MARKET SUMMARY 12-03-2021

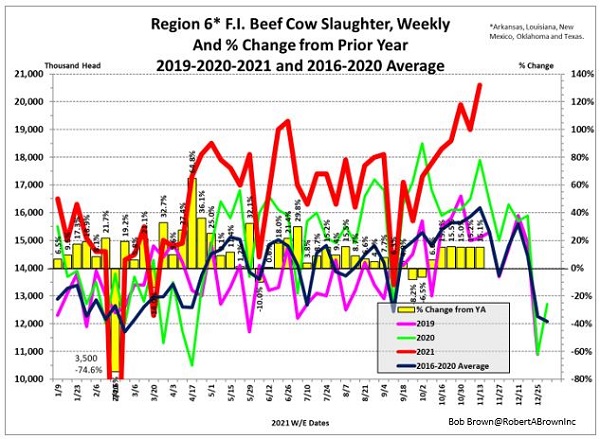

The longer-term picture in the cattle market stays optimistic due to strong beef cow slaughter pace. Taking the U.S. and breaking it down into different regions, Region 6, which is the southern U.S., saw beef cow slaughter for the week of November 13 at 20,600 head. This total was up 15% from last year and 27% higher than the 5-year average. Since the first of October, slaughter pace has been aggressive, average 15% over last year during the past six weeks. The combination of high input costs, weather conditions, and overall lack of profitability has allowed the beef herd to liquidate in certain regions of the U.S. This will tighter the overall cattle supplies, which has been trending lower for the past year. The tight supply picture, and with the demand for beef staying strong, this combination should provide some price support to the cattle market well into 2022.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures firmed on the over-night and stayed strong finishing 9 cents higher in December, closing at 5.86. December 2022 finished 3-1/4 firmer at 5.52-1/4. Sharp gains in the soybean market, along with short covering and corn due to a lack of farmer selling and strong demand from ethanol plants, continues to provide underlying support.

Next week, the USDA WASDE report will be released on Thursday with expectations carry out could be reduced due to strong demand. Proponents of ethanol usage may argue there could be another 100 to 150 million bushels added to the corn grind. It is unlikely all of that will show on this report. While the export pace has leveled off, we make the argument that end users, at high prices don’t usually chase the market. This is especially true for this time of year. Therefore, the demand is still there, it just takes a different form. When prices are as low as they were in the fall of 2020, it made sense for end users to cover significant long-term needs. Attention now focuses on the southern hemisphere and weather, which to date, we would say there is little to worry about. Yet when looking at the forecast in net drying in parts of northern Argentina and southern Brazil, we would say that the weather market is taking a important role.

SOYBEAN HIGHLIGHTS: Soybean futures firmed today gaining 14 to 23 cents on growing weather concerns and talk China will be more actively purchasing US soybeans. Forecasts suggesting regions of Brazil and Argentina will turn drier in the weeks ahead, along with short covering, were primary features in today’s market. Soymeal also firmed again today on strong end user buying.

There is much concern that exports are not running at a pace that is quick enough to meet USDA projections. While early in the marketing year, those concerns may have merit considering southern hemisphere beans are priced cheaper than US, and the Brazil production pace is ahead of schedule. Yet, as mentioned in the corn report, high prices tend to keep end users buying only as needed. If the La Nina weather pattern does in fact strengthen, we wouldn’t be surprised to see additional buying interest on futures. An inverted head and shoulders formation on charts points to 14.00 as an upside objective. Today’s rally above the 40, 50, 21, and 10 day moving average looks impressive. The next resistance level is the 100-day and 200-day moving averages, both at 12.92 in the March contract. Stats Canada, the Canadian reporting service, indicated canola production is down about 1/3 from a year ago. This isn’t a change, but a confirmation that world supplies of both oils and protein remain tight, suggesting little room for error with South American production.

WHEAT HIGHLIGHTS: Corn and soybeans showed their strength today, though wheat struggled to do the same. With a lack of positive news, pressure from a high US Dollar index, and reports that Russia may limit exports, the market simply had no reason to go higher. March Chi lost 11-1/4 cents, closing at 8.03-3/4 and July down 8-1/4 at 7.94-1/4. March KC lost 18, closing at 8.24-1/4 and July down 11 at 8.12-1/2.

The US weather outlook remains dry for the US southern plains for the next few weeks as drought concerns are growing for that part of the world, whereas SRW wheat areas have plenty of soil moisture. In Australia the forecast comes mixed at a time when they may have a record large wheat crop but have been plagued by heavy rains that could affect quality. They are getting light showers in the east but have a drier forecast on longer term maps. China has been buying Australian feed wheat, which is helping to firm their futures market. Along with the US, Paris milling futures were under pressure today after yesterday’s bounce off recent lows. The middle east is in need of wheat, as evidenced by tenders from Jordan, Algeria, and Saudi Arabia. Stats Canada reported their all-wheat production at 21.65 mmt – this is 38% down from the crop a year ago. There were reports today that Russia is considering limiting February through June wheat exports to 9 mmt. This added pressure to the trade, with concerns that there will be a flood of wheat into the market before the quota goes into effect. Concerning Russia, the accumulation of their troops on the Ukrainian border is upping tensions between the two. The fear is that Russia will invade Ukraine, which could have drastic consequences for the wheat market. In the southern hemisphere, the Buenos Aires Grain Exchange reported Argentina’s wheat crop to be 45% harvested.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.