MARKET SUMMARY 12-07-2021

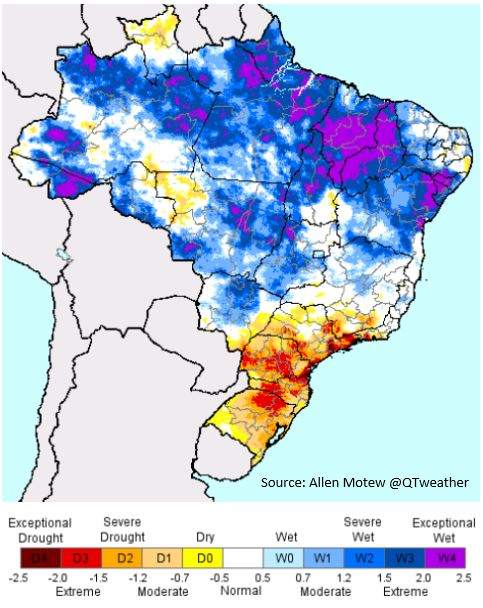

Southern Brazil is experiencing dryness concerns as we move deeper into December. While much of the main growing regions are more located in the center of the country, the southern portion of Brazil is responsible for approximately 36% of the soybean crop, and 43% of the first season corn crop. The dryness across this region looks to be maintained, as rainfall and temperature are likely impacted by the La Nina weather patterns that are set up in this region. As the crop moves into the more important January/February development window, the lack of moisture will likely have an impact on production overall in these areas. The question will be the quality of the northern crops, which are currently in good shape. It is possible the production in the north could offset the losses in the southern Brazilian states. This weather trend will be closely watched going into 2022, and may still be a developing story overall.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures edged higher today gaining 2-3/4 cents in Dec closing at 5.86-1/4. Dec 2022 gained 2-1/2 closing at 5.55. Both the old and new crop contracts continue to trade in a range-bound fashion waiting for news to provide direction. Ethanol margins remain supportive. Expectations are Thursday’s WASDE report could show another small bump in ethanol and a small decline in carryout.

With recent export sales and inspections seemingly indicating a more subdued end-user buying methodology, we just don’t see where this month’s report will have much in new numbers to provide direction. As a reminder, this report will not estimate yield. The last yield estimate for 2021 production will come in the January report. The technical picture continues to suggest sideways, yet we are encouraged with the way prices, after trading weaker, gravitated higher late in the session. Farmer selling remains mostly light and basis levels on the strong side. On Thursday, the market will have new export sales figures as well as the USDA report. Resistance in Mar corn is 5.99-3/4. If this is violated, a potential move to 6.15 is in store.

SOYBEAN HIGHLIGHTS: Soybean futures softened giving up 8 to 11 cents on old crop with new cop losing 1-1/2 cents in Nov closing at 12.31-3/4. Jan closed the session at 12.50-1/4, down 11-1/4, yet still within its recent range. Concerns that biofuel mandates could be reduced along with some additional moisture in near-term forecasts for parts of Brazil and Argentina weighed on futures today.

Today was the weakest close in three sessions, a sure disappointment for those who are bullish. We have mentioned the formation called an inverted head and shoulders. Higher prices are needed to confirm this formation and provide a likely incentive for traders to then expect soybeans to advance toward 14.00. Nonetheless, we don’t want to read too much into any one day. Most markets seem somewhat subdued today. The good news is energies and equity markets continue to trade firmer on lessoning Covid concerns. Additionally, China has taken several steps to help ensure stability in its markets. Ultimately, this could be a long-term friendly development. Soy oil led today’s drop on concerns bio-fuels demand will be less than anticipated.

WHEAT HIGHLIGHTS: Wheat futures eked out modest gains with another lackluster close. The headlines that could be market movers are somewhat in opposition to each other, and futures remain in a trading range as the market looks for direction. Mar Chi gained 2-1/4 cents, closing at 8.08-1/2 and Jul up 2-3/4 at 8.01-1/2. Mar KC gained 5 cents, closing at 8.27-1/2 and Jul up 3-1/4 at 8.18-1/4.

Another relatively quiet close today comes with gains of 2 to 5 cents in Chi and KC across the board. MPLS did fair a bit better, with Mar up 8-3/4 at 10.36-1/2. Export inspections for wheat totaled only 9 mb with total inspections down 17% from last year at 410 mb. This is behind the pace needed to meet the USDA’s estimate. While major changes are unlikely to appear on the December 9 WASDE report, carryout could increase due to these lower exports. Today, President Biden met with Vladimir Putin on a video call – Biden issued a warning that if Russian conflict with Ukraine increases there would be economic consequences. It was reported that this warning was not well received. The Russian / Ukraine conflict could have major implications for the wheat market; jeopardizing their exports could bolster the futures market. On the other hand, the fact that Russia may limit exports in February brings a bearish tone to the marketplace short term (exporters may try to ship as much as possible before then). Last week Russian cash wheat prices were down for the first time in six weeks and their export tax may increase to 85 dollars per ton this week. There is also news regarding the U.S. diplomatic boycott of the Beijing Olympics; the Chinese foreign minister called this a mistake and said that the U.S. would “pay the price”. Any impact to commodity markets and exactly what this might entail is not clear at this time. The wheat market, in general, has lost a lot of demand premium recently, but U.S. spring and summer weather in the Southern Plains looks like it will have a bullish influence longer-term.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.