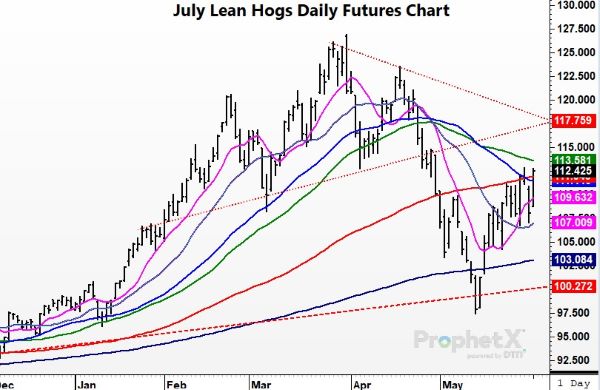

Hog markets rallied with strong triple digit gains on Wednesday, as prices are looking to push out through the upside. Led by the July futures, which touched limit up during the trading session, the July contract posted its highest close in over a month. The strong buying strength came after a difficult day on Tuesday, which hog markets saw selling pressure as positions squared going into the end of the month. The hog market has seen a friendly turn higher in the cash market and a firmer retail market in recent weeks, helping build support under the hog market since posting a low on May 12. Since that low, the July futures has added over $15.00 of value at Wednesday’s close. July futures closed back overtop the 100-day moving average for the first time since late April and the improved technical picture could help bring additional money flow. The hog market is keeping a close eye on daily slaughter totals. Last week, weekly hog slaughter numbers dropped 2.6% under last week and 1.1% below last year. The expectation of the market is for hog numbers to make a steady decline going into later summer. The tighter supply should help support retail and cash prices, as the hog futures look to recover even further off the May lows.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures plummeted for the second day in a row as funds were likely continuing to pare down positions. Heavy technical selling in addition to likely margin call liquidation helped to pressure prices today, as did another round of relentless selling in the wheat pit. July lost 22-1/4 cents to close at 7.31-1/4, and December ended the session at 6.91-1/2, down 20.

USDA reported 86% of the crop planted in their weekly update on Tuesday afternoon, up from 72% a week ago and in line with the 5-yr average. 61% of the crop has emerged vs 39% a week ago and the 68% 5-yr average. On Tuesday, managed funds were net sellers of 23,000 corn and were estimated to be long 248,000 contracts coming into today. Just like yesterday, prices traded quietly but near the 9:00 hour started to accelerate downward with July trading more than 30 cents lower. It would not surprise us if managed money dropped another 25,000 contracts today. July closed at a 50% retracement of the low from 6.43-1/2 (the low on February 25) to the high of 8.24-1/2 (April 29). December’s decisive close below the 50-day moving average (7.20) and 7.00 looks negative suggesting the market has reached a near term high. It is too early in the season to argue a high is in with the entire growing season ahead. Bears will argue the outlook has rain in it for the entire and rain makes grain. Continued talk that Russia could allow for ag commodities to move out of Ukraine has been viewed as negative for price. One, we are not sure that will occur and two, it doesn’t change the picture with the 2022 Ukraine crop down (planting season is about over) from previous years.

SOYBEAN HIGHLIGHTS: Soybean futures closed higher despite the sharp sell-off in corn and wheat, showing the fundamental strength and strong demand for beans. Higher crude gave a boost to soybean oil, while meal fell lower at the end of the day. Jul soybeans gained 7 cents, closing at 16.90-1/4, and Nov gained 5-3/4 cents at 15.15-3/4.

Soybeans performed impressively today with a higher close, even though corn and wheat got hammered lower thanks to funds offloading some of their long positions. The trend for the most part has been that the strong demand for beans has held them higher even with bearish outside news bringing the rest of the grains lower. July is priced 65 cents above August, a bullish indication of commercial demand for the tight supplies of old-crop beans. The USDA reported yesterday that 66% of soybeans have been planted compared to 83% last year, with 39% of the crop having emerged. Minnesota is only 55% planted and North Dakota 23% planted. These two states should see better planting weather in the next five days and make rapid progress toward the five-year average. July crude worked higher today as worries arise over the possibility of declining oil contributions from Russia as Europe cuts it’s purchases. This comes at a time when demand for soybean oil is already high with Brazil and Argentina’s bean crop hit by drought. In China, COVID restrictions are easing but July beans on the Dalian exchange closed 1.1% lower at the equivalent of $22.24 a bushel, falling in sympathy with yesterday’s US markets.

WHEAT HIGHLIGHTS: Wheat futures suffered another round of long liquidation today. There was not much fresh news, but it appears that funds may be liquidating positions. July Chi lost 46-1/4 cents, closing at 10.41-1/4 and Dec down 43-1/4 at 10.63-3/4. July KC lost 37-1/4 cents closing at 11.28-1/4 and Dec down 36 at 11.45.

While at this point in time it does not seem likely that Russia will actually allow grain shipments out of Ukraine, some out there seem to be taking this news quite seriously. Though the market did not see the same near limit down moves as yesterday, all three US classes did close sharply lower. Fundamentally though not a lot has changed, with winter wheat crop ratings coming in yesterday at 29% good to excellent, which is up only 1% from last week. This remains the lowest rating since 1989. Spring wheat was reported to be 73% planted vs an average of 92%. And although they have both passed the halfway mark, Minnesota and North Dakota are still running well behind the average planting pace with 53% and 59% done respectively. Globally, western Europe is perhaps too dry while eastern European crops are ok. All in all, this year has seen several compounding issues affect the wheat market including weather issues, war, export restrictions, and generally tight supplies. Despite the large number of supportive factors, wheat has been trending lower and the past couple sessions gives the impression of managed funds exiting their contracts.

CATTLE HIGHLIGHTS: Both live and feeder cattle closed higher today with feeders leading the way as corn closed 22 cents lower. June cattle finished 2.275 higher to 132.800, and Aug live cattle were 2.525 higher to 132.900. In feeders, Aug feeders gained a whopping 4.600 to 169.725.

Today’s move higher can be attributed to lower corn, an increase in boxed beef, and falling weights. Choice cuts were up 2.12 and select were 2.15 higher this morning. With weights falling, the packer will need to be aggressive in buying numbers, especially following this holiday weekend with the need to replenish. The gains made today in July live cattle wiped out yesterday’s losses and then some, but the real show stealer was feeder cattle; August charged higher for a nice close above the 21-day moving average. It may be too soon to tell, but cattle could finally be seeing their seasonal lows, especially if grains keep getting hammered by fund selling. Last week’s negotiated cash cattle trade totaled only 79k head and was a dollar lower, falling under 140 for the first time since early April. This week’s slaughter is holiday reduced but is estimated at 560k head. Cash trade was reported today at 135, 2 dollars lower than last week’s weighted averages.

LEAN HOG HIGHLIGHTS: Hog futures reversed direction on Wednesday, supported by technical buying and a firm retail market as July hogs led the market higher. June hogs finished 1.825 higher to 109.800, and July hogs 4.425 to 112.425.

The most actively traded July hog contract touched limit higher during the day on Wednesday, as buyers pushed July to its highest close in over a month. With the strong close, the July futures closed back above the 100-day moving average, opening the door for additional upside room. The 50-day will be the next level of support at 113.500, but a break there could open to challenge trend line resistance near $118.000. To reach that, the market will need to see some fundamental support. The cash market has been supported under the hog futures. Midday direct trade was 3.80 higher with the weighted average price at 112.89 on Wednesday, and the 5-day average moved lower to 111.09. The CME Lean Hog Index is reflecting the higher cash tone overall and gained 0.22 to 105.15. The June contract is limited by its premium to the cash market, trading at $4.650 premium on Wednesday. Demand runs into a slower period after the Memorial Day holiday, but pork carcasses have been firmer to start the week. Retail values were firm on the Tuesday close, and at midday on Wednesday, carcass values 1.66 higher to 109.37. Movement was good at 148 loads, after a strong 342 load movement on Tuesday. The CME Pork Cutout Index gained 0.23 to 107.47. After starting the week with a negative tone, buyers returned on Wednesday and boosted hog prices to their highest close in a month. Retail and cash market fundamentals support, and that has helped bring money flow.

DAIRY HIGHLIGHTS: Wednesday saw Class III milk close out the afternoon with small gains once more, and the roll tomorrow will bring July into play as the second month contract, which finished at a respectable $24.69. Spot cheese saw a small bump today with a close at $2.2750/lb, but whey led the charge higher with its largest daily gain in more than a month, jumping 2.75 cents to $0.55/lb. Class IV trade was also green and tomorrow’s roll will bring the second month chart to another all-time high. Spot butter gained another penny today with a $2.89/lb close, 4.50 cents beneath the 2022 high from January, while powder garnered a quarter-cent to the topside.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.