MARKET SUMMARY 11-17-2021

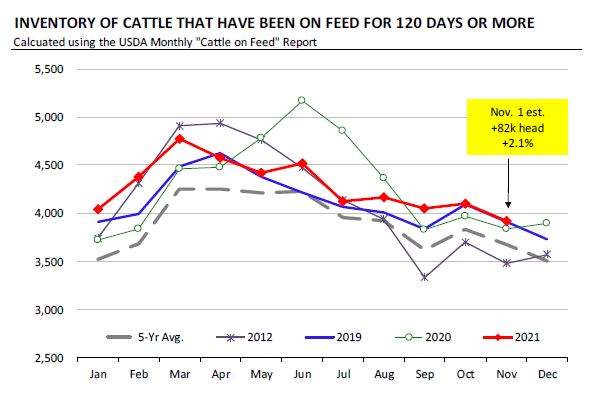

The USDA releases the November Cattle on Feed Report this Friday, and expectations are for feedlots to be close to last year’s totals. On Friday numbers, analysts are expecting total cattle on feed as of November 1 to be 99.7% vs last year at 11.937 million head. Within the numbers, the market will be watching the totals of heavy weight cattle, or those cattle that have been on feed for 120 days or more. This total is expected to be 2.1% above last year, signaling that there is still plenty of cattle to work through going into the end of the year. This higher total is a product of the slower slaughter pace, averaging around 120,000 head/day. This has been consistent over the past months, and taking a possibly tighter supply picture and extending it out over time. The impact on the cash market has been noticeable, even with the recent strength. The large supply of heavy cattle has allowed packers to keep bids softer knowing that supplies are there for them.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures finished the day with moderate gains, driven by the strength seen in soybeans. Dec settled 4-1/4 cents higher, closing at 5.75-1/4. This was after giving back about an additional 8 cents, with today’s high in Dec at 5.84.

Today’s weather outlook showed moderate rains in parts of the Midwest, which may cause small harvest disruptions. The bigger concern today seems to be South American weather. Overall conditions there have been favorable, but the La Nina pattern appears to be growing in strength which could bring dryness to Brazil and Argentina. This, in part, had the funds buying today and sent the soybean market drastically higher. Corn seemed to go along for the ride. That is not to say it doesn’t have its own legs to stand on. Ethanol margins are positive – the weekly report shows production up 21,000 barrels per day but stocks are down 205,000 barrels. As harvest comes to completion, pressure there should ease as well. Looking to next year, fertilizer and input cost concerns are abundant, not only in the U.S. but in South America as well. This could limit their production in 2022, though it is still early to make a judgment call. In China, Jan corn remains expensive, near the equivalent of 10.67 per bushel so although U.S. corn export sales are down 6% from last year, China may need to step up and buy.

SOYBEAN HIGHLIGHTS: Soybean futures had a strong rally today, with double-digit gains. January settled 25-3/4 cents higher at 12.77. What seemingly drove the market today was fund buying due to concern over South American weather.

This morning there was a reported sale of U.S. soybeans to China in the amount of 132,000 metric tons. While not a huge sale, it seemed to excite the market, as China has been absent as of late. China’s purchases of U.S. soybeans are down 34% from last year so this sale was an encouraging sign. Additionally, a sale of 30,000 metric tons of U.S. soybean oil to India also lent support to the marketplace. Technical buying also seemed to be key today as soybeans breached the 200-day moving average as well as the 100-day in some contracts. The main driver, however, seems to be managed fund buying on concern over inflation as well as South American weather. Conditions in that part of the world have been mostly favorable, however, a strengthening La Nina pattern could bring dryness. Another factor lending support to the soybean market was the higher close in meal and oil with favorable crush margins. In other news, there were rumors yesterday that the Biden Administration is considering boycotting the Winter Olympics, which will be held in China. This could be bearish for the grain markets as the political relationship between the two countries has not been great as of late.

WHEAT HIGHLIGHTS: Although wheat markets backed off of their highs achieved this morning, a nice close was still seen at the end of the day. Dec Chicago wheat gained 12 cents, closing at 8.22-1/4 & Dec KC wheat gained 13-1/4 cents, closing at 8.34, both contracts nearly erasing yesterday’s selloff.

Today’s move higher was not totally surprising, as yesterday’s selloff was viewed as profit-taking as the market hit new contract highs. A sharp drop in basis and lack of buying indicates the demand for Minneapolis wheat is waning for now. Deliverable supplies of HRS wheat are over 1 million bushels larger than a year ago, and although temporary, is a comfortable situation despite USDA’s estimate of HRS being so low. U.S. weather is anticipating snow in the northern Plains & showers in parts of Illinois. There is grave concern over the impact of La Nina this coming growing season, and the effect more dry weather could have on the southwestern Plains. Rains & floods in British Columbia continue to cause problems that will take weeks or months to repair, and more rain is on the horizon. The U.S. dollar put in a contract high today, which the wheat market seemed immune to.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.