MARKET SUMMARY 11-29-2022

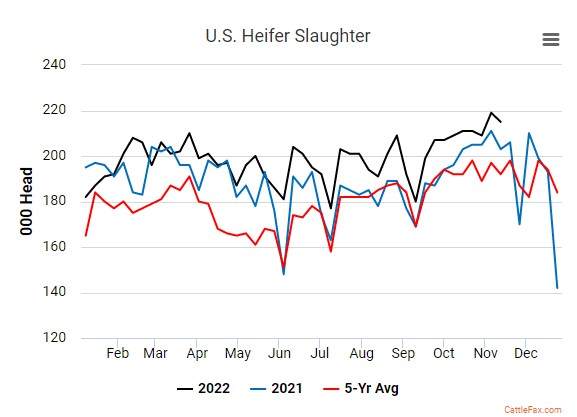

One of the factors that has kept live cattle supplies fairly heavy in the recent month has been the impact of heifers going to slaughter. For most of the year, beef heifer slaughter has been running at a strong pace year-over-year, and well above the 5-year average. Last week, heifer slaughter pushed 215,000 head, 12,000 head over last year, and over 20,000 above the 5-year average. The impact of difficult pasture conditions and tight margins has forced producers’ hands in pushing heifers into feedlots versus back into the breeding herd. This has increased placement numbers and kept available animals for slaughter relatively consistent despite tight cattle numbers. At this point, producers are still avoiding pulling heifers back into the shrinking cow herd, but that trend could change. If that does occur, we will start seeing breeding stock numbers increase, and tighten even further the total cattle on feed, which could be supportive of longer-term prices.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures continued their trend to nowhere with more sideways trade. Dec lost 3 cents sagging into the close to finish the session at 6.65-3/4, while Dec 2023 gained a 0-1/2 cent to close at 6.11-1/2. Supportive for corn prices were small gains in soybeans and wheat. Higher energy prices also offered support. New news of consequence was lacking and export sales sparse.

The potential for a rail strike has gained traction the last several sessions, however, it does look like congress will vote to block a potential rail strike. While this may provide some support for prices, managed money has still been exiting, with the most recent Commitment of Traders reports indicating about 170,000 net long versus near 270,000 from earlier in the month. The money shift in commodities may, in part, have to do with rising interest rates. Net combined positions in agricultural futures by funds has been gradually reduced as interest has moved higher. Interest rates and the dollar tend to move in tandem. Therefore, the rising dollar and consequently higher cost of purchases by importing countries reduce demand. Slow exports are the result. When bull markets do not have multiple “things” driving them higher, especially from higher price levels, it is a challenge to expect speculative money to hold onto long futures.

SOYBEAN HIGHLIGHTS: Soybean futures closed slightly higher today but bounced off the midday highs after reaching the top of the trading range. Crude oil moved higher today giving bean oil an initial boost, which faded into the close but still ended higher. Jan soybeans gained 2-1/4 cents to end the session at 14.59-1/2, and Mar gained 3-1/4 cents at 14.66.

Soybeans have trended higher since yesterday morning when OPEC began talking about making a cut to their production, which has also benefited bean oil. Prices did fade for all three soy products despite crude staying strong as a lack of fresh news allowed beans to slip from the top of their range at 14.75 in Mar. The rail strike appears as though it will be averted as the U.S. House voted today to block the strike which would heavily affect the U.S. economy. Soybeans and grains in general need the railroads to stay accessible, especially with the Mississippi allowing less barge traffic. Yesterday’s export inspection numbers were solid and the 4 mb flash sale to unknown was encouraging, but the time of year is approaching when exports tend to slow down. China is likely to try to hold out for Brazilian new crop which is as much as 85 cents per bushel cheaper than U.S. Gulf offers for Feb-Mar. Brazilian weather remains mostly favorable, but Argentina is still struggling with drought that may impact their crop. It is possible that the production of Brazil’s potentially record crop offsets some losses in production from Argentina. Last week’s CFTC data showed non-commercials as sellers of beans reducing their net long position by 10,830 contracts to 82,135 contracts. Mar beans are rangebound and closed just below the top of their range and upper Bollinger Band.

WHEAT HIGHLIGHTS: Wheat futures had a mixed to mostly lower close. Poor U.S. exports due to a premium over other world exporters is not helping the situation but fundamentals remain mostly bullish. Dec Chi gained 1 cent, closing at 7.57-3/4 and Mar up 3/4 at 7.81-1/2. Dec KC lost 3-3/4 cents, closing at 9.01 and Mar Down 8 at 8.87.

After showing earlier strength, wheat gave up most of those gains into the close. Remaining near the lows from mid-August, wheat has become very oversold in all three U.S. futures classes. The market simply seems to be having a tough time gaining its footing despite underlying bullish fundamentals. Likely pressuring the market are poor export sales and the fact that Russian and Ukrainian wheat offers are cheaper than the U.S. But as we mentioned yesterday, there are concerns with South American crops, namely Argentina, and Australia which should support the market. The former has suffered drought and the latter had just the opposite, with flooding that introduced quality concerns. Probably the biggest market-moving news over the coming weeks, however, will be the possibility of a railway strike on December 9. Reportedly, President Biden has asked congress to avert the railway strike and they are set to vote tomorrow. There is the potential for a $2 billion loss in GDP per day if the strike does take place and up to 7 million travelers could be affected. Aside from rail transport, there has still not been much rain to help the Mississippi River situation which continues to slow barge traffic.

CATTLE HIGHLIGHTS: Live cattle futures helped support and consolidated on Tuesday as the market may be anticipating the development of cash trade this week. Dec finished 0.100 higher to 152.675, and Feb gained 0.125 to 154.800. Feeders saw some buying strength as Jan feeders gained 1.125 to 178.000.

Cattle markets stabilized on Tuesday, after selling pressure to start the week, as prices finished higher, but trading at the bottom of yesterday’s trading ranges. This keeps the charts technically weak, but prices at least held support levels. The pause may be likely due to the anticipation of cash trade developing. Cash trade is still undeveloped on the week, but expectations are for steady to firmer cash trade again this week, bids are still undefined, but asking prices are starting out at $156-157 in the south. Trade will likely develop later in the week. Retail values have softened recently, as choice carcasses are back to October levels. The softened retail market has tightened packer margins, which could limit the cash bids. Beef prices were lower at midday as choice carcasses slipped 1.18 to 253.35 and select lost 1.99 to 226.54 on light movement of 82 midday loads. Feeders traded mostly higher, fueled by a jump in the cash index on Monday. The Feeder Cattle Index jumped 3.56 higher on Monday and added an additional 1.60 today to 178.79 and has jumped to a premium over the Jan futures, which may limit supported the trade on Tuesday. The concern is that prices broke support levels and are testing trendline lows and could be at a key crossroads. Feeder prices, like live cattle, consolidated on Tuesday and still remain vulnerable. The technical picture has turned weaker and could bring additional pressure, as money is moving out of the cattle market, which may reflect a seasonal tendency, even though fundamentals are still supportive overall.

LEAN HOG HIGHLIGHTS: Lean hog futures saw mixed to mostly lower trade on Tuesday as prices continued to drift lower with the exception of the front month contract, which was supported by the cash index premium. Dec hogs gained 0.475 to 81.075 but Feb lost 0.600 to 84.150.

The selling pressure started last week in the hog market, and prices rolled through key support levels during the session, triggering additional long liquidation. The Feb contract dropped below the key swing moving averages at the 100 and 200-day, opening the door for a technical break on Monday, and the weak technical picture pressured prices again on Tuesday. Prices closed at their lowest levels since mid-October, and the weak price close leaves additional room to the downside as prices are looking to test trend line support around 81.000. The fundamental picture still limits the Dec contract as it looks closer to expiration on 12/14. Direct cash trade was firmer on Tuesday gaining 0.31 to 82.04 and a 5-day rolling average of 82.00. The Lean Hog Index was softer, losing another 0.93 to 84.63. The Cash Index holds a 3.550 premium to the futures, which could provide support for the front month contract. Retail values jumped sharply higher at midday on Monday but failed to hold those gains into the end of the day. At midday today, retail values were softer, losing 0.75 to 88.77. The load count was moderate at 173 loads. The Pork Carcass Index was softer, losing 0.83 to 90.14 reflecting the recent downtrend in carcass values. The fundamentals still keep the front of the market limited, but the market is hoping for a seasonal turn. At this time, the technical picture and money flow look to be leaving the market.

DAIRY HIGHLIGHTS: With spot cheese prices under recent pressure and spot butter trending sideways, Class III milk prices have found room to move lower while Class IV shops around. These prices moving lower are despite recent reports of active government buying and a dairy herd that continues to neither contract nor grow at a substantial rate, however, the holiday ordering period is in the rearview. Milk production remains steady and recent regional reports show solid export demand remains for dairy products, as US prices are more attractive than other markets. Our next indicator of export appetite for US products will come on December 6th with a Global Dairy Trade auction, while we will have an updated Dairy Products production report on Friday. Technical traders may have been buyers on the December Class III milk contract as a 62% retracement level of the recent high became support around $19.85.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.