MARKET SUMMARY 3-3-2023

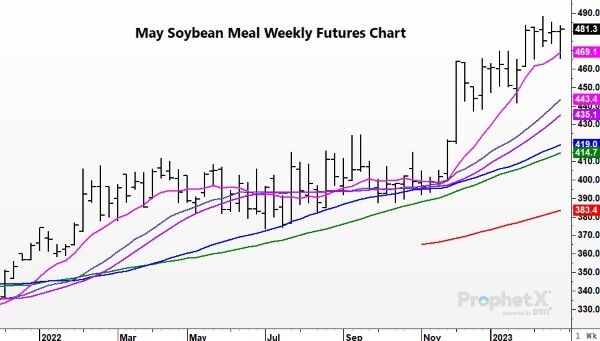

Soybean meal prices rallied aggressively off lows early in the week and pushed to a new weekly high close on the May charts. May soybean meal closed the week at $481.30/ton, posting its highest close for the May contract on the weekly chart. This was $15.50/ton off the lows for the week. The reason for the strong support in the soybean meal trade comes back to the Argentina weather forecasts. Weather conditions are staying hot and dry overall in Argentina, and these conditions may now be affecting the later planted soybeans. This week private analyst groups lowered the forecasted soybean harvest in Argentina even further into the low 30 MMT ranges. The USDA is currently at 41 MMT, reflecting a large potential drop on the radar from the USDA. This has help trigger some additional buying in the soybean meal market, despite the record production of Brazilian soybeans coming online. The strong soybean meal prices improved crush margins and helped trigger buying strength into the soybean futures market. The soybean market next week could be an interesting battle of forces as Brazil soybeans are coming more online, USDA report next week on the 8th, and the market is watching the Argentina weather forecasts.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures firmed today, ending the session with bull-spreading a feature. May gained 6-0 cents to close at 6.39-3/4, and December added 0-1/2 to end the session at 5.71. For the week, prices slid with May giving up 9-1/2 cents, which followed losses last week of 28-1/4. December lost 5-1/4 cents on the week following last week’s loss of 19-1/2. Oversold and a stochastic buy signal may have spurred end of week buying as did a continued hot and mostly dry forecast for Argentina.

The last couple of weeks are a stark reminder of how quickly prices can fall apart. Thus, in a year of high prices, if the technical picture begins to erode it may be beneficial to plan for rapid price declines. Perhaps another way to phrase this is expect volatility to remain high. For the moment the trend is down. Yet adverse weather in Argentina heightens the need for big production out of Brazil and the US. There’s little prospect for Ukraine to produce anything close to a pre-war crop. Therefore, in the weeks and months ahead, anticipate that price activity could be swift. It appears that between a higher dollar during February and lack of positive news, coupled with a confirmation of increased supply expectations from the USDA Outlook Forum, corn prices came under pressure. From a long-term perspective, one scenario is that prices continue to erode. On the other hand, volatility is beginning to pick up and with significant uncertainty both on the demand and production fronts, expect that the slow sideways price trade of the previous couple of months has come to an end.

SOYBEAN HIGHLIGHTS: Soybean futures closed higher for the third consecutive day as bean meal rallied and bean oil fell. March beans have been getting deliveries and the higher futures despite that shows strong commercial demand. May soybeans gained 9-1/2 cents to end the session at 15.18-3/4, and Nov gained 5-1/2 cents at 13.73.

Soybeans continued their trek higher for the third higher close as they move back into their pre selloff trend. March beans have gotten 966 deliveries so far and with a 10 cent price increase today combined with gains in the past two days it is clear that processors are willing to pay up. Crush margins have been one of the more supportive factors lately as exports are slipping due to the Brazilian harvest and cheaper soybeans. Thursday night’s cash bean meal price in Illinois was 9.70 higher than the March contract which is another bullish signal for soy products. Export sales for last week were poor as Brazil picks up most of the business but the fear that China would start canceling US sales isn’t such a big concern seeing as there are only 71 mb of unshipped sales. On Wednesday the USDA will release their next WASDE report but no large changes are expected. May beans ended even on the week losing only half a cent and making back all of the losses from the beginning of the week, and prices are now back up above all its moving averages.

WHEAT HIGHLIGHTS: Wheat was the only grain that closed lower today and was pressured by increased chances for rain in the southwestern Plains. In addition, funds only seemed keen to keep prices above support levels and not press things higher. May Chi lost 4 cents, closing at 7.08-3/4 and Jul down 3 at 7.16-3/4. May KC lost 9-3/4 cents, closing at 8.16-1/4 and Jul down 8-1/2 at 8.08-3/4.

There has been no fresh news to bring wheat prices higher, but futures have been unwilling to fall below 7 dollars for Chi wheat and 8 dollars for KC. The southwestern Plains is forecast to receive more rain that it needs over the next two weeks which put a bit of pressure on prices today. US wheat has not been the only one facing low prices due to Russia’s sales of low priced wheat, but May milling wheat in France closed at its lowest levels since the war in Ukraine began. Despite the smallest wheat stocks globally in over a decade, Russia continuing to offer wheat so cheaply has forced prices lower everywhere. Both Russia and Ukraine are estimated to produce less wheat this year which may start a correction that has prices reflecting world supply. The USDA has estimated that the cost of producing all wheat in the US in 2022 is at 9.05 a bushel so theoretically, prices will need to rise to meet the lower supply. May Chi wheat has so far failed its buy signal crossover from yesterday and remains oversold and below all its moving averages.

CATTLE HIGHLIGHTS: Cattle futures used outside market strength and strong cash trade to push sharply higher as live and feeder cattle markets finished with triple-digit gains. Apr cattle gained 1.325 to 165.425, and June live cattle added 1.225 to 160.675. Mar feeders gained 1.425 to 190.000. For the week April cattle finished 0.050 higher, while June slipped 0.400. In feeders, the March contract added 0.925 with today’s strength.

The live cattle and feeder cattle markets looked tired, and charts are showing some signs of weakness, but prices came to life to end the week. In outside markets, weakness in the interest rate trade helped fuel a “risk-on” mentality across the markets, and cattle benefited from the money flow. Beyond the outside markets, the development of cash was the extra fuel to push prices higher. Cash trade was slowly developing again this week, but trade was more active on Friday. Light to moderate trade took place in most areas this afternoon, with Northern dressed trade at mostly $265, $4 higher than last week’s levels. In the South, live deals are marked at $165, which traded $1 higher than last week. The strong cash stays are a driver of the futures prices. Today’s slaughter totaled 117,000 head, which was 5,000 less than last week, and 4,000 below a year ago. The estimated kill for Saturday is at 11,000 head. This would bring the weekly total to 629,000 head, 11,000 greater than the prior week, but 30,000 head under 2022. Retail values were mixed at midday with Choice gaining 1.58 to 290.08 but Select slipped 0.16 to 277.42. The load count was still light at 48 midday loads. Choice carcass values traded steady to higher on the week. The feeder cattle market also looked on the defensive in the charts, but followed live cattle higher, even with a strong grain market on Friday. The cash feeder index up 1.41 at 185.43. The index is still at a discount to the front-end futures. The cattle market looked a little tired earlier this week as charts posted some top-side reversals earlier in the week. These price levels are still intact, even with the strength today. The cash market will still be the driver. Prices may be due for some pullback, but the supply picture will limit any longer-term weakness.

LEAN HOG HIGHLIGHTS: Lean hog futures traded moderately higher on buying strength, supported by the cash trade, and firm retail values. Outside market strength helped aid the buying support to end the week. Apr hogs added 0.700 to 84.550, and Jun gained 0.050 to 100.625. For the week, April hogs lost 1.475 and June dropped 2.850.

April hogs held support on Friday and worked higher on short covering and end of week position squaring. Risk markets in general saw buying strength on Friday, and hogs participated. The hog market was technically challenge during the week with soft price action and selling pressure overall this week. The fundamentals have remained firm this week, but price action was poor. Cash trade worked higher overall this week. On Friday, direct cash hogs trade on Friday was 0.22 lower at midday to an average of 77.85. The lean hog index traded 0.07 higher to 78.65. For the week, the index gained 0.92, completing its fifth consecutive higher week. Retail values were 0.21 higher at midday to 85.94. The load count on Friday was light at 118 midday loads. Going into the afternoon close, pork carcasses hung near the 85.00 handle, and demand was supportive. The fundamentals have improved, and it feels like the hog market wants to work higher overall, but this week did bring a test of underlying support. The gap between April and June narrowed on the day but is still extremely wide. The cash market and its discount to cash is still a limiting factor.

DAIRY HIGHLIGHTS: Despite some green on the board today, most of the dairy complex was lower on the week. Nearby prices for Class III and IV found gains today with heavier losses throughout Class III from July ’23 through March ’24. The nearby gains were likely attributed to active purchasing in the spot cheese trade where prices may have found recent support. A trendline dating back to the middle of 2020 on the second month Class III contract continues to provide support on current levels. Dairy slaughter rates are well above levels from last year. To date, 406k head have been slaughtered, roughly 21.5k head above last year’s levels, these cull rates did not slow down the growth of the dairy herd which grew 9k head from December to January. Today’s Dairy Production Report showed year-over-year growth in production and inventories for most dairy products in the month of January. US butter production was up 3.8%, total cheese production up 3.2%, powder production up 2.8% with a rise in inventories, and whey production was conversely down 9.7% but inventories up 27.7%.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.