MARKET SUMMARY 12-13-2021

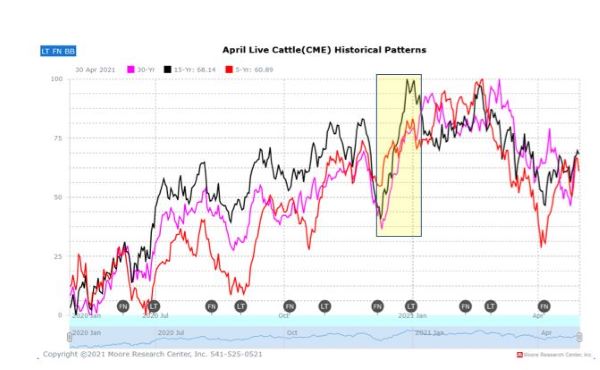

Cattle futures may be looking to post a seasonal turn despite a weaker fundamental picture. Historically, April live cattle futures trend higher from early December until the end of the calendar year, and cattle futures posted a bullish technical turn on charts to start the week. Cattle futures have pulled back seasonally after the Thanksgiving holiday, as futures have traded lower of the highs of November 24. Retail beef values have slipped. Last week, the cash market traded steady to lower for the first time in a handful of weeks. As the futures market works through December contract expiration, money seems to look toward the spring months and possibly trend toward a winter high. The overall cattle numbers stay supportive, and tighter cattle supplies should support the market. Beef demand is also strong, and that should be an underlying theme throughout next year.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn opened the session Sunday evening near unchanged to a penny lower and continued its slide to end the day session, 5-0 cents lower in choppy trade. The nearby March 22 contract settled at 5.85, down 5-0 cents. July 22 settled at 5.87, down 4-0 cents, and new crop December 22 closed at 5.42-1/2, down 8-1/2 cents.

Corn seemed caught between the stronger wheat market and much weaker bean market. The corn market saw no new sales reported this morning from the USDA’s daily sales reporting system, and Export Inspections came in at 810,395 metric tons versus 775,000 last week. Inspections fell within the estimates of 700k-1,200k, though the year-to-date totals continue to trail last year’s by 16%. Overall, it felt like corn succumbed to the weakness of the bean market, and profit taking, as ethanol margins continue to be strong. Exports sales have also seen an uptick recently with Mexico being the number one buyer and China entering the mix. South American weather continues to be in the forefront of the markets mind. Argentina experienced some shower activity over the weekend, a possibly a bit more than what was expected, but still light.

SOYBEAN HIGHLIGHTS: Soybeans opened Sunday evening slightly firmer but traded lower throughout the session to close 23-3/4 cents lower on the day. Front month Jan 22 closed at 12.44, down 23-3/4 cents. Jul 22 settled at 12.66, down 22-0 cents, while new crop Nov 22 closed at 12.30-1/2 down 18-1/4 cents.

Demand and South American weather remain two of the primary things that the market is focused on. Unfortunately, this morning there were no export sales reported through the USDA’s daily sales reporting system, and weekly export inspections came in at 1,724k metric tons, below expectations of 1,900k-2,300k. In South America, some light shower activity was reported for Argentina over the weekend, which may have lent pressure to the market today. Additionally, despite dry forecasts and the dryness that has been experienced to this point, Brazil’s production this season is being seen by some in in the trade as possibly record large. Basis continues to be supported as crush margins are still quite profitable, and there has been talk about the lack of Lysine availability, which is in turn supporting meal demand.

WHEAT HIGHLIGHTS: Wheat futures saw some additional follow through to the upside as the market tries to climb off recent lows. Strong global demand helped push wheat prices firmer. Chi gained 3-1/2 cents, closing at 7.88-3/4, and Jul added 3-1/2 to 7.86-1/2. Mar KC was 7 cents higher, closing at 8.12-1/2 and Jul gained 5 at 8.03-1/2. Spring wheat futures were mixed on the day.

Wheat futures saw additional strength after Friday’s strong close. Global demand news stays as the force under the market. Russia raised its export tax to $91/mmt, lifting the global wheat prices. This helped support U.S. wheat classes, as the higher Russian prices should help support U.S. demand. Algeria was tendering for wheat over the weekend, and Egypt should be tendering for more bushels soon. The strong demand tone for exportable wheat helped support the market in general. Weekly Wheat export inspections were light at 9 mb, and total inspections are running 17% under last year, and sales are 24% behind the pace of last year. The slower export pace reflects the stronger wheat prices. In the U.S. cash market, basis levels stay firm as the market is looking for wheat supplies. On the weather front, forecasts for the southern plains remain low in moisture, which helped provide buying support in the KC contracts.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.