The CME and Total Farm Marketing offices will be closed Monday, December 26, 2022, in observance of Christmas.

Merry Christmas from all of us at Total Farm Marketing!

MARKET SUMMARY 12-22-2022

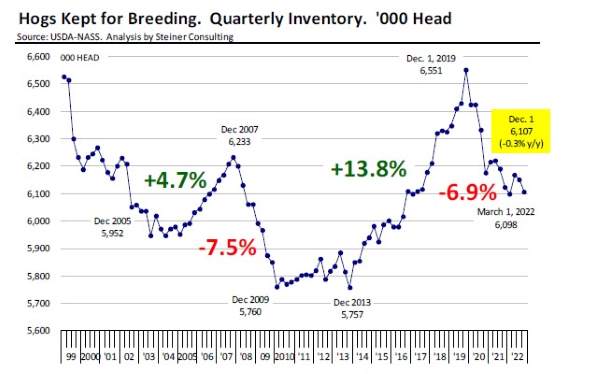

The USDA is releasing the Quarterly Hogs and Pigs report on Friday afternoon after the market closes. Hog prices have trended higher this week in anticipation of this report, reflecting an ongoing tightening hog supply picture. All hogs and pigs on December 1 are expected to trend down 1.5% from last year’s levels, and animals kept for marketing down 1.6 % from last year. This should have hog slaughter in the Dec-May window down around 2.1% from last year’s levels, reflecting those tighter hog supplies. The animals kept for breeding are expected to be down 0.3% from last year. This total will be down 6.9% from the peak in hog breeding numbers of the December 2019 report. The impact of high feed costs has had producers pause any expansion plans overall, even with strong slaughter hog prices. The hog supply picture is relatively tight, and given a good demand tone should stay supportive of hog prices into 2023..

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures traded in a narrow range today giving up 1-3/4 cents in Mar to close at 6.60-1/2. Dec lost 1 to end the session at 6.01-1/4. The range in Mar futures was 6 cents. Slow export sales and weakness in the stock market, as well as softer wheat and soybean prices, weighed on corn futures. A winter storm is keeping movement of corn at a minimum.

Export sales at 25 mb were on the low end of estimates and confirmed another week of slow sales. Year-to-date sales are 813 mb, 48% lower than a year ago at this same time. End users still appear to be hand-to-mouth in their buying or perhaps are digging into supplies and betting South American crops will be available to meet longer-term supplies. We don’t believe the winter storm will have a lasting impact. However, there is some potential for winter wheat damage in the southern plains and consequently, this could mean more feed usage for corn. High winds and bitter cold could also add to feed usage and the macro picture. However, a lack of friendly news and what appears to be a lack of positive managed money buying is keeping prices from rallying. Yet despite double-digit losses in soybeans, corn prices did manage to hold together relatively well today. Resistance in Mar is 6.45, the 40-day moving average. If that is crossed, expect a move to the 50-day moving average at 6.70.

SOYBEAN HIGHLIGHTS: Soybean futures closed lower today as thin holiday trade makes prices more volatile. Bearish influences came from rain in Argentina and southern Brazil as well as export sales that were slightly less than were hoped. Both meal and bean oil fell too with a small drop in crude oil. Jan soybeans lost 13-1/4 cents to end the session at 14.67-3/4, and Mar lost 12-1/2 cents at 14.72.

The soy complex fell today as resistance was met yesterday at the 14.90 price level with selling spurred by technical indicators and beneficial rains falling in Argentina and southern Brazil. Exports were mixed and didn’t add any bullish momentum with an increase of 27 mb of soybean export sales in 22/23 and 5.1 mb for 23/24. Last week’s export shipments of 73.1 mb were above the 30.4 mb needed each week to achieve the USDA’s export estimates, and China was the primary buyer picking up 1,480,400 mt. It is likely that China is stocking up in order to hold out for Brazil’s new crop, and the last solid month of exports that the U.S. can look forward to is January before China turns to Brazil. The Buenos Aries Grain Exchange said just 12% of the soybean crop was rated good to excellent which is down 7% from last week, and only 61% of the crop is planted due to the drought. The continued bullish factor in the U.S. is the crush demand with Mar futures showing the value of crushed beans 3.26 above the cost of uncrushed, and incentive for processors to buy cash beans. The trend for Jan beans has flattened out over the past two weeks but remains higher and sits just above the major moving averages.

WHEAT HIGHLIGHTS: Wheat futures had a mixed close with losses in Chi and small gains in KC. The extreme drop in temperatures may be recognized by traders as a threat to the HRW crop and add price support. Mar Chi lost 5-1/2 cents, closing at 7.62-1/4 and Jul down 4-3/4 at 7.74-3/4. Mar KC gained 2 cents, closing at 8.66 and Jul up 3-1/2 at 8.52-3/4.

It was another relatively quiet day in terms of news, as Christmas approaches and lighter trade over the next several sessions may keep markets choppy. The biggest headline, which we touched on yesterday, is in regard to President Zelensky’s U.S. visit to ask congress for aid for Ukraine. This surprise visit has fanned the flames, so to speak, between U.S. and Russia relations. Only time will tell how the situation plays out. Fundamentally, the bitter cold hitting the U.S. HRW crop is a cause for concern. Also relevant, is the seven-day forecast for the southern plains which continues to show a lack of precipitation in that region. As for today’s export sales data, it was another relatively disappointing week. The USDA reported an increase of just 12.3 mb of wheat export sales for 22/23. There is not much more to report on today, but the outlook for the wheat market remains on the bullish side for the winter, with tight U.S. and global supplies.

CATTLE HIGHLIGHTS: Cattle futures were mixed to mostly higher on Thursday, as cash trade has been slow to develop, and the market squaring positions before the Cattle on Feed report on Friday. Dec cattle slipped 0.225 to 155.900, and Feb cattle lost 0.400 to 157.700.

Front-end contracts saw some profit-taking as prices stay tied to the developing cash market and squaring before the Cattle on Feed report tomorrow. Cash trade started to find some footing, but it was very limited with light Northern dress trade at $249, up $1 from last week’s average. Southern live trade is still quiet, but asking prices are $156-157, mostly steady with last week. Tomorrow brings the next Cattle on Feed report and the market is anticipating friendly numbers. After the strength yesterday, some of the friendly news may be priced in. Expectations are for total cattle on feed as of December 1 will be down 2.9% from last year, and possibly the lowest December total number since 2016. Placements are also expected to be lower than last year at a 4.2% decline, the lowest November placement since 2016 as well. The low placement numbers should support the market well into 2023. The forecasted winter storm has also kept the buyers active and helped push cattle movement. Retail values at midday were higher. Choice carcasses gained 1.88 to 266.74 and select added 3.91 to 240.20. The load count was light at 52 loads. Weekly export sales were lackluster with new sales reported last week of 4,500MT for 2022 and 7,200MT for 2023. Exports were 17,700 MT for last week. Japan, China, and South Korea were the top buyers of U.S. beef last week. Feeder cattle were higher, following through on yesterday’s strength. The prospect of low placement number on Friday’s Cattle on Feed report is providing strength. A quieter tone in the corn and wheat markets helped support as well. The Feeder Cash Index was 0.31 lower to 177.83. The index is still at a discount to the Jan board, which was likely a limiting factor. The direction overall in the cattle markets is higher and the market looks well supported. Price may be choppy on Friday with squaring going into the cattle on feed numbers. Prices moved nicely higher and may have priced in the potentially bullish cattle on feed numbers.

LEAN HOG HIGHLIGHTS: Lean hog futures found a way to work higher on the day despite some early selling pressure, as the market is anticipating the Quarterly Hogs and Pigs report to be released on Friday. Feb traded 0.650 higher to 89.050 and Apr hogs gained 0.750 to 96.025.

Feb hogs closed the 200-day moving average, which could be a key swing price on the charts. It was encouraging to see prices close near the highs on the day, which could lead to additional buying strength on Friday. The USDA Quarterly Hogs and Pigs report is on Friday, and expectations are for the hog herd to continue to tighten. All hogs and pigs are expected to be 98.5% of last year and animals kept for marketing at 98.4% of last year. This should reflect approximately a 2% drop in estimated hog slaughter in the first half of 2023. Animals kept for breeding will be closely watched to see if any expansion has been occurring. Expectations are for that total is to be down 0.3% from last year. Even with strong hog prices on the back end, the impacts of high input costs has still limited potential hog expansion. The market fundamentals still need to improve in order to build some support in the market. Retail pork values were strongly higher, gaining 5.09 at 87.54. Product movement was moderate at 190 loads. Weekly export sales were strong with 58,700 MT of new sales reported for 2022 and an additional 7,200 MT for 2023. Mexico, South Korea, and Japan were the top buyers of U.S. pork last week. Exports last week were 17,700 MT. Midday direct cash trade was firmer on the day, gaining 0.38 to 79.86. The 5-day rolling average is 79.98. The Lean Hog Cash Index traded 0.29 lower to 80.57 and is a large discount to the futures, which could be a limiting factor. The market will be expecting a tighter hog supply going into 2023, and that supports the longer-term market, which should be reflected in the Quarterly Hogs and Pigs report on Friday. The key will still be the fundamentals, which for the most part are still struggling to support the market and may limit longer trend rallies.

DAIRY HIGHLIGHTS: January Class III futures pushed up 52 cents today to get back over the $19.00 mark, a nice reprieve that gives some hope after the recent beating. But while the Q1 Class III contracts were higher, the rest of the milk complex was even to lower on the day. Cheese had a decent day with blocks up 4.50 cents and barrels up 6.00 cents to bring the average to $1.91625/lb. Spot butter, which had fallen 38 cents in the previous three trading days, was unchanged at $2.4750/lb and Class IV futures reacted accordingly. It is tough to know if the bears will be in control of the dairy markets after the lower volume, quieter sales period around the holiday passes. Overall, fundamentals remain mixed but the main story is a waning of global demand for US dairy products in the short term.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.