MARKET SUMMARY 12-17-2021

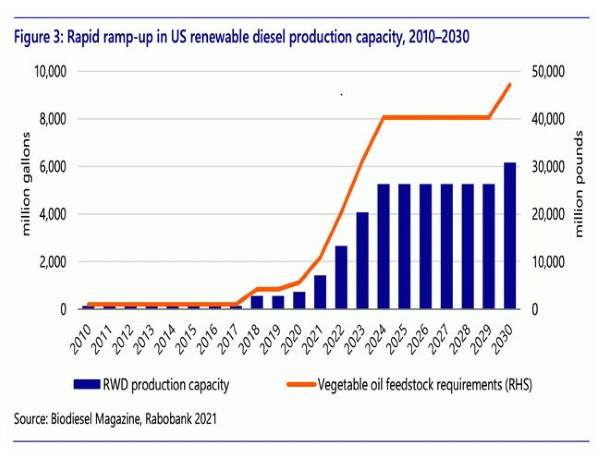

Plans for renewable bio-diesel could be a boom for soybean prices, boosting domestic demand. Talk in markets has been trying to plan out the potential soybean needs for a proposed boom in bio-diesel demand in the years ahead, as the U.S. ramps up production for a more green energy focus. Soybean oil is figured to show increased demand in 2022, as crushing plant projects are being constructed, which will increase the domestic demand for soybeans. The list of proposed and under-construction renewable diesel facilities around the country would spike production from 770 million gallons in 2021 to at least 3 billion gallons in 2023. EPA already forecasts 2022 production at 1.59 billion gallons. This leap in potential production will put soybeans and soybean acres in high demand in the years going forward. As the U.S. struggles with global competition for soybean exports, a boost in domestic demand through new bio-diesel project could have a strong impact on the U.S. soybean market.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures made new recent highs early in the day only to give back much of the gains to close 2 cents higher. March corn traded higher through November’s high of 5.96-3/4, up to 5.98-3/4 to close only 2-0 cents higher at 5.93-1/4. July closed at 5.92-3/4, up 1-0 cent, and new crop Dec settled down 0-3/4 at 5.46-1/2.

Corn futures opened the days session with carry over strength from yesterday’s close and neighboring strength in soybeans and wheat. For most of the week the market traded back and forth between support at the 20-day moving average and upper resistance at November’s high of 5.96-3/4. March corn was able to break through resistance today but was met with selling pressure as it approached the all important $6.00 level and closed near trendline support at 5.93-1/4. This week was also met with a marketing year high in export sales of 1.948 MMT, which were led by Mexico. Though these sales are good, we are merely keep the US on pace with USDA projections. The bright light that has continued to shine lately for the corn market is demand from ethanol production. Even though ethanol production and corn used for ethanol were softer week over week, they remain strong versus a year ago levels. With 1.087 million barrels per day produced and an estimated 110.35 million bushels of corn used. Many contend that the USDA may need to increase corn demand for ethanol between 100 and 150 million bushels in the next WASDE report on January 12. We encourage producers to keep an eye on local basis levels from now into year end. Basis should remain steady to firmer in the near term. Though with fall field work nearly finished, corn may come to market at year end and into the New Year potentially weakening basis levels.

SOYBEAN HIGHLIGHTS: Soybean futures traded mostly on the positive side overnight and found further buying interest on the 8:30 open from a 132,000 MT flash sale of soybeans to China enabling March soybeans to close 8-0 cents higher. The March soybean contract settled at 12.85-1/4 up 8-0 cents, July beans settled at 12.99-1/4 up 9-0 and new crop November settled at 12.46-3/4 up 0-1/2.

This week soybeans were able to shrug off the early weakness to settle above the 100-day moving average for the second day in a row, with decent weekly export sales of 1.306 MMT, additional soybean sales to China and soybean oil sales to India. An additional bright spot to this week’s export sales numbers is that 75% of the sales had China listed as the buyer. Though the bean market was able to trade above highs made back in late September, it was unable maintain much of the gains and settled 12-0 cents off the highs, but still 10-1/2 from its lows. Beans were also able to find continued strength from meal as soybean oil lost ground from its recent highs this week. The market continues to keep all eyes on South American weather. Crops there have an overall good start to the growing season, and with that, the potential to grow another record crop. The market is also wrestling with the fact that the US export window is closing, giving the US less time to make any sizable sales, and with Brazil possibly having their crop available for export in January. Any continued poor weather in Argentina may prove beneficial to the US as it may lead to more export sales for meal and soybean oil, as they are the worlds largest exporters of soybean products.

WHEAT HIGHLIGHTS: Wheat futures saw choppy and relatively quiet trade to end the week, as overall market news was lacking to push prices firmly in one direction or another. Chi March gained 4-1/2, closing at 7.75, and July added 1-1/4 to 7.69-3/4. Mar KC was 6-1/4 cents higher, closing at 8.10, and Jul gained 5 cents at 8.01-1/2. Spring wheat future traded lower, losing 2-4 cents. For the week, Chi March wheat lost 10-1/4, While the March KC contract gained 4-1/2.

Wheat futures are trying to build in a bottom , as prices have rallied nicely off Wednesday’s lows. While news was limited, the majority was supportive of prices. The demand news this week was friendly with U.S export sales at a market year high after the most recent price drop. Global, there are ample amount of wheat tenders looking for exports, supporting prices after this price drop. Weather wise, in the U.S., a large portion of the winter wheat region remains dry, and forecast are holding a drier bias going forward. On the negative, Argentina wheat harvest and Australian wheat crop looks strong. The Buenos Aires Grain Exchange is hinting to raise crop projections higher to a record wheat harvest. Australia pushed their output higher earlier in the week, but there are still some quality concerns there. The firmer weekly close off the lows of the week improve the technical picture for wheat, as prices are trying to build a bottom. Global wheat supplies are still friendly and demand seemed to kick in at these lower price levels building support.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.