MARKET SUMMARY 7-29-2021

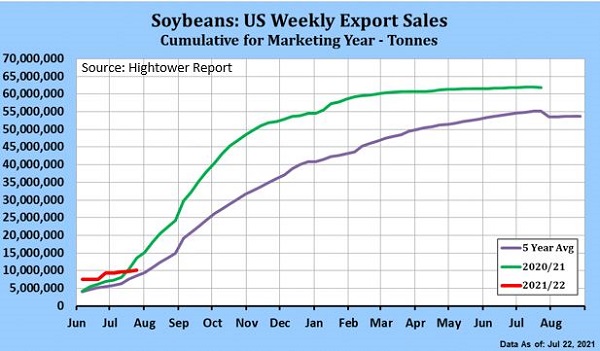

The quietness of export demand for the 2021-22 marketing year for soybeans has been a concern of the market. Even with the market forecasting a historically tight carryout projection for the next marketing year, prices have become stagnant looking to find additional soybean demand. Currently, U.S. exporters have 10.178 MMT of sales on the books for 2021-22 marketing year. This is about 3.5 MMT below last year, but above the 5-year average for this time frame. The large and late harvested Brazilian soybean crop has kept the U.S. soybeans over-priced as global importers have been securing the cheaper South American supplies. That time period may be coming to a close, as Brazilian soybeans are starting to add premium and making the U.S. soybean more competitive. The first sign was the purchase of 132,000 MT of U.S. soybeans by unknown destinations on the overnight. The U.S. soybean market may be starting to move into the window where the U.S. soybeans is more competitive in price, and if that is the case, the market should expect more sales for this fall’s delivery to start ramping up.

CORN HIGHLIGHTS: Corn futures firmed, finishing with moderate to strong gains despite another week of poor export sales news. September gained 8-3/4 cents to close at 5.58 and December 7-1/2 to end the session at 5.56-1/2. Export sales showed a net cancellation of 4.5 million bushels for the current marketing year, but did show 20.8 million bushels sold for new crop. Year-to-date sales are 2.7422 bb or 96.2% of 2.850 bb of forecasted sales. The old crop cancellation is discouraging, but as mentioned last week, not necessarily a surprise at this time of year. It does potentially suggest that the USDA may revise downward total expected sales. Supporting prices today is concern of more frost in Brazil tonight. A weaker dollar and strong gains in wheat and soybeans provided underlying support, as did higher stock prices. Energy prices continue to rebound with crude oil now trading at 73.00 per barrel, gaining a dollar today. This is remarkably different from last spring when prices spent some time in negative territory. COVID is a continued concern as the delta variant is on the rise, yet analyst seem to be mixed on how it may affect the overall economic conditions world-wide and commodity prices. Likely the most supporting factor for corn prices today is more dry weather for the western Corn Belt. Rainfall, while it has been present throughout parts of the Midwest, has been scattered and mixed in amount received.

SOYBEAN HIGHLIGHTS: Soybean futures gained 2-1/4 cents in August, closing at 14.34-1/4 and November 16-3/4 higher at 13.77-3/4. Tomorrow is first notice day for the August contract. Support came in the form of a lower US dollar, dry weather concerns, and palm oil, which continues to show strength. Moisture needs are most critical at this junction and forecasts just don’t seem to offer copious amounts of rain in regions where dry weather is an increasing concern. In particular, the Dakotas, western Minnesota, northwestern Iowa and northeastern Nebraska. One consistent pattern this summer is the inconsistent rainfall totals and coverage. The question is whether this can change in August in order to help reverse declining crop ratings. Only time will tell, but currently forecasts do not offer much opportunity for widespread rain. The central and eastern Corn Belt continues to remain in very good shape, yet additional moisture will too be needed soon as the summer’s hottest temperature. Hot temperatures during the latter part of July and forecast into August suggest timely rain is necessary to fulfill high yield in areas where the crop is already rated good or excellent. Export sales were lousy today for old crop with net cancellations at 2.9 million bushels, yet this late in the season cancellations of old crop are not surprise as purchases are often moved forward to new crop. Year-to-date sales are now 2.275 bb or 100.2% of expected sales of 2.742 mb. New crop sales at 11.5 million bushels were noted and viewed as supportive.

WHEAT HIGHLIGHTS: Sept Chi up 16 1/2 cents at 7.05 1/4 & Dec up 16 cents at 7.13 3/4. Sept KC wheat up 15 cents at 6.74 1/2 & Dec up 14 1/4 cents, closing at 6.85 1/4. Wheat continues to gain momentum today as the bullish fundamentals just keep stacking up. Earlier this week, we stated that the wheat market seemed “exhausted” with the news of the drought in spring wheat areas and would need something more to push it forward. Well ask, and you sometimes receive. The wheat tour this week starting to finally prove to traders and funds that the rumors are indeed true, and this year’s US wheat crop is in critical condition has helped bolster prices. Tour estimated the hard red spring wheat yield at 24.6 bpa – down from 40.8 bpa in 2019. Today’s drought monitor showed several areas getting worse in the northwestern Plains and northwestern US in general. Rain is expected to be minimal and scattered, however, temps are supposed to cool down headed into this weekend, which will bring relief although little improvement Is expected at this point. Unfortunately, after the first week in August, however, the hot and dry temps are expected to roll back in which is likely to keep the grain market as a whole extremely volatile moving through August. Exports were stronger than expected considering US wheat is still not all that competitive on a global scale. Export sales came in at 515,200 mt – with China being the biggest buyer.