MARKET SUMMARY 12-02-2021

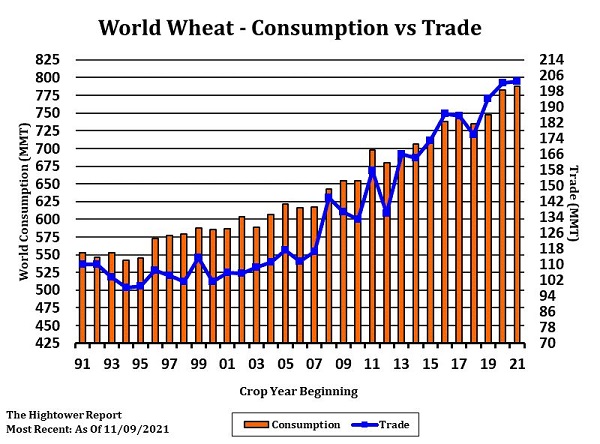

Despite the pullback in the wheat rally, global conditions may still support this market into 2022. In analyzing the global wheat supply/demand picture, for the third consecutive year, wheat consumption will out pace global production. This trend has end users in the market very cautiou and aggressively trying to secure supplies. Expectation are for this trend of consumption exceeding production is expected to continue into 2022, even though global wheat production looks to increase in the next year. This tighter supply issue, and at amount of available wheat supplies being tight to importers will keep the wheat market very sensitive to weather events, headlines, or any trends that could further limit the global wheat production.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures recovered today showing good strength by late morning with gains of close to 10 cents. Sharp price increase in the wheat market and less concern regarding the omicron variant had equities and futures on the offensive today. December corn closed 5 cents higher to 5.77, while December or 2022 finished 0-1/2 firmer at 5.49. Export sales at 40 mb were termed neutral.

Sales to date at 1.39 bb and compare to 1.508 bb last year at this same. Reports continued to suggest that farmer selling remains light and now that weather in South America could be having a more important impact on crop production, the most likely trend for prices is sideways if not higher. Forecasters are increasing chances for dry weather in southern Brazil and northern Argentina throughout the rest of the month and into January, a key time for crop growth, as well as maturity. A strong recovery in the equity markets today reflected a more biased opinion that the COVID variant omicron, while contagious, may have less severe symptoms. Also, it may spread quickly, and this could possibly be beneficial as it moves through populations at a faster rate and therefore, may die out sooner rather than a prolonged exposure like other variants have. Yet, much is unknown, and speculation is probably the most common analysis currently.

SOYBEAN HIGHLIGHTS: Soybean futures finished with gains of 5-1/4 to 16 cents on favorable announced export sales and growing concern conditions are turning drier in South America. Sales of 39 mb were termed neutral to supportive. Daily announced sales of 130,000 mt to China and 160,000 mt to unknow destinations helped provide underlying support. January futures gained 16 cents to close at 12.44-1/4 and new crop November added 5-1/4 to end the session at 12.19-1/4.

Weather is gaining attention, as well as drier outlooks, for northern Argentina and southern Brazil and could be creating more uncertainty. A strong recovery in the equity market today and increased confidence that the latest Covid strain may not be hurtful as first thought had markets taking on more risk. Many stock and commodity prices are trading at their highest prices for the week, negating losses from earlier in the week. An inverted head and shoulders formation is beginning to form. If it holds true could suggest that both the January and March contracts have an upside potential of 14.00. It will likely take adverse weather to drive prices this high. Currently Brazil beans are still priced lower than the U.S.

WHEAT HIGHLIGHTS: Wheat futures showed quite a bit of intensity today with all three classes posting gains of more that 20 cents in the front months. Fears over the new virus strain seem to have subsided for the time being and traders are willing to get back into the market. Dec Chi wheat gained 28 cents, closing at 8.06-1/2 cents, and July up 16 at 8.02-1/2. Dec KC wheat gained 24-1/4 cents, closing at 8.38-1/2 and July up 18-1/4 at 8.23-1/2.

Despite a US Dollar index over the 96 mark and a poor export sales announcement of only 2.9 mb, today ended up being very positive for wheat as the market took on a risk-on position for the second day. Chi, KC, and MPLS all had double digit gains and each Chi contract out to March 2023 is back above the 8.00 level. Paris milling wheat futures (though still off from recent highs) also had strong gains today. Globally, world markets are concerned that Europe is shipping too much wheat, and while the Australian weather forecast is turning drier, concern still exists around the quality of their crop due to recent heavy rains. Russia also has rising tensions with Ukraine – reports today suggest that Russian troops are gathering near the Ukraine border and there are concerns of a looming war. Russia is the world’s largest wheat exporter, and a conflict could have great consequences to the marketplace. In the US, the southern plains have a dry forecast for the next couple of weeks and the fundamentals of low supply have not changed.

CATTLE HIGHLIGHTS: Cattle futures posted moderate to strong gains as cash trade stayed supportive in the live cattle market. Dec live cattle gained 1.650 to 137.650, and Feb cattle were .975 higher to 139.575. Feeders saw mixed, to mostly higher market as Jan feeders were slightly lower, losing .050 to 165.775.

The cattle market was trying to recover off the lows from a couple days back, and a strong outside market helped support the futures. The cash market is still king, and the live cattle cash market saw supportive trade on Thursday. Light trade was seen across all of cattle country with trade ranging $140-142. This was steady to $3 higher than last week in most areas, and with the Dec futures trading well below those level, help get the buyers into the cattle futures. On the demand tone, Boxed beef values has been trending lower this week, but today at midday, Boxed beef values found a little footing with Choice carcasses gaining 1.28 to 271.50 and Select was .61 higher to 258.58. Load count was light at 140 loads. The afternoon close in retail values will be key going into the open tomorrow. Retail values may be under pressure going into the end of the year as retailers will look to hold off on building inventory given the calendar turning to 2022. USDA released the weekly export sales numbers for last week, and new beef sales totaled 21,600 mt, up 12% from last week and 5% from the 4-week average. South Korea, China, and Japan were the top buyers of U.S. beef last week. Feeder cattle saw moderate gains at the cash feeder market has been trending higher. January feeders are running a premium to the cash index, which helped limited its rally potential. The Cash feeder index was .26 lower to 161.34, but has been trending higher. The seasonality makes the market cautious and the price action has signaled a near-term top. The stronger cash trade helped support prices, but prices are consolidating at this weeks trading range. Keep an eye on headlines going into the end of the week, more news about the new COVID strain could pressure outside markets.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.