MARKET SUMMARY 4-19-2022

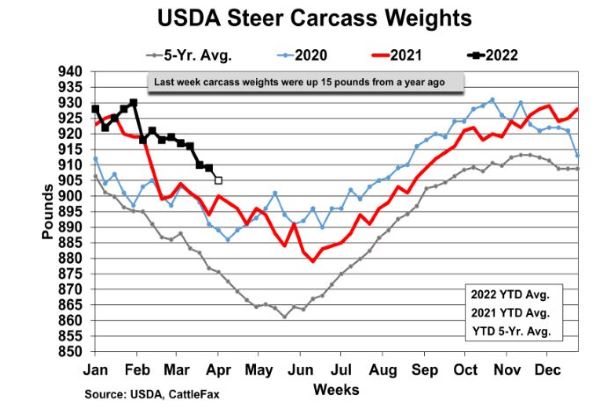

Live cattle futures have struggled to maintain any short-term rallies, as a heavier slaughter tone has kept pressure on cash markets. Cattle slaughter has been running ahead of last year’s pace, and carcass weights have been heavier, which has limited the cash market. Last week, beef carcass weights (though trending lower) were 15 pounds above last year and well above the 5-year average. There may be some indicators that are changing, which could help cattle prices. The Choice-Select spread has started to widen, showing packer demand for higher quality beef. As carcass weights work lower, the amount of Choice-graded animals tightens, and packers are more aggressive in the cash market to secure the higher quality beef. Last week, the cash market finally worked higher, and this could be the start of a trend going into the summer months.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures ended the session with bear-spreading a noted feature after reaching new contract high prices on the over-night session. May futures lost 9-1/4 cents to close at 8.04, July lost 7-1/4 cents to close at 7.99-3/4, and December gave up 2-3/4 to end the session at 7.47. December of 2023 added 5-1/2 to end today at 6.74-1/2.

Over-bought conditions and a technical sell signal in stochastics may have pressured prices in conjunction with crude oil trading 5.00 to 6.00 lower. May futures peaked at 8.19-3/4, July at 8.14, and December at 7.55. As far as big picture targets, it could be argued that 8.00 old crop and 7.50 new crop have been achieved. The way the market traded today, it looks like short covering may have been met with either traders who were long stepping aside or those who wanted to sell an overnight rally to start a position. Whatever the case, corn futures may be signaling the recent push higher could be coming to an end. If behind on sales, use today’s signals to get more current. No room for error with the upcoming crops suggests volatility will remain high. It does, however, seem likely that at current price levels, it’ll take something more than we currently know to drive futures higher. The most recent 6-to10-day forecast remains with a mostly wet and cool forecast – probably not an ideal forecast.

SOYBEAN HIGHLIGHTS: Soybean futures ended quietly without much change yet well off the daily highs. If this was turn-around-Tuesday, today’s losses were muted. An announced sales of 125,650 mt for the current marketing year for unknown destinations was supportive. May soybeans gained 1-3/4 cents to end the session at 17.16-1/2 and November closed 0-1/2 cents softer to close at 15.20-1/4.

Soybean futures gave up overnight gains when crude oil prices went defensive. Crude lost between 4.00 to 5.00. Soybean oil will likely continue to be a sought-after commodity with the market continuing to worry itself with tight world vegetable oil supplies. With futures holding above 17.00 for old crop and above 15.00 new crop, prices look well supported having factored in war issues in Ukraine. The March 31st acreage report indicated about 2 million more acres in the U.S. There could be some acres switch, but we doubt it. Strive to be balanced in your approach.

WHEAT HIGHLIGHTS: Wheat futures traded lower today despite a reduction in the crop rating yesterday and gains early in the session. Nothing fundamentally has changed, meaning that this is most likely just a setback in a market with an underlying bullish tone. May Chi lost 21-1/2 cents, closing at 10.99 and July down 19-3/4 at 11.09. May KC lost 13-1/2 cents, closing at 11.71-1/2 and July down 12-3/4 at 11.76-1/4.

The phrase “turnaround Tuesday” held true today, with the grains trending lower. Bear spreading was again noted in both Chi and KC wheat and contracts starting in July of 2023 closed in positive territory. This likely signals the concern on the minds of traders about supply down the road. Not much has changed in terms of news or fundamentals, but some might consider wheat to be overvalued, and fund managers may be reducing some of their net positions to diminish risk. Paris milling wheat futures were also lower today, which may indicate that long liquidation was not exclusive to US contracts. Yesterday’s winter wheat crop ratings did show a decline of 2% in the good to excellent category, now at 30%. Texas looks especially bad, with 81% of the crop rated poor to very poor and warm and dry conditions expected to continue there. On the other end of the spectrum, northern Plains areas including North Dakota and Canada have received heavy snow which may delay the planting of spring wheat. Yesterday afternoon’s crop progress report showed 8% of spring wheat planted vs 6% last week. But when looking specifically at North Dakota, only 3% is planted, compared to 12% at this time last year. The Ukraine war has been an underlying bullish factor for a while now but is not predicted to go away any time soon with some media outlets reporting that Russia is starting a new offensive in eastern Ukraine.

CATTLE HIGHLIGHTS: Cattle futures finished mixed to mostly higher as grain prices were lower, and the prospects of a higher cash market supported prices. Apr live cattle gained 0.875 to 141.350, and June added 0.775 to 136.575. For feeders, May rallied 1.625 to 160.775.

The most actively traded June contract worked higher on Tuesday, but prices stayed within yesterday’s training range, consolidating. The technical picture is still concerning given the reversals established on the chart Monday. With Cattle on Feed reports to be released at the end of the week, June cattle are likely range bound with 137.500 as top resistance and 135-400 supporting the bottom. Cash trade may still be the key for price movement this week. Trade saw some very light action on Tuesday, with southern deals at $140, up $1 over last week. Asking prices are still targeting $142, which if firmer than last week. Cash trade is still likely a be developing with a stronger tone on Wednesday. Beef cutouts were firmer at midday (Choice 271.12 +.04; Select 260.25 +0.79), with light box movement of 53 loads. The market is anticipating a firmer Choice beef tone as cattle weight are working seasonally lower, and packers will be searching for Choice beef to fill orders. The feeder market saw some price recovery with the softer grain market, but, like Live cattle, consolidated within Monday’s range. Apr feeders are likely tied to the index, which lost 0.11 to 154.51 but is running at a discount to front-month futures and could be a limiting factor. Cattle on Feed report is Friday this week, and the market is expecting to see feeder placement decline year-over-year, which could support Feeder prices. Though the market saw some buying overall on Tuesday, the price action was consolidative in nature, and the near-term trends is still softer, unless the cash market can help build some optimism.

LEAN HOG HIGHLIGHTS: Bear spreading returned to the hog futures market, as the premium of futures to the cash market weighed on front month contracts and posted triple-digit losses. May hogs lost 1.825 to 114.700, and the more actively traded June contract slipped 1.075 to 121.325.

Hog futures reversed off upward early session momentum, as price action was soft overall into the close. The weaker technical signal could leave the market open to additional selling pressure on Wednesday, but if the cash market were to find some stability, prices may look to challenge the most recent high. The cash market has been a concern, but midday values saw some strength on Tuesday. National Direct midday values were 5.64 higher compared to Monday, and the weighted average price was 99.69 and the 5-day average firmed to 97.26. The Lean Hog Index was firmer for the second consecutive day, gaining 0.35 to 100.33. The deferred futures premium over the index is concerning and could be a limiting factor, as May is holding a 14.370 premium to the index. Pork carcasses showed higher midday trade. Pork carcasses were 2.07 higher to 111.56, rebounding after Monday’s disappointing close. The load count light at 142 loads. Daily hog slaughter is estimated at 479,000 head, 13,000 head higher than last week. The hog market numbers are still expected to tighten, and the rate of slaughter may be our first indicator of supplies tightening. The hog market might be trying to find some equilibrium and balance in price values. Supported by strong demand, front-end hog prices are lofty compared to the current cash. Deferred futures may not be reflecting the true picture of the hog market supply and may be undervalued.

DAIRY HIGHLIGHTS: The Global Dairy Trade Auction fell 3.60% this morning which set the tone for a weaker spot trade where all four products were lower. Spot whey was down just a half-cent but the block/barrel average dropped 2.8750 cents on the Class III trade, following a 3.90% drop for GDT cheddar which fell from $2.93/lb to $2.80/lb. This is compared to the $2.3775/lb spot cheese finish. GDT butter fell from $3.12/lb to $3.01/lb, a 3.70% drop, compared to today’s close at $2.7175/lb for spot butter. While a few negative closes for GDT do not signal a major shift in the global fundamental setup, it could be a sign that production is starting to catch up to demand and US prices could begin to look overpriced.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.