MARKET SUMMARY 11-28-2022

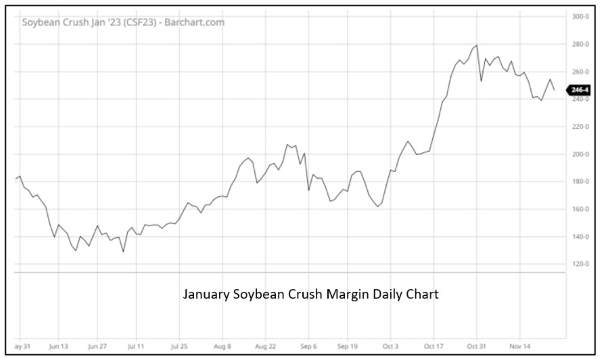

The competition between exporters and domestic demand is supporting the soybean market overall in the near term. The crush margins for soybean in January are staying very supportive, as strength in soybean oil and soybean meal markets are profitable for domestic crushers. This is building competition for the export market, as both groups struggle to secure a tight supply picture for the freshly harvested U.S. soybean supply. Last week, exporters shipped an additional 2.0 MMT of soybeans overseas. This competition has pushed the national soybean basis to positive values and stronger than 5-year averages. The strength of the cash market can be noticed in the bull spreads as front month contracts are getting a strong bid over the deferred contracts on the futures market.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures ended the day without much fanfare closing 0-3/4 cents higher in Dec at 6.68-3/4 and up 0-1/4 in Dec 2023. Poor export inspections (not a surprise) and a lack of friendly news kept prices in check, while strong gains in soybeans and soybean meal may have provided some support. A bounce in crude oil was also noted.

Export inspections came in at 11.9 mb. Though not unexpected, it still is reflective of poor sales and indicative of a growing concern that sales and inspections need to pick up soon, otherwise downward revisions to exports from the USDA will be expected. The next scheduled release date for the WASDE is December 9. Bulls will argue that a void of news of poor export sales has not had much impact as Dec corn is trading near 30 cents under its most recent high at a time when Dec Chicago wheat has dropped near 1.50 since the beginning of the month. The bottom line is that farmer selling has remained mostly lighter than normal. This could be from a variety of reasons which include a lack of want of cash flow in 2022, they just put it in storage and expectations that prices will rally. Whatever the case, unless basis is encouraging producers to sell, they are on the sidelines. South American weather will become increasingly important in the days and weeks ahead with Argentina and southern Brazil on the dry side.

SOYBEAN HIGHLIGHTS: Soybean futures closed higher today following OPEC talk of cutting production at their next meeting, which also caused a reversal in bean oil which closed significantly higher. Strong crush margins and a new flash sale today added to the bullishness. Jan soybeans gained 21 cents to end the session at 14.57-1/4, and Mar gained 20-1/2 cents at 14.62-3/4.

The soy complex had a strong day across the board with the main source of the rally being OPEC’s talks of serious consideration of production cuts at their next meeting. This news caused a reversal in both crude oil and bean oil and both of which closed higher. Earlier in the day, private exporters reported sales of 4.0 mb of delivery to an unknown destination for the 22/23 marketing year, and export inspections were strong for soybeans. An impressive 74.3 mb of soybeans were inspected for export last week despite the continued barge traffic on the Mississippi River. In China, over 40,000 new Covid cases were reported today, a new record. This comes as Chinese citizens began protesting the strict Zero-Covid policy over the weekend which has shut down many cities, schools, and public spaces over the past few months. China’s economic situation, largely caused by their Covid shutdowns, has not had much of an impact on soybean demand, and Jan soybeans on the Dalian exchange closed at the equivalent of $18.91 a bushel. Domestically, crush margins remain strong, which has helped prop up cash markets. South American weather remains largely favorable, and Argentina’s government is implementing the “soy dollar” program again at the end of December to incentivize selling with prices 40% above market value. Jan beans closed at the upper end of their rangebound levels and above the 200-day moving average.

WHEAT HIGHLIGHTS: Wheat futures posted significant losses, as funds are selling and southern plains moisture over the weekend added to the pressure. Dec Chi lost 18-3/4 cents, closing at 7.56-3/4 and Mar down 16-1/4 at 7.80-3/4. Dec KC lost 17-1/4 cents, closing at 9.04-3/4 and Mar down 17 at 8.95.

Wheat was under pressure today as funds are adding to short positions. But searching for a reason why is a bit of a head scratcher. A poor inspections number, reported at 7.3 mb, wasn’t helpful but on its own shouldn’t lead to a significant downturn. (Total 22/23 inspections now at 385 mb). Perhaps the rains this weekend in some HRW areas added to the pressure. As far as new headlines, there is the threat of a railway strike, which could occur as soon as December 9. If it does happen, grain will likely back up in the country and negatively impact basis. Again, one would not expect this to have much impact as it has not yet (and may not) occurred. There were also increasing protests in China over the weekend due to their Covid restrictions. While not necessarily a direct impact to wheat, this could have a greater impact on the markets overall. On the topic of China, they are also said to be selling wheat from their state reserves. Overall, the fundamental picture still looks mostly friendly for wheat. The Buenos Aires Exchange in Argentina estimates their wheat crop at 12.4 mmt (vs earlier projections of 20 mmt and a crop last year of 22.3 mmt). In addition to Argentina’s poor growing conditions, Australia has had issues of their own in terms of quality. The biggest impact right now continues to stem from the Black Sea where the export corridor was recently extended by several months. As a reminder first notice date for Dec grain futures is this Wednesday, November 30.

CATTLE HIGHLIGHTS: Live cattle futures had another difficult day on the charts with profit-taking and technical selling in the face of an optimistic cash market. Dec finished 0.500 lower to 152.750, and Feb was down 0.450 to 154.675. Feeders also saw selling pressure as Jan feeders lost 1.425 to 176.875.

The seasonal sell window in the cattle markets seems to be right on task, as weak price action to end last week spilled over to start this week. The Thanksgiving window sees some seasonal weakness as the market moves past holiday demand. Cash trade was a pleasant surprise last week with week-over-week gains, but that failed to support the market. On a typical Monday, cash trade is still undeveloped on the week, but expectations are for steady to firmer cash trade again this week, which should support the market. Retail values have a tendency to peak in early December and this could be anticipated by the market, setting the seasonal in place. Beef prices were mixed at midday as choice carcasses gained 3.00 to 254.83 but select slipped 1.35 to 233.02 on light movement of 25 midday loads. Feeders followed the weakness in live cattle to see some follow-through selling after last week’s close. This set up the third day of profit-taking across the group. Prices broke support levels and are testing trendline lows and could be at a key crossroads. The Feeder Cattle Index jumped 3.56 higher to 177.19, and has jumped to a 0.3150 premium over the Jan futures, which may limit losses in the near term. Even with strong cash, the cattle market sold off on Wednesday. The technical picture has turned weaker and could bring additional pressure, as money is moving out of the cattle market.

LEAN HOG HIGHLIGHTS: Lean hog futures were sharply lower on long liquidation and technical selling, as prices broke through support levels. Dec hogs dropped 3.175 to 80.600 and Feb was down 3.750 to 84.750, leading the market lower.

The selling pressure started last week in the hog market, and prices rolled through key support levels during the session, triggering additional long liquidation. The Feb contract dropped below the key swing moving averages at the 100 and 200-day, opening the door for a technical break. Prices closed at their lowest levels since mid-October, and the weak price close leaves additional room to the downside available on Tuesday. After today’s trade, prices are looking to test trend line support around 81.000. The fundamental picture still limits the Dec contract as it looks closer to expiration on 12/14. Direct cash trade was softer on Monday losing 0.66 to 81.73 and a 5-day rolling average of 81.99. The Lean Hog Index was softer, losing another 0.61 to 85.56. The Cash Index holds a 4.960 premium to the futures, which could provide support for the front month contract. Retail values jumped sharply higher at midday, gaining 9.80 to 97.43. Strong buying in the picnic shoulder and belly primal supported the retail market. The load count was moderate at 146 loads. The strong buying in the retail sector could be an indication of a seasonal bottom in the market as buyers jumped in at the lower values. Possibly, pork has gotten cheap enough. The Pork Carcass Index was softer, losing 0.70 to 90.97 reflecting the recent downtrend in carcass values. The retail market may be looking optimistic that prices may have been looking for a seasonal bottom and the strong buying surge on Monday may be an early indicator. The fundamentals still keep the front of the market limited, but the market is hoping for a seasonal turn.

DAIRY HIGHLIGHTS: Buying pressure in the dairy trade has reached a lull period after a recent holiday push took contracts higher. In the past few spot sessions, the cheese price has drifted back below $2.00/lb and powder is back near the low for the year. Recent government reports, like last week’s US Milk Production report and US Cold Storage report, didn’t provide enough bullish news for the market to rebound. Milk production in the US grew 1.20% and cow numbers were up 31,000 head from a year ago. Cheese in storage in October was down slightly from October 2021, but is still near an all-time high. The market is showing good support near the $20 level, though. For now, the dairy trade may just be range bound between about $19.50 and $21.00. News this week will be quiet, but there is a dairy products report on Friday.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.