MARKET SUMMARY 7-26-2021

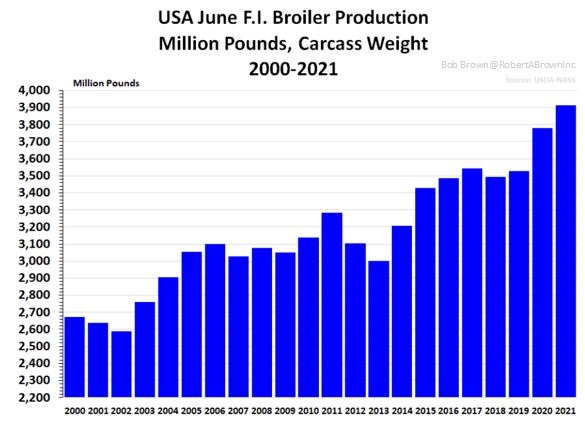

One of the key components of corn demand and the most variable is the feed usage category. Calculating this total is very subjective and formula driven based off the numbers of animals fed and their production. The market may be more focused on the feed usage for cattle and hogs, poultry production is still very key. Poultry production in the month of June was running at a record level. In the month of June the US produced 3.913 million pounds of broiler (Meat) production, the highest June on record. That total was up 133 million pounds, or 3.5% over last June, and the 4th highest production month on record. The production was reflective of the strong profit margin and demand for meat proteins in the U.S. and overseas. The corn market is still concerned about overall demand, but the strength in animal production has allowed the USDA to keep he feed demand numbers supportive.

CORN HIGHLIGHTS: Corn futures started the week steady to higher early on the over-night trade, yet weakened into the morning hours. Despite a lack of rain and high temperatures experienced in the northwestern regions of the Midwest, a lack of new positive news and better chances of rain in the forecast weighed on prices so that by mid-morning, double digit losses were recorded. Yet, buyers bought the dip and mid-day forecasts seemed to generally agree with a bit drier in the near-term outlook. September finished 2-1/2 cents higher at 5.49-3.4 and December up 3-3/4 at 5.46-3/4. Export inspections at 40 mb were termed neutral, bringing the year-to-date total to 2.412 bb, or 84.6% of the total expected sales total of 2.850 bb. As far as crop production is concerned, this is the most critical weather time of the season. Much of the crop is pollinating or beginning to set ears requiring more moisture than any other time of the growing season. Much of the Midwest is well behind normal for precipitation. As an example, Iowa remains in a moderate to severe drought in the northern half of the state. Yet, as noted in last week’s crop ratings, only 6% of the state’s corn crop is rated poor to very poor. In other words, timely rains, despite low subsoil conditions, have kept the crop moving along in a generally positive fashion. This past week’s heat and lack of rain in certain areas will likely stress the crop in the upcoming week. Brazil importing corn from Argentina underscores tight supply, as does continued strong basis.

SOYBEAN HIGHLIGHTS: Soybean futures started the week on a softer note, with double digit losses registered by the session at 7:45, as a lack of positive news and rain in the extended forecasts weighed on prices to start the week. In essence, futures started where they finished last week, weaker and under pressure. Selling interest appeared to dry up by midday, which may have had a more reflective tone for forecasts which seemed to be indicating warmer and drier and less rain. August futures closed 11-3/4 higher at 14.12-3/4 and November 6 higher at 13.57-3/4. Both contracts posted positive hook reversals. Export inspections at 8.9 mb were termed neutral, bringing the year-to-date total to 2.133 bb and 93.6% of the yearly forecasted total of 2.280 bb. Today’s closing price was impressive as the market rallied significantly off the daily low. As an example, August reached a low of 13.80, well more than 20 cents softer on the session. November soybeans also reached losses of near 20 cents with today’s low at 13.32. Also providing support today were firmer vegetable oil prices, as palm oil moved higher overseas. Soybean oil finished the session with gains of 70 to 85 points. Soybean meal finished steady to softer, continuing to be an anchor on soybean prices. The technical picture for new crop beans looks sketchy. Prices broke under channel line support earlier in this session, but managed to claw back enough to finish just above this key support area.

WHEAT HIGHLIGHTS: Sept Chi down 7 cents at 6.77 & Dec down 6 3/4 cents at 6.86 3/4. Sept KC wheat, down 7 cents at 6.39 & Dec down 6 3/4 cents, closing at 6.50 1/2. Today’s crop progress confirms that winter wheat harvest has progressed to 84%, making great progress with last week being dry and optimal for harvest and challenging the 5-year average of 81% at this time of year. Colorado making great strides, moving from 61% last week to 92%. Oregon is still behind at 59%, but better than last week’s 39%. South Dakota went from 33% to 71% this week. Idaho is still behind, coming in at 29% harvested. The real devastating news, although not shocking, is spring wheat condition fell another 2 points to 9% good to excellent. Currently, 66% of the crop is rated poor to very poor. For a second week in a row, Washington has 0% of their crop rated good/excellent and 88% rated poor to very poor. Spring wheat headed is at 97% and harvest has just began at just 3%. Unfortunately, except for a shower here or there, there is no real rain forecast for the northwestern Plains or Canadian Prairies for the next week. More extreme triple digit temps will be seen in Montana & the Dakotas through Wednesday. Although the extended forecast is supposed to not be as hot, there is still little moisture built into the forecast. Wheat Quality Council’s spring wheat tour starts tomorrow and will give more insight to where the US sets. Weekly grain inspections were relatively friendly this week, coming in at 477,900 mt. US has seen a couple weeks of decent export sales, we’ll see if this week holds the trend. Although a record crop is easily achievable this year, the idea of everyone having a perfect crop is quickly falling apart. China & parts of the EU has flooding, while western Russia is too hot and dry. Australia still looks great for the year and may produce a record crop.