The CME and Total Farm Marketing offices will be closed Monday, December 26, 2022, in observance of Christmas.

Merry Christmas from all of us at Total Farm Marketing!

MARKET SUMMARY 12-23-2022

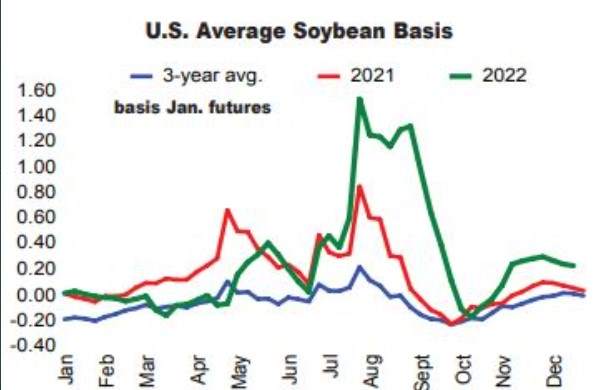

The national average soybean basis continues to remain strong as the market moves into the end of the year. Last week, the National Average Soybean basis dropped 1-1/4 cents but still is trending 24-1/4 cents above the Jan futures contract. This is still running better than the 3-year average that was 2-1/2 cents over futures in this time frame. The strong export pace for U.S. soybeans and competition from domestic crushers fighting for a tight soybean supply is the influence that is supporting the basis. Crush margins for domestic crushers are trading near the highs post-harvest. With those favorable margins, soybean crushers are willing to stay aggressive in the cash market in order to lock in supplies for their operations. In the near term, the soybean basis will likely stay supportive, helping to support the overall soybean market.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures rallied again today gaining 5-3/4 cents in Mar to end the session at 6.66-1/4. Cold weather, double-digit gains in corn and wheat, and short covering provided support. An announced sale of over 100,000 mt to Mexico was also supportive. Lastly, a lack of farmer selling is suggesting it’ll take higher prices to move corn out of farmers’ hands.

Corn futures rallied nicely this week gaining 13-1/4 cents in Mar. New crop Dec added 4-1/4 and managed to close back above 6.00 for the first time in four weeks. As we look ahead to next week, we anticipate trade could be rather slow. Nonetheless, stay informed as weather in South America becomes more and more critical. If behind on cash sales, view price rallies initially as opportunities to make catch up sales sooner than later. The big picture perspective continues to suggest snug world supplies, however with a very slow start to exports, the market will have difficulty making up for lost ground unless China comes roaring in the import market. That doesn’t seem likely with COVID cases increasing at what may be termed an exponential rate. Our best early guess is that the Argentine crop will be average at best if not below due to dry weather and late planting. Cattle on Feed number at 98% confirm feed usage will not likely be on the rise unless winter conditions require more feeding. Markets are closed on Monday, December 26.

SOYBEAN HIGHLIGHTS: Soybean futures closed higher today along with meal and bean oil following a flash sale of beans to unknown destinations, higher crude oil, and continued drought in Argentina. Jan soybeans gained 11-1/4 cents to end the session at 14.79, and Mar gained 12-1/2 cents at 14.84-1/2. For the week, Jan beans lost 1 cent.

Soybeans have been chopping around in a range between 14.60 and 14.85 in the Jan contract since the middle of December, as no real recent news is driving prices, but resistance remains firm at 14.90. Bullish aspects this week have been a drought in Argentina which will likely harm their production in a big way, as well as crude oil prices that have gained 5.18 per barrel this week in Feb giving bean oil a boost. There was also a surprise flash sale today of 4.6 mb to unknown destinations for delivery in the 22/23 marketing year. Export sales were good for soybeans too, but January may be the last month for solid U.S. bean exports, as Brazil is already beginning early harvest of their crop. Bearish points to watch out for include the strong technical resistance at 15 dollars, as well as rising Covid cases in China which may impact their demand of raw materials. Currently, Jan beans on the Dalian exchange traded higher and are at the equivalent of $19.19 per bushel. The biggest threat is Brazil’s potential record crop which may end up pegged around the 5.6 billion bushel mark. The availability of cheaper new crop Brazilian beans will have a negative effect on U.S. exports. The general trend for March beans is higher, but the upward momentum has stalled over the past two weeks and has left prices rangebound.

WHEAT HIGHLIGHTS: Wheat futures rebounded today as frigid temperatures hit the HRW crop and uncertainty surrounds exports out of the Black Sea after Zelensky’s U.S. visit. Mar Chi gained 13-3/4 cents, closing at 7.76 and Jul up 11-1/2 at 7.86-1/4. Mar KC gained 8-3/4 cents, closing at 8.74-3/4 and Jul up 9-1/4 at 8.62.

All three U.S. futures classes moved higher today with Paris milling wheat futures also seeing a nice jump. For the week, Mar KC was 30-3/4 cents higher and Chi was 22-1/2 higher. This may signal a turnaround in the trend for wheat, with higher prices to come down the road. The market seems to be finding some support after a couple months of falling. As for today’s trade, more sub-zero temperatures covered much of the U.S., with wind chills bringing those temps much lower. For the southern plains, this is especially concerning in areas without snow cover as it could harm the crops. The 6-14 day forecast does show the potential for some precipitation in that region though. The other big news item this week was the surprise U.S. visit by Ukraine’s president Zelensky. He is reportedly now back in Ukraine where much of the country is struggling with war and harsh winter conditions. Many are struggling without power, water, and more, as Russia has been relentless in its attacks. It is a sad state of affairs but in all likelihood, even if the war came to an abrupt end, it would take a long time for their lives to get back to normal. And that includes life for their farmers; their wheat crop is estimated to be one-half the size or less compared to before the war began. Furthermore, an estimated one-third of their corn crop might remain in the fields this winter.

CATTLE HIGHLIGHTS: Cattle futures were higher on Friday, as cash trade continued to develop and the market was squaring positions before this afternoon’s Cattle on Feed report. Dec cattle gained 1.000 to 156.900, and Feb cattle added 0.450 to 157.750. For the week, Dec live cattle closed 1.850 higher and Feb live cattle added 1.975. Jan feeders were 0.225 higher on the week.

There was some buying strength, positioning itself before the December Cattle on Feed report to be released after the market close. Dec cattle used a firmer cash tone to jump to a new contract high in the session. The USDA Cattle on Feed report reflected what was anticipated for the report. Total cattle on feed as on December 1 was at 97% of last year or 11.7 million head. This was slightly below estimates of 97.1%. Placements were at 98% of last year, and above expectations, but at the high end of the range. Expectations were for 95.7%. Marketing was in line with expectations at 101% of last year. The report offered no big surprises and could be deemed neutral to bearish with the placement number being slightly higher than expected. The only drawback may be the fact the market traded higher on the week and priced in the most favorable numbers. Cash trade continued to build on Friday with Southern trade at $156, up $1 over last week’s averages. Northern dress trade was $249, also $1 higher than last week. Today’s slaughter totaled 104,000 head, 15,000 less than last week, but not comparable to last year’s holiday kill. Saturday’s slaughter is estimated at 3,000 head, bringing the weekly total to 562,000 head, 63,000 below the prior week, but 75,000 greater than 2021. Retail values at midday were strongly higher. Choice carcasses gained 6.32 to 271.53 and select added 3.53 to 245.34. The load count was light at 48 loads. Feeder cattle were higher, supported by the stronger live cattle market. The Feeder Cash Index was 1.08 lower to 176.75. The index is still at a discount to the Jan board, which was likely a limiting factor. The higher placement number than expected could weigh on the feeder cattle market on Tuesday’s open. The Cattle on Feed report was generally neutral to bearish with a slightly higher placement total. The cattle market is overbought and could be due for some correction. Regardless, the trend is still higher and cattle numbers remain tight going into 2023.

LEAN HOG HIGHLIGHTS: Lean hog futures finished mixed with some profit-taking in the front month contracts as positions squared while anticipating the Quarterly Hogs and Pigs report to be released on Friday. Feb traded 0.650 higher to 89.050 and Apr hogs gained 0.750 to 96.025.

Feb hogs closed the 200-day moving average, which could be a key swing price on the charts. It was encouraging to see prices close near the highs on the day, which could lead to additional buying strength on Friday. The USDA Quarterly Hogs and Pigs came in with little surprises overall, confirming market expectations. The inventory of all hogs and pigs on December 1, 2022, was 73.1 million head. This was down 2% from December 1, 2021, and down 1% from the September report. Market hog inventory, at 67.0 million head, was down 2% from last year, and down 1% from last quarter. Breeding inventory, at 6.15 million head, was up slightly from last year, and up slightly from the previous quarter. Breeding inventory was expected to see a small decline. The Dec-Feb farrowing intentions were up 1% over last year, so the combination of the two showed some slight expansion in hog numbers into the future. This could put some pressure on prices when the market opens next week on Tuesday. In fundamentals, retail pork values were firmer, gaining 0.79 at 89.55. Product movement was light at 146 loads. Midday direct cash trade was unreported due to confidentiality, but the 5-day rolling average was firmer at 80.00. The Lean Hog Cash Index traded 0.90 lower to 79.67 and was 2.21 lower on the week. The cash index is at a large discount to the futures, which could be a limiting factor. The market will be expecting a tighter hog supply going into 2023, and the Hogs and Pigs report confirmed that. The increase in breeding stock and farrowing intentions will likely weigh on the market to start the week, but the overall uptrend in hogs is still higher.

DAIRY HIGHLIGHTS: The positives for this week lie mainly on the Class III side with cheese gaining a dime, the January contract closing 81 cents off the weekly low for a gain of 22 cents, and the February contract leaving a nice tail off its low as well. Outside of that, the deferred Class III milk contracts and the Class IV complex gave up value and struggle to find a footing. Monday’s Milk Production report was devoid of any major surprises, Tuesday’s Global Dairy Trade was negative, and yesterday’s Cold Storage report was uneventful. Arguably, the biggest risk to the dairy market at the moment is a lessening of demand for US export products.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.