Happy Thanksgiving from all of us at Total Farm Marketing!

Thursday, November 24, 2022: The CME and Total Farm Marketing offices are closed.

Friday, November 25, 2022: The CME closes at noon, and the Total Farm Marketing office closes at 1:00.

MARKET SUMMARY 11-22-2022

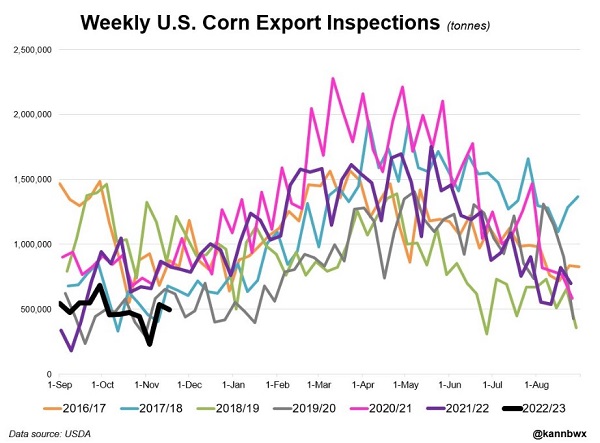

Weekly corn export inspection continues to disappoint the market overall, limiting price rallies in the corn market. Last week, 495,000 MT of corn was inspected for shipment, at the lower end of market expectations. Year over year, export inspections are down 30% from last year, while the USDA is only forecasting a 13% drop in corn exports. The U.S. corn is still struggling globally in price to encourage further demand as U.S. corn is still currently the most expensive in the world on the export market. regardless, corn prices have stayed relatively supported as the cash market domestically has remained strong with national corn basis trading well above the 5-year average. The question going forward is with prices related to the strong basis. As domestic end users lock in the necessary supplies going into the spring/summer months, will the corn market hold, or do prices drop to be more in line with global prices?

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures traded quietly today, but ended up closing lower ahead of the Thanksgiving holiday. There hasn’t been much news released, but the bearish concern has been export business. Ethanol has slipped as a result of lower crude, which hasn’t helped corn prices either. Dec corn lost 2-3/4 cents to end the session at 6.56-3/4, and March lost 4-1/4 cents at 6.59-1/4.

Corn traded either side of unchanged for most of the day with very little volatility before ultimately closing lower. This week will likely continue to be uneventful with Thanksgiving on Thursday and a half day in the markets on Friday. Last trading day for December options is on Friday, so any positions in the money should be handled by tomorrow. Yesterday, the USDA reported a US harvest estimated at 13.93 billion bushels with 96% completed. While US corn exports have been present, China has not been a major buyer and total corn export commitments are down 52% from a year ago. Domestic demand is still good with demand for ethanol, but light exports may allow prices to drift lower. Brazilian corn is 11% cheaper than US corn right now, and China has looked to Brazil as a supplier as a result. The USDA reported that corn’s processing value in Iowa fell 95 cents to 8.85 a bushel last week due to the drop in ethanol and crude. Weather in Brazil has been favorable, but has turned slightly drier in southern Brazil and Argentina. March corn remains rangebound and managed a narrow close above its 100-day moving average and is nearing oversold territory technically.

SOYBEAN HIGHLIGHTS: Soybean futures closed lower today, along with bean meal, while bean oil closed higher again thanks to a recovery in crude oil. The US Dollar Index slipped today, which allowed support for crude, but did not lend itself to the rest of the grain complex apart from bean oil. Jan soybeans lost 7 cents to end the session at 14.29-3/4, and March lost 5-1/4 cents at 14.36-1/2.

Soybeans ended the day lower with light volume over this holiday week, but bearish news about more Covid in China weighed on prices as well. Traders are worried about a slowdown in China’s economy with 28,000 new cases reported today and the shut down of schools, cities, parks, museums, and other public spaces. According to the Financial Times and an economist at the bank Nomura, the Covid restrictions in China are negatively affecting 1/5th of China’s GDP. This news still worries the market even though China hardly slowed soybean imports when they were at the heights of lockdowns. Soybean prices on the Dalian exchange were up 0.3% today at the equivalent of $18.61, not far from their 5 month highs. Export business has been strong with export commitments on track and running 4% higher than a year ago at this time, with the majority destined for China. Domestic demand has held firm as well with continued generous crush margins. The combined value of crushed soybeans was 3.55 above the cost of soybeans based on the January futures. January soybeans remain rangebound, and the presence of good domestic and export demand should keep prices supported, but bearish factors may prevent prices from moving higher and things are likely to stay rangebound.

WHEAT HIGHLIGHTS: Wheat futures weakened for the fifth session in a row, losing 7-3/4 cents in Chicago December and 8-1/2 in July. December closed at 7.91-1/2, its lowest close since s August. July closed at 8.22-1/2. December Kansas City lost 8-3/4 to end the session at 9.25-1/2, while December Minneapolis gave up 2 cents to close at 9.46. Bullish traders must be disappointed today with another day of losses despite a drop in the U.S. dollar and over-sold conditions according to stochastics.

Yesterday, we indicated managed money was adding to short positions and it looks like that is the case again today. With a holiday shortened week, the lack of bullish response today, despite firmer French milling wheat and weaker dollar, is discouraging. It appears managed money has been easing out of row crops. In the case of wheat, managed money has been adding to short positions. The technical picture for Chicago December now points to a possible drop to the summer lows of 7.43-1/4. A big problem for wheat is perception. The winter wheat crop is in less-than-ideal shape, world supplies of exportable wheat remain snug, and yet, there is not much perception that end users are going to actively buy U.S. wheat. That is a perceptive problem in the near term. Add to that a weak technical picture and buyers appear to be on the sidelines. This sets the stage for more of the same, a weaker price slide in the near term, yet a potentially violent price recovery.

CATTLE HIGHLIGHTS: Live cattle futures finished mixed to mostly lower as the market is heading into the Thanksgiving holiday trade and taking some profits after Monday’s strong day. Dec finished 0.250 higher to 153.800, but Feb was down .300 to 156.425. Jan feeders lost .950 to 181.675.

Prices consolidated at the top of Monday’s strong trading range as the market was causing before the holiday trade at the end of the week. The strong move higher off the cattle on feed numbers keeps the charts bullish, but watching a seasonal window post-Thanksgiving, which could see some potential pullback of slowing in the market. Regardless, the technical picture and price action is strong and will likely support the market in the near term. Cash trade was undeveloped to start the week, but saw some light bids for northern dress trade. Asking prices in the South are $154-$155, trending higher than last week. With the holiday trade this week, the cash development will be closely watched and could likely see some business develop on Wednesday. Retail values were higher at midday, as choice carcasses gaining 1.96 to 257.53, and select trade added 1.84 to 2335.07 on light movement of 85 midday loads. Beef retail values have a tendency to peak around the Thanksgiving holiday, and that trend could limit upside gain. At this point, there is still good value in retail beef to support cash prices. Feeder cattle traded in a similar pattern to live cattle with some profit taking, despite a softer grain complex. The Feeder Cattle Index traded unchanged to 174.64, but is at a 7.035 discount to the Jan feeders, which may have limited gains. Bullish cattle on feed numbers helps support the market, but the holiday trade triggered some profit taking. Cash trade will still be a key again this week.

LEAN HOG HIGHLIGHTS: Lean hog futures were mixed to mostly lower as spread unwinding in the front end and discount to the index supported the Dec contract. Dec hogs gained .450 at 84.250, but Feb was down 0.075 to 90.075.

The Dec-Feb hog spread has jumped the past few sessions, and profit taking on the spread going into the Thanksgiving holiday looked like the trade on the day, as prices seemed to consolidate overall. After a recent run higher, the Feb contract looks tied to the $90 handle as prices have traded around that market for 6 consecutive sessions. The fundamental picture still limits the Dec contract as it looks closer to expiration on 12/14. Direct cash trade was firmer on Tuesday, gaining .31 to 82.06 and a 5-day rolling average of 83.09. The Lean Hog Index was softer, losing another .80 to 86.97. With the market moves today, the Cash Index holds a 5.800 premium to the futures, which could provide support for the front month contract. Estimated hog slaughter on the day was 492,000 head, 3,000 more than last week, and 11,000 more than last year, as the near end slaughter pace stays strong, limiting the cash market. Retail values have been soft overall, tightening packer margins, and weighing on cash trade. Retail values were firmer at midday. Pork carcasses traded 1.72 higher to 93.71, recovering after a difficult close on Monday at 91.30. The load count was moderate at 149 loads. The Pork Carcass Index was softer, losing 0.92 to 93.51. The retail market was looking optimistic that prices may have been looking for a seasonal bottom, but that still seems elusive at this point. The fundamentals still keep the front of the market limited, but the market is looking for a seasonal turn.

DAIRY HIGHLIGHTS: Class III milk futures have been under pressure the past few sessions as the US cheese price has pulled back to retest the $2.00/lb level. The cheese block/barrel average topped out last week at $2.13875/lb and closed today at $2.0025/lb. Sellers moved just 1 load of inventory today, however. Buyers may be a bit cautious on the spot trade due to the fact that the spread between blocks and barrels has widened to 39.50c. This is the widest spread between those two since November of 2020. Meanwhile, the spot butter price keeps pushing higher. Butter was up another 3c today and closed at $2.93/lb. The dairy trade currently is being supported by tight butter inventories, strong exports, and high feed costs. Pressure stems from weakening global prices, higher milk production in the US, and a strong dollar.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.