MARKET SUMMARY 12-15-2021

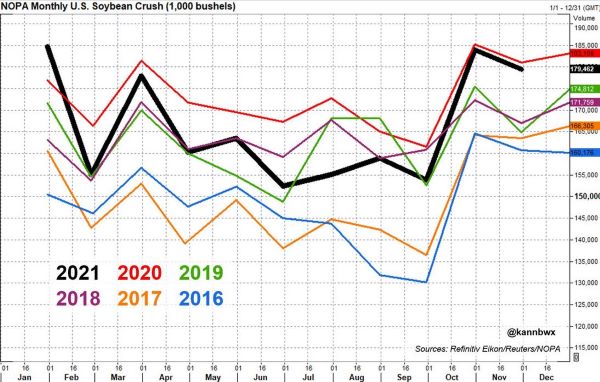

The U.S. NOPA crush number for November were the second-best total for the month of November. NOPA released a crush estimate of 179.462 million bushels of soybeans used for crush capacity. This was 0.9% lower than last November, which was a record crush month for November. The total was slightly below the 181.64 million bushels that the market expected but well within expectations. Soyoil stocks posted their first monthly decline since June at 1.832 billion pounds as oil yields were down, the lowest since last February. The soybean product market, soyoil and soybean meal, has been extremely volatile in recent session with wild swings in both markets. The demand for both products will continue to support the NOPA crush totals going forward and provide positive support of soybean prices.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn traded higher on the 8:30 am reopening, challenging last month’s high of 5.96-3/4, before reversing to close 4-1/2 cents lower at 5.85-3/4 in the March contract. July 22 closed 5-1/4 cents lower at 5.86-1/2, and new crop Dec 22 settled down 2 cents at 5.43-3/4.

March corn traded up to its high today of 5.96-1/2, testing the recent resistance high of 5.96-3/4 made last month before reversing shortly thereafter to close almost 11 cents off the high and 4 cents from the low. Officials from the Federal Reserve met earlier today and approved to scale back its pandemic stimulus efforts in response to recent higher rates of inflation. Concerns over these actions may have contributed to the market’s decline from today’s highs. US imports to China remain profitable with current domestic prices, and there have been rumors of recent sales, though there has yet to be any confirmation. Ethanol continues to be a bright spot for the corn market. Production last week reportedly faded some, but demand remains strong, keeping margins profitable, and basis stable. South American weather remains a focus as well. There is ongoing talk of dryness in Argentina and southern Brazil, which will likely continue to support the market on breaks.

SOYBEAN HIGHLIGHTS: Soybeans ended the day mixed after trading back and forth in a 15-1/2 cent range. The January 22 contract settled 3-0 cents higher at 12.62-1/2. July 22 closed 0-1/4 cents higher at 12.79-3/4, and new crop Nov 22 settled 2-1/4 cents lower on the day at 12.40-3/4.

Both meal and soybean oil experienced reversals in today’s trade, with soybean oil ultimately lending strength to help beans end the day on a positive note. World veg oils have been under heavy pressure as of late, adding to the weakness in soybean oil and creating very oversold conditions. Meal has seen strength from tight supplies, as crush yields have been lower than expected, and demand strong from tight canola meal supplies. Export demand remains a concern to the market. Soybean sales are currently running 27% behind last year, and load outs are 21% behind. It has also been rumored that China has its December needs covered and half of their January needs filled as well. With Brazil likely to come into the export market in January with an early harvest, there is precious little time for the US to make sales before our export window closes. South American weather continues to be on the front page, and any continued concerns should provide support to the market.

WHEAT HIGHLIGHTS: Wheat futures broke apart technically as prices posted strong losses. After breaking nearby support, prices broke to challenge the low for November. Chi March lost 31 cents, closing at 7.56, and July lost 27 to 7.62. Mar KC was 26-1/4 cents lower, closing at 7.85-1/2 and Jul dropped 22 cents at 7.81-3/4. Spring wheat futures also trade 9-11 cents lower.

Wheat prices have been building a bearish technical pattern, and prices broke through to the downside on Wednesday. With the light holiday trade, stop orders were triggered under the market as prices fell. The weakness in the wheat market weighed across all the grains during the day. Outside markets did help support the wheat market as the dollar is trading near the top of its latest trading range, and early trading in energy and equity markets were softer. Since Nov. 24, Chicago March wheat has now fallen $1.20 per bushel from the high and Kansas City is down $1.07 from the high. Other than a overall softer demand tone for U.S. wheat, there was little news leading to the selloff today. The next round of weekly export sales will be released on Thursday morning, with expectations of 200-400,000 MT of sales for last week. Global export demand stays active with multiple tenders working as end users are trying to book supplies. Russia is looking into revising their Feb. 15 to June 30 wheat export cap to just 8 mmt from 9 mmt, which would be supportive of wheat prices. On the weather front, forecast for precipitation across portions on the winter wheat belt added to the selling pressure, but technical selling was the trigger.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.