MARKET SUMMARY 12-01-2022

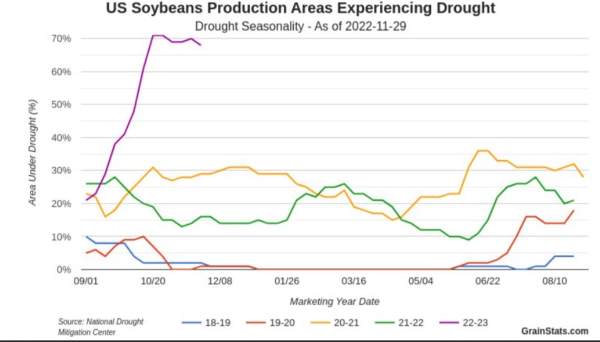

Though planting is a long way off for the next crop of U.S. soybeans, one trend that will be closely watched is the areas impacted by drought. As of this week’s drought monitor, 68% of U.S. soybean acres are experiencing some form of drought as we move into the winter months. This is significantly above last year’s and most historical levels. Last year in this time window, acres in drought were at 17%, peaking to 37% in March and again to 31% in the summer. That weather impacted the crop with below-trendline yields. The recent dryness has accelerated since September, and U.S. soils in many areas are lacking water supplies overall. The winter and precipitation will be key to replenishing soils going into next spring’s planting window.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures suffered double-digit losses on front month Dec which gave up 12 cents on the session to finish at 6.50, its lowest close since August 25. Mar lost 6-1/2 to end the day at 6.60-1/2. Dec 2023 closed at 6.01-1/4 down 5-1/4 cents. Sharp losses of near 40 cents in soybeans and wheat giving up 8 to 12 cents weighed on corn futures, despite the dollar trading to its lowest level since August. Concerns about bio-energy use won’t be as large as anticipated after the EPA made announcements of mandates had bears on the offensive.

Export sales at 23.7 mb are slow and need to pick up soon to avoid a line-item adjustment downward on USDA WASDE reports. There is not a yield estimate on the December report, but a final estimate will be in January. The December report will include line-item adjustments. Many feel an export reduction is likely on the next report, however, if there is one, we expect it will be small. Snug world supplies and high prices historically are creating a just-in-time inventory approach by importing countries. Add to that low water levels in the Mississippi creating higher barge rates and higher prices at the port for importers, and the problem is compounded. Yet, it is likely just a matter of time before demand picks up. Drier weather in Argentina is already a concern. The key in the months ahead is how southern hemisphere weather affects production as well as energy prices, the war, and the U.S. dollar. Common sense suggests that weather will have the greatest impact on a trader’s mindset.

SOYBEAN HIGHLIGHTS: Soybean futures closed sharply lower after being dragged down by bean oil which closed limit down. News from the EPA regarding changes in biofuel obligations did not sit well with traders and bean oil got hammered despite crude oil having a higher close. Jan soybeans lost 39-3/4 cents to end the session at 14.29-3/4, and Mar lost 38-3/4 cents at 14.36-3/4.

Soybeans fell hard today prompted by a huge sell-off in bean oil. The EPA made an announcement regarding RVO biofuel mandates for 2023-2025 in which they proposed increases in U.S. biofuel use over the next three years with volumes for 2023 at 20.8 billion gallons, 21.87 for 2024, and 22.68 for 2025. Trade was looking for higher volume, but the EPA’s numbers were still above expectations. This sell-off seemed like an overreaction and it would not be surprising to see prices recover tomorrow. The other bearish factor for bean oil right now is Russia and Ukraine unloading sunflower oil on the market, which is much cheaper than bean oil, and the price differences between the two are the widest seen in over 9 months. Export sales for last week were 25.5 mb, but shipments were strong at 77.8 mb and were primarily to China, the Netherlands, and Spain. So far for 22/23 export commitments are slightly higher than the previous year while shipments are still down 10%. Argentina’s soy dollar program is in effect and China is rumored to have purchased 6 to 7 cargoes of Argentinian beans for December through January. So far Argentinian farmers have sold 44 mb of beans, but the program has not been as successful as it was in September, likely because the majority of beans were sold then on that incentive. Mar beans are back in their trading range but at the bottom of it, and just above support at the 50-day moving average. Bean oil will have expanded limits tomorrow due to the limit down close.

WHEAT HIGHLIGHTS: Wheat futures gave up a good chunk of ground today as they were pulled lower by soybeans and U.S. exports continue to lag. Mar Chi lost 12-1/2 cents, closing at 7.83, and Jul down 8-1/4 at 8.00-1/2. Mar KC lost 9-1/2 cents, closing at 8.90-1/4, and Jul down 6-1/4 at 8.77-1/2.

Most of yesterday’s gains were wiped out today. Lower corn and soybeans didn’t help. A limit down move in bean oil may have been brought on by news that credits may be given to electric vehicles in terms of renewable biofuel mandates. This led to sharply lower soybeans which added to pressure for wheat and corn. The US Dollar Index was also sharply lower today, but that did not seem to matter for wheat. Bear spreading was noted for both Chi and KC contracts, which may indicate that supply down the road is still a concern. Currently, U.S. exports have been struggling as offers out of the Black Sea are $45 cheaper per ton for soft wheat. The discrepancy is even greater when looking at HRW wheat, with offers almost $100 per ton lower than at the U.S. Gulf. The USDA reported an increase of just 5.7 mb of wheat export sales for 22/23 and 0.3 mb for 23/24. Export commitments are now at 494 mb and the 22/23 export estimate is 775 mb. In other news, the US House voted to avoid a railway strike, but as of this writing, the Senate still needs to vote on the legislation. The December 9 deadline for the strike is fast approaching. From a weather perspective, Argentina and the U.S. southern plains are still too dry but conditions may improve after the first of the year. As a final item of note, funds are estimated to be net short about 66,000 contracts of Chi wheat.

CATTLE HIGHLIGHTS: Live cattle futures finished mixed, and feeders saw some buying strength as cash trade developed and a weak grain market helped support cattle futures. Dec finished 0.025 lower to 153.050, and Feb slipped 0.250 to 155.425. Feeders saw strong buying strength as Jan feeders gained 0.600 to 181.075.

The live cattle market was choppy, digesting the cash trade totals building this week. Southern trade saw additional business at $155, and northern trade was pushing $157, both fully steady with last week. Some northern dress trade reached $249, up $4 from the last week. The steady to firmer tone helped support the market. Most trade is likely in place for the week with some exceptions of clean-up trade on Friday. Beef carcasses found some footing at midday. Choice carcasses gained 0.23 to 255.11 and select added 1.97 to 225.98 on light movement of 87 midday loads. The USDA released weekly export sales numbers on Thursday morning. Last week saw new sales of 15,400 MT for 2022 and 2,000 MT for 2023. China returned to the market as the top buyer of U.S. beef last week, followed by Canada and South Korea. Feeders traded sharply higher, following through on yesterday’s strength, supported by weak grain markets. The Feeder Cattle Index gained 0.03 to 178.43. Feeder prices broke support this week but have quickly recovered to be trading higher on the week. The cattle market has found some footing in the second half of the week and is looking to end the week with good gains on Friday after rejecting early week lows.

LEAN HOG HIGHLIGHTS: Lean hog futures finished sharply higher on short covering and technical buying, closing with strong triple-digit gains on the session. Dec hogs, held in check by the cash market, gained 0.225 to 83.125 and Feb jumped 3.850 higher to 89.200.

Feb contract posted a bullish reversal on the charts yesterday, and that triggered additional buying strength on Thursday. Prices quickly moved higher during the session, and Feb hogs are back to the price levels the market closed at last week. Dec hogs are moving closer to expiration on 12/14 and stay tied to the cash market and the index. The Lean Hog Index was softer, losing another 0.32 to 83.89. The cash index and Dec futures are trading mostly in line, which should limit gains or losses for the Dec futures. Feb is building a strong premium to the cash market, anticipating a turn higher in cash trade in the first quarter. Last year, Feb hogs bottomed and turned higher on December 8 and rallied into the Feb close. Direct cash trade was softer, losing 1.14 to 85.06 and a 5-day rolling average of 84.79. Retail values at midday today were firmer, gaining 0.28 to 87.61. The load count was moderate at 145 loads. USDA released weekly export sales on Thursday morning. Last week, new net sales totaled 20,100 MT for 2022 and an additional 3,800 MT for 2023. Japan, South Korea, and the Dominican Republic were the top buyers of U.S. pork last week. The strong rejection of lower prices just signals that the market is anticipating firmer strength going into 2023. The fundamentals are the lagging piece at this time.

DAIRY HIGHLIGHTS: The January Class III contract broke an eight-day losing streak today in a big way, closing up 61 cents at $20.03. Spot cheese, which had not posted a positive close in 10 trading days heading into today’s action, garnered 5.75 cents to close just beneath the $2.00/lb mark. Some reprieve for the Class III market and products was not surprising after the last two weeks, and the focus will be on whether this move is a short-lived bounce or the bottom end of the range is holding. Class IV action was even to down on the day, with the second month contract closing just 34 cents above its Class III counterpart. Tomorrow, the USDA will provide Dairy Product Production numbers for the month of October.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.