MARKET SUMMARY 12-20-2022

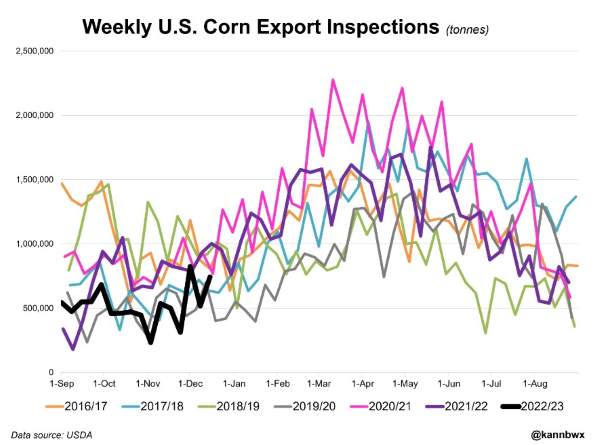

Weekly corn export inspections were at the top end of analyst estimates this past week with 743,000 MT inspected for export. This finally has corn inspections trending higher as a very difficult and poor start on the marketing year. Year to date, corn export inspections are down 30% from last year’s levels. The slow pace to start the marketing year has resulted in the USDA’s lower export demand projections on the latest Supply/Demand report. Going forward, the export activity for corn should be looking to pick up the pace. Recent price weakness and the weaker U.S. dollar is making the U.S. corn more competitive to the rest of the world. Regardless, the export sales on the books are still behind previous year’s levels, and the U.S. will need to see importers step up and pick up bushels more aggressively or the corn market faces further reduction in export totals forecasted.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures rebounded today holding early gains and finishing near the high for the day. Mar added 4-3/4 cents to close at 6.52 and Dec gained 1-0 to end the day at 5.96-3/4. Double-digit gains in soybeans and steady to higher wheat prices provided support in an otherwise news-starved market day. The short-term forecast for Argentina looks improved for moisture, but after the next week it may turn warmer and drier. A drop in the U.S. dollar was supportive.

The La Nina pattern that has kept Argentina and Southern Brazil dry is expected to shift to a more normal pattern into early January. While some of the crop will be planted late, it is too early to draw conclusions as to final yield, however, expecting robust production out of Argentina is not likely. Today’s close in Mar futures is above a near-term downward sloping resistance line on charts. The next level of resistance is the 21-day moving average, at 6.54-1/2. Japan indicated it would be raising interest rates, signaling the reason for the year to strengthen against the U.S. dollar. A major winter storm will slow movement of corn and likely limit weight gain for livestock suggesting feed usage could tick higher. Expect the current rangebound pattern to continue into the weekend. Markets are closed on Monday.

SOYBEAN HIGHLIGHTS: Soybean futures closed higher today as hope for some rain to quench Argentina’s drought was extinguished in the weather forecasts. The country was supposed to receive much needed rains this weekend, but forecasts have turned drier and the moisture they do receive should be less and more scattered. Bean oil surged helping soybeans and meal close higher as well. Jan soybeans gained 17-3/4 cents to end the session at 14.78-1/2, and Mar gained 16-1/4 cents at 14.79-3/4.

With South American production as the main focus right now, all eyes are on weather in Argentina and Brazil. While the Brazilian crop was planted under essentially perfect conditions and has received continuing good weather, Argentina’s crop has been severely hurt by drought, and planting pace is very far behind. Initial forecasts called for rain heading into this weekend that might have alleviated some of the problems, but forecasts turned drier today and the rain they receive is now expected to be minimal. It is possible that Argentina’s poor crop is offset by Brazil’s record crop. Jan bean oil gained over 2.5% on the day as traders renewed interest in the contract and that renewable biodiesel capacity is expected to grow significantly. Soybean crush margins are historically high and domestic soybean basis is at a 20-year high. Exports have been solid with China as a major buyer, and total sales commitments are now 4% higher than a year ago. Export inspections were ok at 59.5 mb, but that was a 10-week low. China will still need to continue purchasing U.S. soybeans for now, but as soon as Brazilian new crop beans are ready exports are likely to drop off as China turns to Brazil for their needs. When this happens, prices could fall significantly so producers with unpriced beans and decent basis should be looking at making sales within the next three weeks or so. The charts appear very bullish, but the 15-dollar level is a strong point of resistance and technical selling could take over at that level. Jan beans are near the top of their range but have traded sideways since December 8.

WHEAT HIGHLIGHTS: Wheat futures, after a two-sided trade, closed marginally higher. There was not much fresh news to move the market but a lower U.S. dollar may have offered support. Mar Chi gained 2 cents, closing at 7.50-1/2 and Jul up 1/4 at 7.62. Mar KC gained 3-1/2 cents, closing at 8.47 and Jul up 3 at 8.34.

Oscillating back and forth like a metronome, all three U.S. futures classes posted gains with MPLS leading the way with gains of about four to six cents. Chi was mixed with small increases in the front months but losses in 2024 contracts. While there was not much news to move the market today, there were a few items of note. Japan’s unexpected increase in interest rates may have led to a lower U.S. dollar and offered support to the grain markets. Additionally, spillover from sharply higher soybean prices was helpful. But the most impactful thing so far this week is the forecast for much of the Midwest. The major winter storm set to hit much of the corn belt will bring with it blizzard conditions. Heavy winds and snow will be coupled with very cold temperatures that could extend into the southern plains along with the threat of winterkill. Parts of Oklahoma, Kansas, and Texas could be affected. Extreme weather is also impacting the Black Sea region and slowing their exports. Ukraine’s infrastructure also remains under attack, which along with tight supply, does offer some support to the market. As a reminder, markets will be closed Monday, December 26, in observance of Christmas.

CATTLE HIGHLIGHTS: Cattle futures traded mixed to lower trade on the day in the live cattle market, but buyers stepped back into the feeders. The potential storm forecasted for cattle country over the next week will likely bring support to live cattle as harsh conditions could affect cattle weight gains and the cash market. Dec live cattle lost 0.225 to 155.050, and Feb cattle futures slipped 0.475 to 155.575. In feeders, Jan feeders saw posted good gains adding 1.525 to 183.625.

The market seems to be looking for true direction as trade has been very choppy to start the week. The forecasted winter storm keeps the buyers active and helps push cattle movement, but traders are cautious of the Cattle on Feed report at the end of the week, and the holiday volatility from light trading volumes. Cash trade was undeveloped to start the week, but expectations are for steady trade again this week. Trade will likely start developing over the next day or so before the holiday weekend. Retail values have firmed recently, and that has moved packer margins back into the black, which should support cash bids. At midday, carcass values were mixed with choice carcasses gaining 1.25 to 265.08 but select dropped 4.18 to 234.39. The load count was light at 67 loads. Feeder cattle were higher as value buying stepped back into the market after Monday’s weakness. The market put added the premium back into the Jan contract to the index. The Feeder Cash Index was 1.50 lower to 178.01. The index is still at a discount to the Jan board, which was likely a limiting factor. The feeder market saw a bid on Tuesday despite an overall strength in the grain markets. The direction overall in the cattle markets is higher and the market looks well supported. Cash trade will likely give the market its end-of-week direction before the Cattle on Feed Report, which is expected to show ongoing tightening in cattle supplies.

LEAN HOG HIGHLIGHTS: Lean hog futures saw mixed to mostly lower trade on Tuesday, as the choppiness of the holiday week stays in play, affecting price direction. The market is still watching end-of-year fundamentals, the forecasted winter storm, and focusing on the Quarterly Hogs and Pigs report at the end of the week. Feb dropped 1.450 to 84.250 and Apr hogs gained 0.825 to 92.175.

Hog futures are still looking for direction to start the week. The winter weather forecast for a strong winter storm toward the end of the week could likely bring some impact on animal movement and the market may be looking to price in some restrictions. Some of the storm’s impact may already be priced into the market. The USDA Quarterly Hogs and Pigs report is on Friday, and expectations are for the hog herd to continue to tighten, and that has been reflected in summer hog prices. The market fundamentals still need to improve in order to build some support in the market. Retail pork values were lower at midday losing 2.06 to 82.87, following a difficult afternoon close on Monday. Product movement was good at 193 loads. The cash market stays disappointing. Midday direct trade was softer on the day, losing 0.41 to 79.98. The 5-day rolling average is 80.36. The Lean Hog Cash Index traded 0.33 lower to 81.55 and is a discount to the futures, which is a limiting factor. The market will be expecting a tighter hog supply going into 2023, and that supports the longer-term market, which should be reflected in the Quarterly Hogs and Pigs report on Friday. The key will still be the fundamentals, which for the most part are still struggling to support the market and may limit longer trend rallies.

DAIRY HIGHLIGHTS: Nearly all dairy markets were in the red today. Class III second month futures continue a nose dive below $20 per CWT, while Class IV second month has managed to stay above $20, but is quickly approaching that price. The spot trades have been extremely active this week as the purchasing is likely coinciding with the lower prices. Spot butter prices fell another dime today, down over 25 cents this week, but six loads have traded already this week. Five loads of cheese have traded as prices have fallen over 3 cents per pound this week. A whopping 15 loads of whey have traded this week as prices have plunged below a 40 cent support level, down over 8 cents on the week to $0.37 per pound. Spot powder avoided the blood bath today, but prices are trading near the low end of its calendar year range.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.