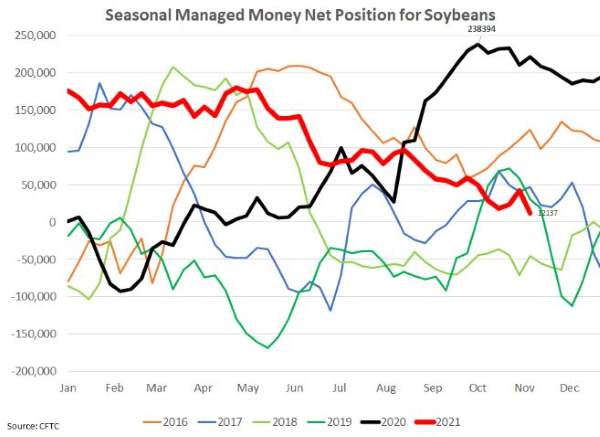

The managed money positioning on last week’s Commitment of Traders report saw the funds move to their smallest long position since August 2020. The liquidation of long positions has been related to the price movement in soybeans, since hitting the high for the year in May. Soybean prices have been on a slippery slope, trending lower as the concerns regarding overall export demand and, recently, the strong start to the Brazil soybean crop, have turned the market more negative in trend. Recently, a strong surge in soybean meal prices has moved soybeans higher, bringing in some money flow and supporting the market. Since the start of November, soybean meal has gained over $30/ton, trading to its highest point in months. Next week’s Commitment of Traders report will be the first to reflect this turn in prices, and time will tell if soybean prices are looking to turn higher, or do the managed money funds stay cautious about the overall soybean market going into the winter.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures were part of a broad-based drop in row crop prices losing 1-1/2 to 6-1/2 cents. Dec 2021 led today’s losses closing at 5.71. A lack of new news and an uptick in farmer selling this week, along with double-digit losses in wheat, kept corn futures on the defensive.

Crop progress indicated 91% of corn acres are harvested, above the 5-year average of 86%. Unless there is a significant weather event in the very immediate future, we expect most of the remaining acres to be harvested by Thanksgiving. Fieldwork continues to move along but the application of fall fertilizer is a big question mark for many. Skyrocketing prices, along with availability, continue to help underpin futures. HIS Market Ltd, an information provider located in London, is suggesting about a 2.5 million acre drop in U.S. corn production. Ultimately, less corn acres in the United States may not be a huge issue to the world if the Southern Hemisphere adds acres, especially from double-crop soybeans in Brazil. Yet, a potentially bullish setup is in place. The current U.S. carry out is on the snug side, near 1.5 billion bushels. However, if feed demand and exports stay as forecasted, and ethanol usage increases 150 million bushels, carryout and stocks to usage figures will suggest limited downside for new crop. Nonetheless, it may be best at this time to assume an increase to South American production this season and a conservative assumption that U.S. acres will not change by more than a million.

SOYBEAN HIGHLIGHTS: Soybean futures gave back some of their recent gains, losing 4 to 6 cents as Jan led today’s drop closing at 12.51-1/4. Meal ended about 4.00 lower, while soybean oil gained near 100 points as traders were reversing long meal and short oil spreads throughout the session. Weaker corn and wheat prices were also impactful adding selling pressure.

Crop progress indicated 92% of soybean harvested versus a 5-year average of 93%. We anticipate most of the remaining bushels will be harvested by Thanksgiving. Bottom line, we don’t see a weather issue leaving measurable crops in the field. Nor do we see any immediate concerns with Southern Hemisphere crops, implying that there is not a lot of reason to necessarily be friendly the bean market. It was reported by the Washington Post that multiple sources indicate that President Biden will soon announce a diplomatic boycott of the Beijing Winter Olympics. This is probably not the friendliest news. Crude oil prices continue to hold near 80.00 which implies that demand for vegetable oils remains at a premium. South American weather likely holds the key to how quickly supplies are available to end users.

WHEAT HIGHLIGHTS: Wheat futures took a beating today due to heavy selling pressure. Dec Chicago lost 16 cents, closing at 8.10-1/4 and Jul down 11 at 8.13. Dec KC wheat lost 15-1/4 cents, closing at 8.20-3/4 and Jul down 10-1/2 at 8.10-3/4.

Chi and KC had steep losses in the front months with less of a decline in deferred contracts. MPLS wheat had a recovery of about 16 cents after dipping below the ten-dollar mark in the Dec contract but still suffered double-digit losses by the close. Paris milling wheat futures also had sharp losses today, though the May contract did reach a new all-time high. Winter wheat is reported to be 94% planted and is rated at 46% good to excellent (the third-lowest rating since 2010). Wheat inspections totaled 14.3 mb but inspections, as well as export numbers, are running behind pace to meet the USDA’s goal. Russia’s export tax continues to move higher as they try to curb domestic food inflation. Currently, it is around $77 per metric ton. Pakistan and the Philippines are in the market for feed wheat and Algeria delayed their tender due to prices being $20 more per metric ton than their previous purchases. As it stands today, 8.50 is a resistance level in Chi and KC wheat, but if Russian prices move higher it may push U.S. futures over that level.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.