MARKET SUMMARY 2-27-2023

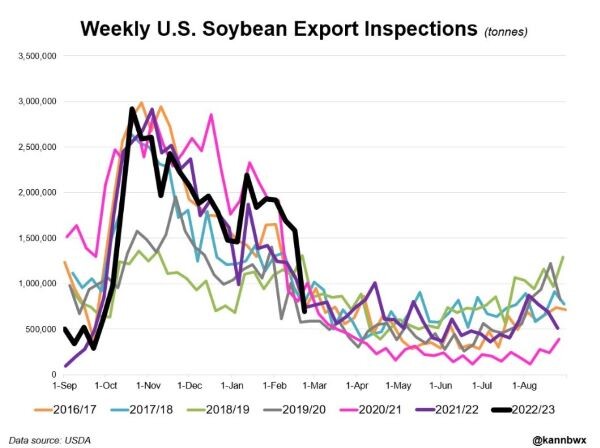

Weekly soybean export inspections dropped sharply from the previous week, possibly due to the closing of the U.S. export window. Last week, U.S. exporters shipped 691,000 MT or 26.7 million bushels of soybeans on the export market. This was down considerably from the 1.584 MMT or the nearly 61 million bushels the week before. The South American export harvest has been limited by wet weather in Brazil, but harvest pace is improving at 33% complete last week (43% 5-year Ave.) and fresh soybean supplies are moving to Brazilian ports. The energy has shifted to receiving those fresh soybean supplies against the U.S. bushels. The concern is the shipping pace now. If U.S. soybeans (which have a strong export sale base) cannot get the soybeans shipped, the possibility of export cancellations grows as the end user shifts to the cheaper Brazilian soybean.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures began the week where it ended last week, losing ground again and again following a large drop in wheat prices. More moisture in the Midwest over the weekend and fund selling were noted features in today’s markets. Export inspections were disappointing at 22.521 mb. First notice day for March futures is tomorrow. This may have also contributed to weakness.

The bigger trend is looking more susceptible to further declines with wheat leading the drop. The technical picture is looking weak with May futures getting close to challenging the early December low of 6.36-3/4. A lack of export activity despite an expected shortfall of production may have sent a signal to traders that holding longs could be risky. In addition, less than ideal relations with China is concerning as well. The Commitment of Traders report still is not available for viewing leaving the market with little fresh perspective on where larger traders are currently positioned. Is corn becoming a value. It is as compared to the first week of December. From a long-term perspective corn may be over-valued. A year ago, the market began a trend to highs that occurred in May. The war is still a concern, but many believe the corridor of exports will be extended beyond March 19, thus keeping the perception of commodities flowing from Ukraine and Russia.

SOYBEAN HIGHLIGHTS: Soybean futures closed lower today, pressured by lower bean and crude oil. In addition, first notice day is approaching for March futures and long positions are likely being liquidated adding to the downward momentum. Between bearish outlook forum numbers, options expiration on Friday, and first notice day tomorrow, it has been difficult for grains to get a break. Mar soybeans lost 10-3/4 cents to end the session at 15.18-1/4, and Nov lost 2 cents at 13.72.

Soybeans closed lower for the third consecutive day and were again pulled lower by bean oil, which lost 1.44% in the May contract as crude fell over 0.75 a barrel to 75.50. Grains have been struggling in general lately with wheat getting beaten down the hardest as funds appear to be adding to wheat short and liquidating long positions in corn and beans. The main story recently has been with South America and Argentina’s poor crop rating but that sentiment may be fading as Brazil’s record harvest nears completion with better than expected yields in some areas. Mato Grosso is reportedly 76% completed and is one such area seeing better yields. The USDA released export inspections for last week with beans posting disappointing numbers at 25.4 mb. Exports are expected to continue the decline as Brazil gears up to have the competitive advantage with their cheaper exports. Regardless, US inspections have been strong this marketing year and are up 3% from this time a year ago. Domestic demand remains supportive with crush margins historically strong. May beans remain in their upward trend but are at the bottom end of their range.

WHEAT HIGHLIGHTS: Wheat futures had another lower close as funds are thought to be adding to their short positions again. Mar Chi lost 12-1/4 cents, closing at 6.96 and Jul down 11-1/4 at 7.18. Mar KC lost 18-3/4 cents, closing at 8.23 and Jul down 16-1/2 at 8.11-1/2.

The pattern of long liquidation continued in the wheat market today. Part of it could be tied to the rains on Sunday in parts of dry Kansas. But the heavy winds and dust around the Texas panhandle may affect their HRW crop. There is also a chance for snow in the southwestern plains this week and more precipitation in the 8-14 day forecast. Likely, though, another day of selloff could be related to fund selling. The commitments of traders report released on Friday (after being absent for three weeks) showed that the funds were still net short Chicago wheat as of January 31. The report has not caught up to the current time, so fund selling is speculation, but it certainly feels like that is what’s happening. With US wheat supplies at 15 year lows, one would expect there to be more support in the marketplace, but when the funds decide to make a move they often do it in a big way. It is worth mentioning that Russian export prices are still below those of the US which may be adding to pressure in the market. There is still much uncertainty, however, out of the Black Sea region. What will Ukraine’s exports look like given the escalation of the war and the March 19 deadline of the grain deal with Russia? At this point it is anyone’s guess but it would be safe to say that things there are still far from normal.

CATTLE HIGHLIGHTS: Live cattle futures faded off early session gains as prices consolidated to start the week. Feeders saw modest gains supported by a weak grain market. Feb Live Cattle were 0.200 lower to 165.000, and Apr cattle slipped 0.400 to 164.975 Mar feeders gained 0.100 to 189.175.

The Cattle on Feed numbers last week did not bring any news surprises, as the market mostly anticipated the report numbers overall. The COF report maintained the tightening supply of cattle trend. The cattle market has moved strongly into these numbers, so some values are likely priced in, so Monday brought light profit taking and sideways trade in front of the cash market this week. The cash market will likely continue to be the driver of price this week. Cash trade was undeveloped on Monday, typical to start the week as bids and asking levels were not defined. Expectation is for a firmer cash tone to continue. The Choice cutout moved $8.36 higher last week, while the Select increased $13.23 as lighter production kept availability limited. Choice carcasses traded 0.32 lower at midday to 286.96 but Select beef added 1.97 to 279.05. The load count was light at 39 midday loads. The Feeder Cash Index was down 0.53 at 182.24. Mar feeders are holding a $6.405 premium to the cash index which could be a limiting factor. The grain market may be the biggest driver in feeder prices in the near future as grain prices are trending lower. A further price break represents the crossover impact on the feeder market. Cattle futures overall look strong, fueled by the cash market being the driver. The April contract consolidated on Monday and some downside follow-through could trigger some technical selling. Be cautious, the market is getting overbought, and may be due for some correction if the fundamentals were to cool.

LEAN HOG HIGHLIGHTS: Lean hog futures stayed under pressure as the premium of the futures to the cash market remains a concern and USDA Cold storage showed some pork product build month over month. Apr hogs lost 1.300 to 84.725, and Jun hogs fell 1.375 to 102.100.

The USDA Cold Storage report on Friday afternoon showed frozen pork supplies were up 13% from the previous month and up 19% from last year, which may have been disappointing to the market. While export demand has stayed relatively strong to start 2023, the domestic consumer may be more of a concern. Cold storage numbers are more of a look into the past number, but as hog slaughter has stayed relatively strong, the pork production may be a concern. The biggest concern still is the premium of the futures market to the cash market, and that stays a limiting factor. The direct cash hog trade was 0.02 to 77.85, and the CME Lean Hog Index slipped 0.24 to 77.49. With the lower print on Monday, this was the first time in 15 days the index was lower on the day. Despite the strength, the index is still trading at a 7.235 discount to the Apr futures. Retail pork prices saw modest gains across the board last week. At midday today, pork retail values gained 4.29 to 89.64, continuing the upward trend. The load count was light at 129 loads. Hog slaughter last week may have been slowed due to the weather. Total slaughter last week was 2.375 million head, down 5% from last week. and total production was done 5% at 514.5 million pounds. The hog market is still being held in check by the premium to the cash market. The strong export sales tone and firm shipment number bring some additional optimism to the market, but can the domestic consumer step up to support more? The cash market needs to stay firm and work on closing the gap to the futures.

DAIRY HIGHLIGHTS: Buyers in the cheese and butter markets were fairly aggressive to start the week, which set a positive tone in the milk futures market. Butter was bid 2c higher to $2.45/lb on 1 load traded, following its 5c up day this past Friday. In the cheese trade, blocks added 3c to $1.91/lb on 2 loads traded, while barrels received a 5c higher bid on no loads traded. The barrel settlement of $1.59/lb brings the block/barrel average back up to $1.75/lb. Bidding in the spot trade could be the catalyst the dairy trade needs to bounce off of recent selling pressure. Although, the fact that the corn price has fallen 37.50c over the past four sessions won’t help. For dairy this week, the market will watch the weekly product reports as well as Friday’s Dairy Products report, which will show product production totals from January. For now, the market remains in a steady downtrend.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.