MARKET SUMMARY 5-12-2022

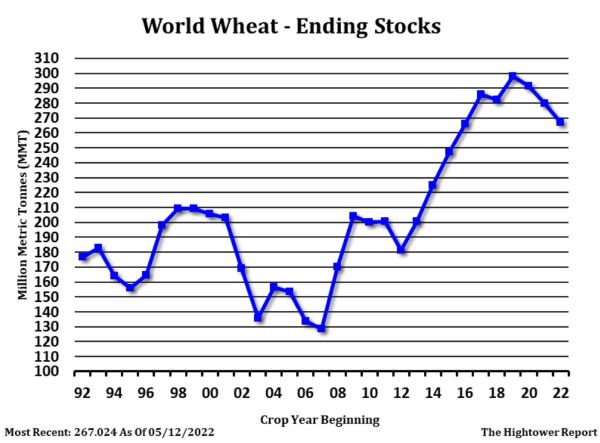

The USDA tabbed world wheat supplies to drop to a six-year low in 2022-23. On Thursday’s USDA WASSDE report, close attention was paid to global numbers as the USDA and the World Agriculture Board had to make projections for global supplies in the face of the Russian invasion of the Ukraine. With production and exports limited from this part of the world, USDA lowered 2022-23 world wheat stockpiles to an estimated 267.02 MMT, or a 12.7 MMT drop from last year, and off over 30.0 MMT from the supply peak from three years ago. Dramatic cuts in production in the Ukraine (the wheat crop is estimated to lose 35% from last year and exports are set to fall 47%) was the obvious leader in the supply reduction, but the USDA also lowered expected U.S. winter wheat production forecast due to dry conditions in the southern Plains. Expected U.S. hard red winter wheat production is forecast to drop 159 million bushels to 590 million bushels. The wheat market in the U.S. will be relying on a spring wheat crop, which currently seeing planting delay concerns. Regardless, global wheat numbers are more friendly as prices touched limit higher during trade on Thursday.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures rallied again today with front month December leading the rally, gaining 17-1/4 cents on a favorable USDA report. Yield was pegged at 177 bu an acre as compared to the base-line projection of 181 from earlier in winter. July added cents to close at 7.91-1/2. Additionally, heavy rains in parts of the northwestern regions of the Midwest suggest that a prevent plant date of May 25, (in mostly ND and NW Minn.) may loom large as an alternative for farmers who are looking at saturated soils and a forecast that doesn’t seem to offer much relief. Export sales at 7.6 mb old crop and 1.8 mb new crop were not supportive; however, an announced sale of 612,000 mt to China was in addition to sharp gains in the wheat pit.

Projected carry out for the upcoming crop year is now 1.360 billion bushels. This is less than the current estimate of 1.440 billion for the 2021/2022 crop year. The recent pullback in corn prices looked as though the market could be tipping over, which is typical for this time of year as planting progress continues. However, saturated soils in the southern half of the Midwest have taken longer than expected to dry out. Soils in the North and Northwest received continuous rain the last 24 hours. The bottom line, it is not an ideal start, and the USDA recognized this by lowering projected yield. With the world tight on inventory and Ukraine a mess, every bushel does count. Weather concerns coupled with today’s drop in the yield forecast were viewed as supportive. Expect December corn to reach into new contract highs.

SOYBEAN HIGHLIGHTS: Soybean futures traded higher today with July gaining 7 cents, closing at 16.13-3/4, and Nov gaining 8-1/4 at 14.80-1/2. The WASDE report was a mixed bag with US 21/22 ending stocks and 22/23 production about on par with analyst projections, but the 21/22 world carryout number lower than anticipated. Outside markets were bearish again, but grains held their own.

The WASDE report showed US 22/23 soybean production at 4.64 bb up from 4.435 bb last year, which was in line with analyst expectations. This reflects the record 91.0-million-acre planting estimate and an average yield of 51.4 bushels per acre. US ending stocks for 21/22 were reported at 235 mb, down from 260 mb a month ago, also in line with expectations. World ending stocks for 21/22 were lowered to 85.2 mmt which is below the range of pre-report expectations, and down from 89.6 mmt last month. World ending stocks for 22/23 were pegged at 99.6 mmt, in line with expectations. Today’s weekly export sales for soybeans were a marketing-year low at 5.3 mb for 21/22 down 80% from last week and 74% from the prior 4-week average. Improved corn planting conditions in the US this week will set up a better pace for bean planting as weather forecasts turn favorable. On the July chart, there is some resistance at the 10-day moving average, but support at the 100-day with continued closes above.

WHEAT HIGHLIGHTS: Wheat futures rocketed higher after a friendly USDA report. July Chi gained 65-3/4 cents, closing at 11.78-3/4 and Dec up 64 at 11.86-1/2. July KC gained 69-1/2 cents, closing at 12.70 and Dec up 68 at 12.73-1/2.

Wheat export sales data was disappointing with an increase of 0.5 mb for 21/22 and 4.6 mb for 22/23. But this was easily overshadowed by the WASDE report, which confirmed that supplies are tight and that is unlikely to change any time soon. US 22/23 all wheat production came out at 1,729 mb vs an average guess of 1,789 mb. US 21/22 carryout was pegged at 655 mb compared to 678 mb in April and an average estimate of 681 mb. US 22/23 ending stocks are estimated at 619 mb vs an average pre-report guess of 655 mb. World 21/22 carryout came in at 279.7 mmt vs 278.4 mmt in April – the trade was looking for 278.3 mmt. The world 22/23 endings stocks number was pegged at 267.0 mmt whereas the trade was looking for 271.6 mmt. In addition to all of this the USDA is projecting wheat yield at 46.6 bushels per acre vs 49.1 bpa at the outlook forum. While the WASDE report was the main driving factor in the wheat market today, it should not detract from the underlying bullish tone set by weather, the Ukraine war, heat and dryness in Europe, etc. With all that said, wheat is at historically high levels, and it should be noted that the US Dollar Index is making new highs. This could limit or reduce upside potential for wheat as they tend to share an inverse relationship.

CATTLE HIGHLIGHTS: Cattle futures had a difficult day with the strong move in grain markets triggering triple-digit selling in the live cattle market, as prices broke to new lows on strong technical selling. June live cattle lost 1.925 to 131.650, and August Live cattle dropped 1.875 to 132.775. In feeders, August feeder were 3.475 lower to 166.525.

June live cattle still held above the most recent lows, holding support at $131.000, but deferred contracts broke to new contract lows as long liquidation and technical selling pushed the market. The selling pressure was still in the face of some positive demand news to start the day. The USDA weekly export sales report posted new sales of 28,400 MT for 2022, a marketing-year high, were up 95% from the previous week and from the prior 4-week average. South Korea, Japan, and Mexico were the top buyers of U.S. beef last week. Cash market was quiet on Thursday, and it looks like business was likely done for the week. Cash prices traded mostly steady with last week. In the South, light $140, and the North saw $144 and $227-230 dressed trade, again, mostly steady with last week. The cash market tried to support the front-end of the futures market, given the premium of the cash market. Retail beef demand has seen Choice beef cutout values fall to nearly an 8-month low. At midday, price firmed, gaining 1.14 to 256.22 and Select was 1.54 higher to 243.72. Load count still shows good movement at 71 midday loads. Feeders broke to new near-term lows, as downward momentum continues. The direction of grain prices will likely dictate the money flow into the feeder market, and the strong price action in the wheat and corn market triggered the selling on Thursday. The premium of front month contracts to the feeder cash index looks concerning, with August trading at a $10 premium to the index. Feeder cash index was .37 higher to 156.61. The cattle market looks concerning, as the downside looks to be the easiest path in the near-term. Additional losses may be determined as a value, especially in deferred positions given the overall supply numbers and trend seen in cattle supplies, but the money flow and the sellers are still in charge of market direction in the short-term.

LEAN HOG HIGHLIGHTS: Hog futures closed sharply lower, as technical selling broke hog prices to new near-term lows as grain price surged after the USDA Supply and Demand report was released on Thursday morning. May hogs lost 0.825, closing at 100.100. June fell 3.375 to 97.475, breaking the $100.00.

June lean hogs are still showing a downward trend, and on Thursday, price closed under the $100.00 level for the first time since January 13 earlier this year. This price move has mostly eliminated the entire 2022 price rally. Prices may still have more downside room as prices while prices are trading under the 200-day moving average at $102.000 above the market, the first top-side resistance barrier. Demand is still a big concern as retail prices have struggled. Retail values have trended lower throughout the spring as grilling demand and export demand has been lacking. Midday carcass values were 1.23 higher to 100.72, as prices try and hold the $100.00 level. Movement was moderate at 152 loads. The CME pork cutout index has also been trending lower, down 0.80 to 102.97 on Thursday. USDA announced weekly export sales with new net sales of 26,300 MT for 2022 were up 10% from the previous week and 14% from the prior 4-week average. Top buyers of U.S. pork on the week were by Mexico, China, and South Korea. Export shipments were strong at 33,100 MT, a marketing-year high. Midday cash market was weak with morning direct trade, dropping 7.41 to 104.95 and a 5-day average at 104.54. CME lean hog index was 0.17 higher at 101.26 on the day. The technical picture is still weak, and buyers are still absent in the market. The trend still looks lower in the near-term and the hog market is oversold, but the triggers to bring money flow back into the hog market are still lacking.

DAIRY HIGHLIGHTS: Class III milk futures were mostly green today as the second month chart popped back above the $24.00 mark. The calendar year average jumped 12 cents to close at $22.94 after finding some buying around the $22.60 mark for the second week in a row. Spot cheese was unchanged as it hangs in the mid-$2.30’s while spot whey fell 1.25 cents to $0.5550/lb. For Class IV, prices were mostly higher as well as the 2022 average closed up 14 cents at $23.86 with spot butter making a 7-cent leap with a $2.7050/lb close. That is the highest spot butter close since April 20.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.