Market Summary 6-7-2021

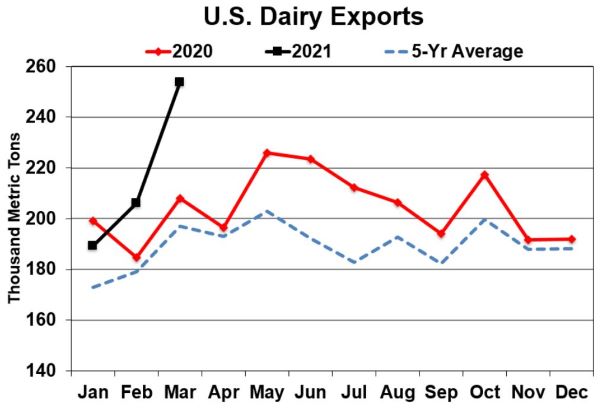

The dairy product export demand has started 2021 strongly. According to the U.S. Dairy Export council, March dairy product exports totaled 253,650 MT. This total is estimated to have covered 18.6% of production and is the second highest month all-time. The strength in exports has not been reflected in milk prices overall, as prices have tumbled in the month of April into May. Milk production, cow number and efficiency have been on the rise, weighing on the cash markets. Dairy export optimism does remain high into the future, as China is looking to be more active in the global dairy markets. The taste for dairy products is on the rise in the country, and expectations are for them to stay active in the global dairy markets. This trend is being closely watched by the dairy markets to see if this possible strength of demand can stay active.

CORN HIGHLIGHTS: Corn futures gapped higher on the overnight, firming on continued concerns of crop stress due to weather issues as a hot and dry pattern engulfs much of the northern and western regions of the Midwest. Weekend temperatures were consistently in the 90 degrees plus range with wind speeds 10 to 30 miles per hour. July corn futures lost 3-1/2 cents closing at 6.79-1/4 while December new crop closed 11-1/4 higher at 6.02-3/4. The good news it is early June. The bad news is it is early June. Small plants, while they can survive for some time, struggle with high wind and heat and may not have the root system or canopy to survive. Yet, if more rain is had soon, concerns may go by the wayside quickly. Export inspections at 55.6 mb were termed supportive which now brings the year-to-date total to 2.063 bb or 74.3% of the current USDA total sales estimate of 2.775 bb. Dry weather continues to be a concern in South America and expectations are that Thursday’s USDA supply and demand report will show a downgrade.

SOYBEAN HIGHLIGHTS:Soybean futures jumped higher on the overnight, but as has been somewhat typical on Sunday night trade, prices are much higher only to lose ground later in the session. July closed 23-1/2 lower at 15.60-1/4 after reaching a high of 16.23-1/2. November gained 4-1/2 ending the session at 14.40, well off the daily high of 14.80. Export inspections at 8.7 mb were termed neutral to supportive bringing the year-to-date total to 2.083 bb or 91.4% of the USDA forecasted total sales of 2.280 bb. New contract highs for soybean oil were again established with most contracts, like the bean futures, finishing well off the daily high. August finished with a new contract high close of 68.17. Soybean meal did not fare well closing 6.00 to over 9.00 weaker with futures reaching their lowest level in seven sessions. The big slide in front months is likely managed money liquidation as well as bear spreading on noted declines in basis. The implication is that prices are reflecting a slowdown for the pace of crush and exports. Supporting prices is less than ideal weather and thin supplies.

WHEAT HIGHLIGHTS: Jul Chi down 7 3/4 cents at 6.80 and Dec down 5 1/4 cents at 6.94 1/2. Jul KC wheat down 6 1/2 cents at 6.30 and Dec down 6 1/2 cents at 6.48 3/4. A disappointing close after such a strong open last night in the overnight trade. One might think today’s trade will not be the trend this week, with not a lot of rain built into the forecast this week. It will be a good week for harvest in Texas and Kansas should be virtually done. Wheat crops in the Plains still need time to develop and are suffering from drought with no rain in sight. Over 100’s temps were reported out of the Dakotas over the weekend – which North Dakota is supposed to get some rains this week, but it is feared the moisture may evaporate faster than it can fall. USDA reported wheat inspections totaled 937.7 mb – short of the projected 965 mb USDA put forth for 2020-21. From a global production standpoint, there are no major concerns for the EU, Black Sea, Southern Russia or Australia.