MARKET SUMMARY 11-9-2021

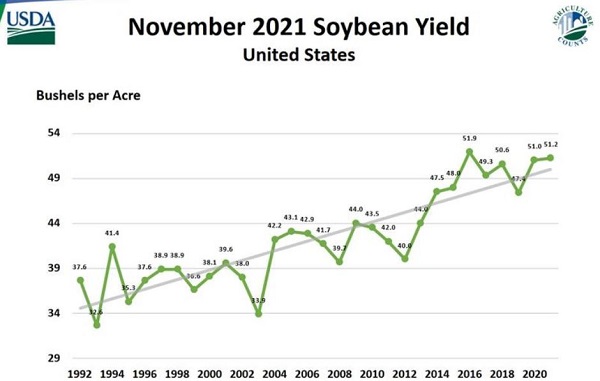

USDA lowered yield by .3 bushel/acre to 51.2, and slightly tightening the over soybean supply. Even with the reduction to 51.2, this is still the second best yield in history, with only 51.9 yield in 2016 being stronger. This yield is a tribute to the producer and the genetics in the seed, as the growing season saw difficult weather in many regions, which had many feeling production would be more limited. A good portion of the soybean crop picked up some very timely rains at the end of summer, which help finish this crop out. The market will now shift it focus back to demand, which did take a hit today with a 40 mb drop in expected exports for the marketing year. Demand and the development of the South American crop will on the radar for the next couple months.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures finished with modest gains of 3 to 3-1/2 cents. Today’s big event was the WASDE report released at 11:00 CST. Projected ending stocks neutral at 1.494 bb, compared to the pre-report estimate of 1.482 bb and last month’s 1.5 bb. There were a few line item adjustments as follows: ethanol production increased 50 mb to 5.250 bb and yield was adjusted upward by .5 bu/acre to 177. Most of today’s support for price came from gains in soybeans (up over 20 cents) and wheat (8 to 10 higher in Chicago). December futures gained 3-1/4 to end the session at 5.54-3/4.

Crop progress indicated 84% of the crop harvested verses the 5-year average of 78%. For some, October has been a slow harvest month due to wet conditions. For others, harvest is complete and corn is locked up in the bin. We don’t think there’s much chance for an uptick in farmer selling unless prices move higher, basis improves, or enough time elapses that farmers need to start moving grain for other various reasons. End users still seem to be adapting a hand to mouth bias, but that could change with this report. It’s probably what this report did not say. There were no surprises to send futures one way or the other.

SOYBEAN HIGHLIGHTS: Soybean futures shot higher by more than 50 cents in the January contract after the USDA WASDE report was released at 11:00. It appeared that most of the buying was in the form of short covering. The oddity was the report really didn’t have all that much that was different from previous reports, and was within the range of estimates. By day’s end, futures closed 19 to 23-1/2 cents higher, with January closing at 12.12-1/2, leading today’s rally. Ending stocks were increased 20 mb to 340 mb, but 20 mb below the average estimate. Yield was reduced to 51.2 bu/acre versus 51.5 last month and the pre-report average estimate of 51.9.

Crop Progress, released yesterday afternoon, indicated 87% harvested verses a five-year average of 88%. Today was certainly an interesting day in the futures market, but one has to wonder if after prices lost so much ground the previous four sessions that traders took an opportunity to either exit short positions or perhaps even establish long positions. The more critical weather for southern hemisphere production will now be the primary focus. Some are suggesting that a strong La Nina pattern will lead to net drying in northern Argentina and southern Brazil, key growing areas. It might be easy to see where traders would buy a price set back anticipating this potential concern. Yet to date, we really can’t argue much if any weather concerns are paramount.

WHEAT HIGHLIGHTS: Wheat futures had a nice day and close due to the USDA giving a smaller ending stocks estimate for both HRW & SRW wheat. HRS wheat ending stocks increased due to the result of fewer exports expected. Dec Chicago wheat gained 10-1/2 cents, closing at 7.78 1/2 & Dec KC wheat gained 12-3/4 cents, closing at 7.93-1/2.

As expected, the USDA did not make any grave changes to the wheat numbers today, but what little they did make were friendly as far as the market was concerned. They estimate wheat carryout for 2021/22 is at 583 million bushels versus the 580 in October. Despite the fact they increased the Russian crop to 74.5 mmt, world ending stocks dropped from 277.18 mmt to 275.80. Ending stocks at the top eight exporters fell to 1.78 bb – lowest in 14 years. As expected, today’s report just brings the focus back to the forefront for traders and end user’s attention that US & world wheat stocks remain tight. Growing conditions, specifically around soil moisture, will be more important than ever in the spring when the crops finally start to develop. US dollar was down again today, which further lent support for the futures.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.