MARKET SUMMARY 2-7-2023

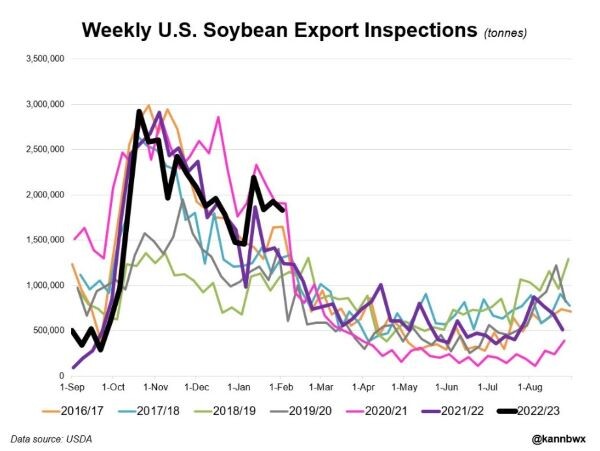

Weekly soybean inspections released on Monday pushed the top end of the expectations as January shipments have remained strong. This latest round of export inspections confirmed that shipments in January were strong, near 7.4 MMT. This was below the all-time record for January established in 2021 at 9.03 MMT and well above last year’s total of 6.4 MMT. The strong shipping pace was influenced by the poor weather in Argentina and the slow start to the harvest in Brazil, keeping the export window open longer for U.S. soybeans. Currently, soybean inspections are running 1% ahead of last year’s pace with the USDA predicting an 8% decline in yearly exports. If the shipping pace continues to run ahead of targets, the USDA will likely need to address the export goal on future USDA Supply and Demand reports.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures took back yesterday’s gains, giving up 5 cents in March and closing at 6.74. December lost 4-1/4, ending the session 5.93-1/2. Position squaring was noted in front of tomorrow’s WASDE report. General expectations are for a neutral to negative report anticipating another potential cut in projected ending stocks. Bulls are likely disappointed that a near 3.00 gain in crude oil failed to ignite buying.

There will be line-item adjustments tomorrow on the WASDE report, but no surprises are anticipated. The average pre-report estimate is for carryout to increase slightly to 1.266 bb from the January estimate of 1.242. World ending stocks, however, are expected to tighten slightly due to lower production from Argentina. The average pre-report world ES is 294.71 mmt verses the January estimate of 296.42. Expect the report to be old news relatively quick and the market to turn its attention to South American weather. 70% of the corn crop in Brazil is the second crop which is also their exportable crop. We can’t underscore how important weather could be for this crop cycle. As for U.S. farmers, we feel they have been steadily moving corn out of storage and this has kept prices in check. From a historical perspective, prices are high, and most farmers do not want to get caught holding significant inventory if prices turn lower by spring or summer. Strong bases throughout parts of the country suggest localized shortages and this underscores the firm undertone prices have experienced this fall and winter.

SOYBEAN HIGHLIGHTS: Soybean futures closed lower today, led down again by bean meal. Meal seemed to be reversing from its overbought contract highs, but bean oil performed well, gaining over 2.50% in March. Tomorrow’s WASDE report is not expected to contain many surprises. Mar soybeans lost 6 cents to end the session at 15.15-1/4, and Nov gained 3-1/4 cents at 13.70-1/2.

Beans were bear spread today with the nearby months losing, but the November contract closed higher in a break from the trend. Bean meal coming off its contract highs has been a bearish factor despite the gains in bean oil supported by the palm oil and crude oil markets. Palm oil closed 2% higher as flooding damaged production and Indonesia who is the number one exporter of palm oil’s decision to suspend export permits until April due to tight supplies. Tomorrow’s WASDE report will likely not show anything that isn’t already expected but Argentinian production will likely be adjusted lower by 3 mmt to 42.5 mmt, but that may still be too high compared to some private estimates. Brazil’s production may turn out to be larger than USDA estimates, but it is probably too early for them to make those adjustments. Beans on the Dalian exchange are continuing higher, but China is unlikely to buy from the US with Brazil’s cheaper beans incoming paired with the spy balloon incident. Strong domestic demand and tight supplies remain the bullish story in the soy complex with spot crush margins near 2.07 as of yesterday. The upward trend in the bean market has slowed down and resistance remains on the chart at 15.50.

WHEAT HIGHLIGHTS: Wheat futures closed mixed. There was not much news to move the market today, but traders may have been positioning in front of the USDA report tomorrow. KC did fare better than Chi, as the cold and dry southern Plains are a concern for HRW yields. Mar Chi lost 1/2 cent, closing at 7.49-3/4 and Jul up 1/4 at 7.67. Mar KC gained 9-3/4 cents, closing at 8.85-3/4 and Jul up 5 at 8.63-1/4.

KC wheat lead the way higher today with the March contract at an 11 cent premium to the May. Bull spreading again noted as well; these things may signify good domestic demand as well as potential supply concerns short term. Wheat futures have been in a relatively sideways trading range, but with all eyes on tomorrow’s USDA report, the results could be the catalyst to push the market in one direction or the other. Pre-report estimates peg US wheat carryout at 576 mb, up from 567 mb in January. The world ending stocks are projected at 268.56 mmt, compared to 268.39 mmt last month. Interestingly, Russian consultancy IKAR has lowered their preliminary wheat crop estimate to 84 mmt from 87 mmt due to weather. SovEcon remains at an 86 mmt forecast. In other news, Algeria reportedly purchased some wheat, but the quantity is currently unknown. Here in the United States, the southwestern plains are mostly dry, and the recent freezing temperatures may have impacted yield potential – this helped KC wheat to rally today.

CATTLE HIGHLIGHTS: Both live and feeder cattle saw some profit taking off the top of the charts on Tuesday, finishing with moderate losses. Cattle futures are overbought, and some potential correction could be in front of the market. Feb cattle, now in delivery, lost 0.250 to 160.575, and April cattle fell 0.875 to 163.600. March feeders lost 0.500 to 187.200.

After pushing to a new contract high again yesterday, the April futures failed to trade above that point on Tuesday, triggering some profit taking as the new cycle was quiet. The cattle markets have priced in the most recent news and moved to overbought condition. Prices could see some potential pullback technically despite the supportive market fundamentals. Cash trade may be the drive to change the tone this week, but trade was still undeveloped on Tuesday. Bids are still absent, but asking prices are $161-162 in the South, and the market is anticipating steady to higher trade this week. Most trade will likely develop much later in the week. Beef cutout values saw strength again at midday with Choice adding 1.11 to 267.68 and Select adding 3.50 to 257.22. The load count was light at 67 midday loads. A firming retail trend could only help strengthen the cash market and could be key this week. The feeder market saw moderate losses, tied to the weakness in the live cattle market and a choppy corn market. The feeder cash index traded 0.99 higher to 182.88 but still at a discount to the futures market, which could be a limiting factor. The trend in the cattle market is higher overall, but the price action on Tuesday brings some caution. The market is overbought and could be due for some pullback on the technical side due to loss of momentum and the strong money flow over the past couple of weeks. We still like the upside longer term, but the cattle market may be due for a pause.

LEAN HOG HIGHLIGHTS: Lean hog futures finished mostly higher, working off early session lows as a strengthening retail market and lean hog index are trying to support the market. Feb hogs gained 0.325 to 75.375, and April hogs added 0.550 to 83.275.

April futures were very active on Tuesday trading in nearly a $3.00 range from higher to lower. Prices saw early selling pressure triggered by the weakness of Monday, but eventually found some footing on short covering to finish the day with moderate gains. The April futures is still not out of the woods, given the premium to cash, but the price action was positive on Tuesday. The next couple of days may be key for the direction of the April contract. The retail market held some of yesterday’s midday gains on the close but was slightly lower on Tuesday. At midday, pork carcasses slipped 0.15 to 81.47. The load count was light at 178 loads. Retail values have been trying to find some footing but have stayed tied near the $80.00 level. The lean hog Cash Index has been trending slowly higher, gaining 0.24 to 73.29. The index has added value slowly since mid-January and could be signaling a potential turn in the cash market, but the turn has been slow. Midday direct trade supported that thought, gaining 0.41 to 72.22, but both values are still running well under the futures market, and that premium is a limiting factor to any longer-term rally. Estimated slaughter on Tuesday was 479,000 head, down 4,000 from last week but still 10,000 over last year. The larger slaughter run has been one of the leading factors limiting the cash market as packers seemed to have plenty of hogs to choose from. The hog market again is trying to find a bottom. The price action the past two days could resemble a blow-off bottom and price may be free to move higher, but it will still take the fundamentals to sustain any rally.

DAIRY HIGHLIGHTS: With the latest Global Dairy Trade Auction showing rebounding interest in US dairy products, the markets failed to react accordingly. The GDT event brought a very welcome positive trade with the index climbing 3.2% overall. With that encouraging news the only dairy products to finish higher on the day were whey and butter, finishing lower were most of Class III and Class IV contracts, spot cheese, and spot powder. The GDT event was not the only fundamental report today and may be the reason for the mixed day in dairy. The latest export data was released today and will be covered in more detail below, but shows export demand falling from November to December of ’22.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.