MARKET SUMMARY 7-14-2022

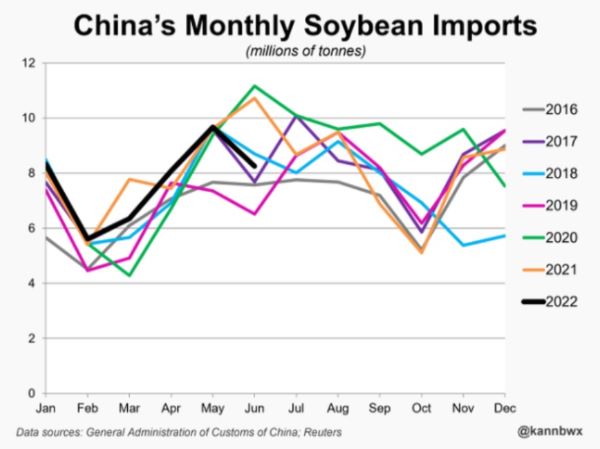

China’s monthly soybean imports have been trending lower, confirmed by June export totals. For the month of June, China imported 8.25 MMT of soybeans, which was a 3-year low for the month. This total was also down 235 from last year’s June totals. Poor soybean crush margins and lower hog inventories have been a major factor in the Chinese appetite for global soybean imports. In addition, high global prices and transportation costs have impacted soybean shipments, keeping the Chinese end users more current in their demand. For the year from January to June, total imports are at 46.3 MMT, which is down 5.5% year over year. Concern regarding Chinese soybean demand has been a limiting factor in soybean prices recently, as the market is cautious that adjustment could be coming on export expectation, which could increase the overall supply picture.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures were higher on Thursday, performing well against more broad-based commodity selling pressure, adding some premium supported by weather forecasts. September futures gained 5 cents, closing at 6.05, and December added 5-3/4 cents, closing at 6.01. July corn closed at 6.95. Tomorrow is the last trading day for the July contract, which is open to wild price swings, like the action on Thursday.

Both the European and American models continue to hold a warmer and drier bias on the 6 to 10-day forecast as well as the 8 to 14-day outlook. With pollination just beginning or right around the corner for most acres, these forecasts bring some buying support to add weather premium. Outside market issues are a limiting factor as a strong U.S. dollar keeps demand concerns in front of the market. In addition, weakness across markets in general triggered broad-based “risk-off” trade on Thursday. Keeping prices in check is a lack of demand. Weekly export sales reflected those demand concerns. USDA announced new net sales of 59,000 MT for 2021-2022 were down noticeably from last week and down 72% from the prior 4-week average. For 2022-23, new net sales of 348,200 MT last week. Both numbers were disappointing and below expectations. Exports of 916,100 MT were down 11% from the previous week and 24% from the prior 4-week average. China was the top destination for corn at 409,000 MT shipped last week. The strong U.S. dollar keeps global competition active for corn exports. The availability of Brazilian corn will continue to make it difficult for US exports in the weeks and months ahead.

SOYBEAN HIGHLIGHTS: Soybeans traded both sides of unchanged today but ultimately faded into the close amid poor export sales numbers. Aug soybeans lost 13 cents, closing at 14.71-3/4 and Nov lost 8-1/2 cents at 13.41.

Poor export numbers and lower crude caused soybeans to close lower despite being positive earlier in the day. It is too soon to tell if the hot and dry weather will continue into the time frame when the crop will be most vulnerable, but weather is still a concern. The USDA reported more net cancellations of 13.3 mb of soybeans for the 21/22 marketing year, and an increase of just 4.1 mb for 22/23. Last week’s export shipments of 16.2 mb were well below the 27.8 mb needed each week to achieve the USDA’s export estimate of 2.170 bb for 21/22. China was behind the bulk of cancellations for the 21/22 marketing year as they seek out cheaper Brazilian beans but were the top buyer for the 22/23 year, followed by Costa Rica, and Japan. Soy meal has continued to trend higher as soy oil trends lower amid falling crude and Malaysian palm oil. Biodiesel margins remain positive but have narrowed some with the break in prices. Rising Covid cases in China remain a concern as renewed lockdowns are likely underway, and September soybeans on the Dalian exchange are down 17% from their June 9 high, similar to the sell-off seen in the US. August soybeans are holding above their 200-day moving average while September and November are still trying to claw their way back above.

WHEAT HIGHLIGHTS: Wheat futures traded both sides of unchanged before ultimately closing lower despite good export sales, as Ukraine may be allowed to start exporting grain safely. Sep Chi lost 15-3/4 cents, closing at 7.95 and Dec down 14-1/4 at 8.13-1/2. Sep KC lost 13-1/2 cents, closing at 8.48-3/4 and Dec down 13-1/2 at 8.56-3/4.

Wheat futures were initially higher amid strong export sales, but news that Russia, Ukraine, and Turkey are signing an agreement next week for a grain export deal that would allow Ukraine to safely export shipments of grain threw a wet blanket over the market. There is unease about how this agreement will be handled and if Russia is to be trusted to uphold their end of the deal, as Russia continues to attack Ukraine with the latest being a strike on a residential and business district in Vinnytsia City. Bearish outside influences were a factor in dragging wheat lower, as equity markets slipped and the Labor Department reported a larger-than-expected gain in producer prices of 11.3% in June, and wheat is sensitive to inflationary concerns. Net sales of wheat were 37.4 mb for the 22/23 marketing year and were up noticeably from both last week and the prior 4-week average, with increases primarily to China. All wheat contracts remain oversold and below their 200-day moving averages but should be nearing a bottom.

CATTLE HIGHLIGHTS: The cattle markets were under selling pressure on Thursday, and outside market concerns led to profit taking in the cattle complex. Aug live cattle closed 1.475 lower to 135.400 and Oct was dropped 1.350 to 139.925. Aug feeders lost 1.900 to 178.900.

The strong start to the week gave the cattle market room for some profit taking as a strong U.S. dollar and weak equity and crude oil markets triggered some “risk off” trade on Thursday. The cash market was still relatively quiet, seeing mostly steady trade. A little scattered live trade has been reported in parts of Nebraska and Colorado at $140 today. It looks as if the bulk of business is basically done for the week except for some light clean-up trade through the end of the week. USDA released weekly export sales this morning and reported new sales of 9,200 MT for 2022, a marketing-year low. Sales were down 17% from the previous week and 35% from the prior 4-week average. Japan, Mexico, Canada and China were the top buyers of U.S beef last week in a disappointing sale total. The strengthening U.S. dollar may be starting to have an impact on U.S. commodity exports. Boxed beef values were firmer at midday, with choice gaining 0.19 to 268.24 and select adding 1.21 to 242.47. Load count was light at 53 loads. The concerns regarding the U.S. consumer will keep the demand concerns active in the live cattle market as consumer income will likely stay tight. The feeder market saw profit taking and price consolidation on Thursday, reflecting the live cattle market. The Feeder Cash Index traded 0.96 higher to 172.30 and is still at a discount to the futures. There is still time until August expiration, but the gap between the two could be a limiting factor. The cattle market has been seeing good money flow, but the concerns regarding the macro market conditions in outside market triggered a pause on Thursday. The market may stay cautious going into the end of the week, given those outside factors.

LEAN HOG HIGHLIGHTS: Hogs futures were mostly lower as outside market pressure in the commodity market weighed on hog futures on Thursday. Jul hogs, which expire on Friday, gained 0.425 to 114.925, Aug slipped 0.925 to 109.575 and Oct slipped to 93.350.

August hogs failed at resistance at the 100-day moving average, keeping the consolidation trade intact. The market is still trading range bound between the 100 and 200-day moving averages. It may be difficult to push out of that range, given the current overall market conditions. USDA announced export sales on Thursday morning, posting new sales of 18,300 MT for 2022 were down 42% from the previous week and 37% from the prior 4-week average. Top buyers of U.S. pork last week were Mexico, Japan, and China. Pork cutout values were higher at midday with carcasses adding 2.63 to 120.91. Movement was light at 136 loads. Carcass values have been strong the first half of the week, helping support the hog markets. Cash markets are choppy. Direct morning trade was stronger on Thursday gaining 3.09 to 118.67 and a 5-day rolling average of 119.23. The CME Lean Hog Index was 0.25 higher to 112.82. July expires on Friday, and is still holding a premium to the index, which could be a limiting factor. The cash hog market is closely watching weather forecast and the prediction of high temperature across the Midwest next week. This could stay supportive of the cash market as packers may need to bid up to keep hog movement active and counter the potential lighter hog weights that may occur. The hog market is trading in a range bound fashion, but if demand continues to pick up, could be poised for a breakout higher. The cash market will still be the key in the days ahead.

DAIRY HIGHLIGHTS: The block/barrel average dropped 5.8750 cents today to $2.08125/lb, its lowest point in four months, which added pressure to an already struggling Class III milk market. A loss of 59 cents in the August contract brings the second month chart back beneath $21.00 for the first time since it rolled from February to March 5-1/2 months ago. Now the question becomes: Will the $20.00 mark, which has served as a point of resistance in recent years, become a line of support? While fundamentals have started to shift more negative, this move has been very sharp and it wouldn’t be surprising to see some retracement soon even if it is short-lived.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.