MARKET SUMMARY 3-11-2022

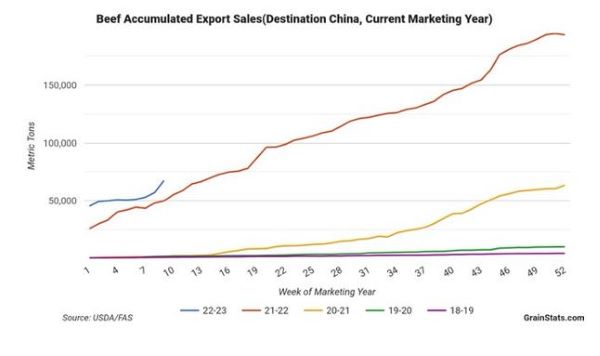

After being absent from the U.S. beef export market for years, China has developed a new need for U.S. beef. Beef exports to China have grown aggressively over the past few years. In 2019, China was the seventh largest importer of U.S. beef, and analysts forecast China to overtake Japan as the top export destination for U.S. beef products. The turn started from the impact of African Swine Fever on the Chinese hog herd, causing a needed overall protein demand. Even now as the Chinese hog herd is in recovery, concerns for food security and the growing appetite of the Chinese population for U.S. beef helps maintain the strengthening export market. The past two years have seen strong growth in exports to China, and 2022 is off to a strong start, keeping the pace intact.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures pulled off session lows to finish firmer on the day, as the market is supported by a strong demand tone. May added 6-3/4 cents to close at 7.62-1/2. December moved 3-1/2 higher to close at 6.55-1/4. With the close today, Dec corn posted another a new contract high close. Despite the choppy week, corn futures finished higher of the week with May gaining 8-1/4 and December was 25-3/4 higher.

After yesterday’s strong weekly export sales numbers, the USDA announce a flash sale of 128,900 mt of corn for “unknown destinations” for the 2021-22 marketing year. This sale adds to the growing piles of corn sales that have picked up since the start of the year. Marketing year sales through March 3 are at an accumulated 50.2 mmt, which is approximately 79% of the USDA forecast. With the ongoing military action in the Ukraine and the prospects of limited or no crop in that region of the world, export demand will likely continue. Price action in the corn markets is extremely strong, and the firm weekly closes will likely keep the buying support in the market to start the week. The next item in focus will be the acre battle between corn and soybeans in the U.S. Prices of both commodities are at historically high levels in an inflationary year. The cost of inputs is still a big variable in the markets in determining that acre mix. The corn market is looking like it is starting to act independently from other grains, and the forces of the outside markets, as price action is firm, are trying to buy additional acres for next year’s crop.

SOYBEAN HIGHLIGHTS: Soybean futures posted modest losses today. Profit taking at a historically high level likely played a role. Additionally, lower meal prices may have put some pressure on beans. May lost 10-1/4 cents, closing at 16.76. November was down 1-1/4 cents at 14.91.

Today private exporters reported 264,000 mt of soybeans for delivery to China during the 22/23 marketing year. Despite the recent purchases by China, their soybean imports were lowered on the WASDE report due to poor crush margins. Malaysian palm oil supplies came in higher than expected for the end of February, which is weighing on that market, but there are rumors that India is looking to buy US soybean oil (as it is cheaper than palm oil). Argentina’s forecast is again turning drier, which may affect the late-planted crop. Private estimates are indicating that South American soybean production could be down another 10-11 mmt from current levels. CONAB dropped Brazil’s soybean production to 122.8 mmt (which is down from the USDA’s 127 mmt). In Argentina the Buenos Aires Grain Exchange remains at 42 mmt, whereas the USDA is at 43.5 mmt. The 17-dollar mark continues to be an area of resistance, and it may take fresh news to push prices over that level.

WHEAT HIGHLIGHTS: Wheat futures stopped the bleeding today, posting modest gains. After a period of long liquidation, traders may be willing to buy back into the market. The fact is that a lot of wheat remains unshipped in the Black Sea region, setting a bullish tone in the market. May Chi gained 19-1/2 cents, closing at 11.06-1/2 and July up 32 at 10.77-1/4. May KC gained 23-1/2 cents, closing at 10.89-1/4 and July up 26-3/4 at 10.81.

Markets were lower this morning as there were some reports of peace talks between Russia and Ukraine, but that may not be the case as Russian troops continue their attack. They are currently surrounding Kyiv, the Ukrainian capital, and are still shelling civilian areas. US futures ended the session higher as did Paris milling wheat futures as traders are still nervous about what this all means. With this war came the shutdown of Black Sea ports; however, US wheat exports are still struggling despite this fact. End buyers are still purchasing wheat at these high prices because they need it. It was also reported recently that John Deere has pulled out of Russia. This raises questions and concern about the availability of spare parts during their crop season. Concern regarding the drought conditions in the US Plains remains a bullish factor with mostly dry conditions for the next 10 days.

CATTLE HIGHLIGHTS: Cattle prices saw some recovery to end the week, consolidating in today’s trading session. The market was supported by some value buying and position squaring going into the weekend. April cattle gained 1.400 to 137.300, and June cattle added 0.500 to 132.950. April feeders gained 1.725 to 157.975. For the week, April cattle were 1.525 higher and June added 0.425. April feeder were 0.725 higher.

Despite the strength today, April cattle traded within Thursday’s trading range as prices consolidate. This reflected more a mode of position squaring and profit taking before the end of the week. Short-term, charts are still on the defensive. Cash trade was most likely done for the week. Most trade was at $138, down $2.00 from last week. Northern dress trade was mostly $220, down $4 from last week. The soft cash trade was disappointing to the market. Demand concerns are still a focus of the market, but the market may be getting some hope. Retail values were firmer again at midday, (Choice: +1.14 to 255.08, Select: +2.85 to 250.22) with demand light at 67 midday loads. Retail strength could be a key going into next week and possible support in cash trade. Feeder cattle futures held gains on the day, despite a firm tone in the corn market. Like live cattle, the strength today was within Thursday’s consolidative trade. The strong tone in live markets helped support the feeder markets, as price may be a value at these levels. The Feeder Cattle Cash Index was 0.83 lower to 153.86. The selling pressure held off for a day, but the negative market tone is still in front of the market. Prices may be a value at these levels, but buying strength next week will be key.

LEAN HOG HIGHLIGHTS: Hog futures saw strong buying support as prices posted triple-digit gains, fueled by strong cash markets. Apr hogs were 12.625 higher to 102.725, and June hogs were 3.275 higher to 118.175.

The April hog contract stay range bound between the 10-day and 40-day moving averages. Price action was strong into the close, and the market could see a potential upside break next week. Summer month posted that technical break, taking out the top of the near-term trading range and down trend. Summer contracts posted a strong technical close. Cash has been supportive, but the National Direct morning direct trade was 2.63 lower to 98.63 from yesterday. Cash Lean Hog Index was 0.65 higher to 99.91, posting its highest close since August. For the week, the index added 0.21. The April futures are trading at a 2.8150 premium to the index, and that could limit gains. Pork cutout values were stronger at midday, supporting the futures market. Cutouts were 5.32 higher to 109.52, load count was moderate at 128 loads. Hog slaughter this week was estimated at 2.378 million head, up 18,000 from last week, but down 70,000 from last year as hog supplies remain overall tight. The tighter supply picture, and strength in retails values have helped support the cash markets. The price action today may be the start of another run higher, fueled by those fundamental factors.

DAIRY HIGHLIGHTS: Within the Class III market this week, the second month April contract finished 30 cents higher but 86 cents off its weekly high. The deferred months saw some good buying to end the week and the overall calendar year average added 22 cents Friday for a weekly total of 42 cents, closing at $22.90. Spot cheese put together a solid week with 4 cents of gains and a close at $2.10/lb, off a bit from its 16-month high of $2.15875/lb posted on Wednesday but still hanging above $2.00/lb for now. Spot whey closed out the week unchanged at $0.7575/lb, a mark that has now held for six trading days. Some mid-week weakness was not a huge surprise given the recent rally and the fact most contracts finished higher on Friday despite a 5.125 cent fall in cheese was a good sign.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.