MARKET SUMMARY 3-31-2022

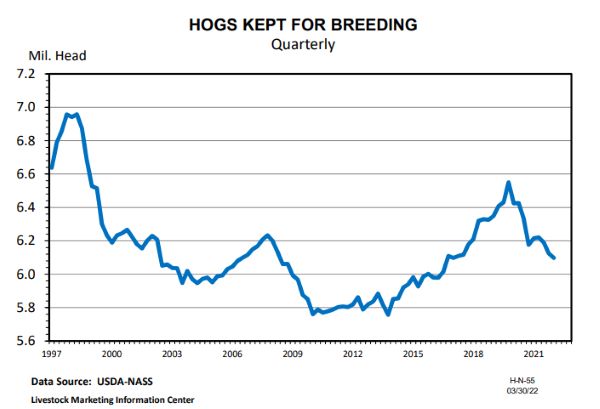

USDA Quarterly Hogs and Pigs report shows that hog herd expansion is still on the sidelines. Hogs kept for breeding were marketed at 98% of last year, down from expectations of 99.9%, as the market was looking for the breeding herd to stabilize and stop contracting. With the impact of high input costs and grain prices, hog producers are holding off plans to increase the breeding herd, even with strong prices for hogs. The total breeding herd was 6.098 million head, the lowest total since March 2017. In addition, farrowing intentions were well below expectations. Mar-May intentions were 98.5%, and Jun-Aug intentions were 99.4, both below the low end of analyst expectations. The tighter than expected breeding herd and farrowing intentions will likely keep the U.S. hog supply picture tight well into the end of the year.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures found support from friendly acreage and stocks numbers which sent futures sharply higher after the 11:00 release. Futures closed 10-3/4 to 27-3/4 cents higher with Dec leading the rally, closing at a new contract high of 6.83-3/4. Jul gained 13 to close at 7.33 and well off the high of 7.53. Export sales were a bit disappointing at 25.1 mb.

Today’s acreage estimates for 2022 came in at 89.49 million, well below the pre-report average estimate of 91.995 million and below last year’s 93.357. Quarterly stocks came in at 7.850 about 0.4% below the pre-report average estimate of 7.885. In theory, with acreage off 2.505 million and stocks down 35 million, ending stocks could be reduced by near 475 million bushels. So, why did corn futures close so far off the high for old crop? One thought is traders who were long were quick to take big gains, especially with crude oil prices dropping. Additionally, today’s export sales figure was a clunker. Jul corn, closing at 7.33, is at the same price level as it was at the beginning of the month. Nonetheless, corn prices are well supported. Attention now focuses on South America, U.S. weather, and still, most importantly, Ukraine.

SOYBEAN HIGHLIGHTS: Soybean futures were hit with a double whammy from today’s USDA reports. Acreage was increased 2.146 million above the pre-report estimate of 88.809 with today’s estimate at 90.955 million. Stocks added 2% from expectations at 1.931 bb. To be fair, we think, we need to remember export inspections are about a month behind due to Hurricane Ida. Nonetheless, today’s acreage number alone could suggest carryout in the year ahead raises close to an additional 100 million. By day’s end May sb gave up 45-3/4 cents to close at 16.18-1/4 and Nov dropped 49-3/4 to end the session at 14.20-1/2.

We can’t really say we are surprised by the acreage number, as a strong fall rally in soybeans and sky-rocketing costs of fertilizer would have farmers leaning toward soybeans. How much should we put into today’s numbers? Stocks have room to change as export activity is likely to pick up with Brazil’s crop near 20 million metric tons less than first thought. As for acreage, it might be harder to imagine a switch to corn, yet if there are many days like today (spread had corn + 27-3/4 in Dec and Nov soybeans down 49-3/4), for a ratio of 2.08, farmers might find a way to plant more corn. Adding pressure to soybean prices today were lower crude oil prices, (near 6.00/barrel) and a recovery in the dollar. A close under the 50-day moving average in Nov suggests prices may now test the low from late February of 14.03.

WHEAT HIGHLIGHTS: Wheat futures posted losses in Chi and KC, though MPLS did settle higher. Nothing stands out as particularly bearish on the report and there is little fresh news on the Ukraine war. May Chi lost 21-1/4 cents, closing at 10.06, and Jul down 21 at 10.02. May KC lost 14-3/4 cents, closing at 10.29-3/4, and Jul down 15 at 10.29-3/4.

Today’s Stocks and Acreage report was the big market mover today, with wheat futures sharply higher after the report was released. The data shows quarterly stocks were down by about 3.67% from expectations at 1.025 bb (which is down 22% from last year). All wheat acres were down by 0.4 million from expectations at 47.4 million (but were up 1% from last year). The story was different by the close though, with Chi and KC prices in the red. There wasn’t anything on the report that was very bearish for wheat, and MPLS futures did manage to hold onto gains; the May contract closed 21-1/2 cents higher at 10.79-1/2. Paris milling futures were also up between 5.25 & 7.00 euros per metric ton. There are still, obviously, concerns about the war and what it will look like for Ukraine to harvest winter wheat. Analyst group APK-Inform is currently projecting Ukrainian wheat production to be down 54% at 14.86 mmt. There will apparently be more peace talks tomorrow but only time will tell if any progress is made. In other news, world wheat importers including Taiwan, Tunisia, Algeria, and Jordan are all tendering for wheat after the recent fall in prices. Perhaps, in part, adding to the pressure in the wheat market today were poor export sales – the USDA reported an increase of only 3.5 mb for 21/22 and an increase of 3.0 mb for 22/23. From a weather perspective, the forecast for the HRW wheat areas is mostly dry for the next two weeks, which should provide support to the market.

CATTLE HIGHLIGHTS: Cattle futures saw selling pressure as livestock markets were pressured in general by a strong move in corn prices after the USDA Planting Intentions report. Cattle futures posted moderate to strong losses during the session on Thursday. Apr live cattle lost 0800 to 139.375, and Jun cattle dropped 0.875 to 137.125. In feeders, Apri feeders were 2.275 lower to 161.400.

April live cattle prices finished with weak price action, closing near the low end of the trading range on Thursday. Prices did hold support above the 20-day moving average, but the disappointing close could bring some selling pressure into the end of the week. The market may see some choppiness on Friday, as Apri options will be set to expire. The cash market added more business on Thursday. Some bid prices did rise, supported by the firm retail market, and light northern dress trade was complete at $222-225, near the top end of the range. Trade will likely be wrapped up for the week but may see some clean-up trade on Friday. Midday beef retail values were higher with Choice carcasses gaining 2.02 to 269.06 and Select 4.61 higher to 262.07. The load count was light at 52 midday loads. Weekly export sales have stayed supportive. Thursday morning, the USDA released weekly exports sales for beef, and they stayed supportive. New net sales of 23,000 MT for 2022 were down 17% from the previous week and 7% from the prior 4-week average. China was the top buyer at 7,200MT. Weekly exports of beef were 20,400 MT. Feeder cattle saw strong selling pressure with the move higher in corn prices, with multiple contacts posting triple-digit losses. Mar feeders expired on Thursday and closed at 155.900. The index gained 0.35 to 155.76, and the premium of futures to the index is a limiting factor. The future direction of grain trade will likely have some impact on the cattle markets going into next week. Cattle prices are still range-bound, but live cattle are still building an uptrend in the near term, on the prospects of lower production moving into the second quarter.

LEAN HOG HIGHLIGHTS: Hog futures posted a strong open after the Quarterly Hogs and Pigs report, but selling pressure and technical selling pushed markets lower by posting strong losses. Apr hogs lost 2.775 to 101.750, and Jun dropped 3.600 to 120.625.

Most of the futures markets posted technical reversals on the daily charts with the negative price action today. Jun hogs closed at the bottom of the trading range. This could set up the market for further long liquidation and a challenge of support levels below. The first target will be the 20-day moving average at the $119 level. In fundamentals, the cash market has been trending softer in the near term, adding to the selling pressure. National Direct Trade at midday was unreported due to confidentiality, but the 5-day average softened to 104.98. The Lean Hog Cash Index was higher, gaining 0.10 to 103.66. The Apr contract is now trading at a discount to the index of 1.91, which could be supportive and help stabilize the front-month contract. Pork retail values were firmer at midday gaining 2.40 to 106.12 on a load count of 174 midday loads. The USDA released weekly export sales on Thursday morning, and new net sales totaled 27,600 MT for 2022 were up 19% from the previous week, but down 14% from the prior 4-week average. Export shipments totaled 30,600 MT, up 5% from the previous week. The top buyers of U.S. pork last week were Mexico, Japan, and South Korea. Buyers jumped into the hog market at the start of Thursday, but the sellers ended the day. This could be tied to profit-taking from the end of the month and quarter trade on the last day of March. More selling pressure will likely start the day on Friday on technical weakness.

DAIRY HIGHLIGHTS: The May Class III contract has tacked on 97 cents of gains in the last two trading days, a nice recovery from falling $1.77 in the preceding three. That contract finished the month of March $1.89 higher at $24.47. With March milk settling earlier this week, May futures take over as the second month and will have to prove itself on a retest of $24.70, a mark that the April contract failed at three times. Spot cheese broke a three-day losing streak as well, with a jump of 5.6250 cents today to close at $2.22625/lb. Blocks lead the way higher with a 7 cent jump to move back to a slight premium over barrels. After Wednesday and today’s trade, the calendar year average sits 64 cents off its high of $23.67 from early last week.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.