Market Summary 6-9-2021

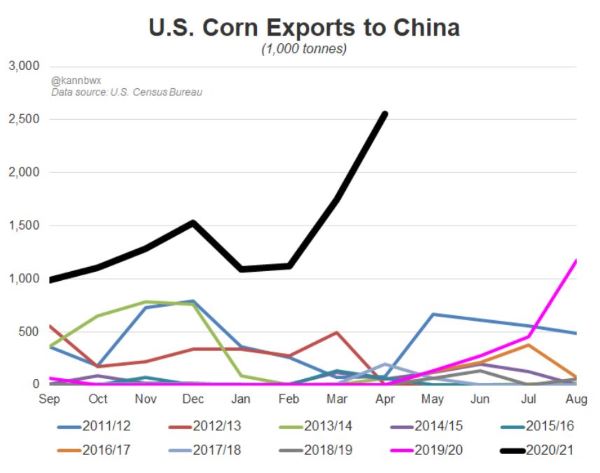

Corn exports to China have been debated in the corn market, with market participants wondering if they will take delivery on their record purchases. In the month of April, the U.S. exported a record 2.55 MMT or approximately 100 mb of corn to China. This was 46% more than the March total, the previous monthly record. Until this year, the largest yearly total of corn exports to China was 2011-12, and the April total alone accounted for half of the 2011-12 totals. There is still a large volume of corn to be shipped to China from their buying program this fall, but the U.S. is currently on a strong pace and has a chance to reach that target.

CORN HIGHLIGHTS: Corn futures closed firmer with July leading today’s gainers, ending the session at 6.90-3.4, up 10-3/4 and December 0-1/4 higher at 6.09-3/4. Both contracts finished significantly above the low price for the session, July up 21-1/4 cents and December 16-3/4. Today’s ethanol report indicated 107.8 mb used this past week, which compares to 104.466 mb the week before. Stocks are at 19.96 mb and total production 7.469 mb versus 7.238 the prior week. Corn used for ethanol needs to average 95.14 mb per week. The current pace is above what is required to meet USDA’s projection. Thursday’s USDA report is expected to estimate projected carryout for this year at 1.207 bb. Last month’s estimate was 1.257. Total production is expected to come in at 15.018 bb, and this compares to the 2020 crop at 14.182. Most analysts are expecting a downward revision to Brazil’s corn crop from last month 102 mmt. The range of estimates is wide from 102 mmt to 90 mmt. The yield number used last month for US production was 179.5 and will likely be the same tomorrow. Weather has been mixed, some rain and more in the forecast the next 24 hours. Rain will be helpful to some but probably not enough for all. The latest 6-to-10-day outlook calls for the entire central United States to experience above normal temperatures and below normal precipitation.

SOYBEAN HIGHLIGHTS: Soybean futures closed weaker with bear-spreading a noted feature today. Weakening basis was also a factor, reflecting a recent slow-down in export and crush activity. July futures lost 17-1/2 cents to end the session at 15.62-1/2, and November gave up 8-3/4 to close at 14.48-1/4. Tomorrow’s USDA report is expected to show 4.414 bb of estimated production, and this compares to 4.135 bb a year ago. Acreage will likely be higher on the June 30 Acreage report and ultimately, assuming normal yield (50.8 bpa), production will be on the rise unless weather factors change trader’s views. Meal and oil softened with meal losing near 3.00 and oil off about 30 to 45 points. Oil continues to hold near contract highs. Tomorrow the USDA will release its monthly Supply and Demand report, which is to confirm tight carryout for this year and again for next. The average pre-report estimates for ending stocks is 122 mb bushels and for next year 146 million. These are both extremely tight numbers with historically low stocks to usage percentages. Again, just as it did last month, the report will confirm there is little room for error producing this year’s crop. We were a bit surprised soybean prices were as soft today as they were while corn rallied. Considering the forecast looks just as negative for soybean production as it does for corn with below normal precipitation and above normal temperatures forecasted, soybeans just didn’t have a gusto today.

WHEAT HIGHLIGHTS: Jul Chi down 2 3/4 cents at 6.82 1/4 and Dec down 1 3/4 cents at 6.97 1/2. Jul KC wheat up 3 1/4 cents at 6.35 3/4 and Dec up 2 3/4 cents at 6.52 1/2. After a disappointing trade in the morning, as the news of recent rains in northern Plains pressures prices, wheat followed corn’s lead and returned close to even money for the day. Southwestern Plains are expected to be in the 90s through Sunday and even hotter in areas of Texas. Seven-day weather has minor rains built in but not enough to lend the aid that’s needed currently to stressed crops. Minn wheat continued to fall today after more rains land in the Dakotas – ultimately, these rains will help these drought ridden areas but it’s hard enough to be out of the woods. Globally, Russia’s winter wheat region is doing well and a chance for more rains this week – but windy/dry conditions continue to threaten their spring wheat crop. Tomorrow is the June WADE report – it’s expected the USDA will once again publish a record world wheat production number – but even still it is very early in the growing season to throw in the towel and claim a record crop is a for sure thing.