MARKET SUMMARY 7-7-2021

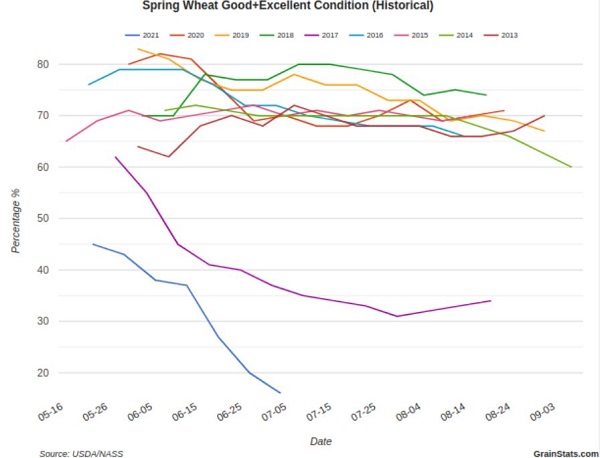

The wheat market has been keeping a close eye on weather forecasts and the possibility for any adequate rainfall that could help crops in the northern Plains. Weekly crop ratings for the Minneapolis or the Hard Red Spring wheat (HRSW) crop tumbled another 4% last week to 16% good-to-excellent, one of the lowest ratings on record. Nearly 100% of the spring wheat crop is experiencing some form of drought and despite some recent rainfall, the damage has likely been done to this crop. Beyond cropland in the U.S., the Canadian Prairies have also been dealing with persistent dryness. With the recent push lower in prices, spring wheat also saw some profit taking and value removed, but may be set again to push higher. The biggest limiting factor will be the developing harvest for winter wheat and Soft Red wheat harvest, which have been showing good yields.

CORN HIGHLIGHTS: Corn futures weakened again today on continue calls for rain in the northwest regions of the Corn Belt. After limit losses yesterday of 40 cents, futures did settle down today with small gains of 5 or more cents on the over-night trade. Yet, as has been the case often this spring and summer, early morning losses begin to mount with futures 20 cents lower at one point giving back all the gains from last week’s support news in the form of supply issues in Brazil due to freeze damage and favorable USDA reports, not to mention challenging growing conditions here at home for parts of the Midwest. September corn finished down 9-1/4 cents at 5.42-3/4 and December down 8-3/4 at 5.31. Reports from the field continue to be mixed. Some farmers suggest recent rains have been extremely beneficial, yet more will be needed. That may be stating the obvious. Others either missed rains or the rain totals were very light and while their crop continues to hang on, it may be difficult to reach trendline yield at this time. Moisture requirements are much higher in July and August. Some forecasters are hinting at a lack of moisture from mid to late July, along with warming temperatures. Should this occur, major concerns with a lack of subsoil moisture will likely surface. For now, the trend remains extremely choppy with prices holding above the 100-day moving average in December corn, which is at 5.32-1/2. Futures did trade under this level today, but came back late in the session to close above it. Yet, the corn market is hanging on by its fingernails, as it appears funds are either liquidating, establishing short positions, or both. It was estimated they reduced their position by about 35,000 contracts yesterday. Historically, a rally in spring or early summer in most years proves to be an opportunity too forward sell expected crop or for traders to establish short positions as the odds favor average to above average crops in most years.

SOYBEAN HIGHLIGHTS: Soybean futures rebounded today, gaining 22-1/2 cents in September to close at 13.66-3.4 and November up 22-1/4 to end the session at 13.27-1/4. After a significant hit yesterday with futures closing more than $0.80 lower, today’s rebound was welcomed, yet prices failed to hold on the stronger gains from earlier in the session, with prices finishing near 20 cents off their high. This during a week where crop ratings lost ground again, albeit small with 59% of the crop rated good to excellent. This compares to 71% a year ago. Beneficial rainfall is noted this week with more in the forecast. Yet, reports from many farmers suggest that this week’s rain totals were mixed and was light in areas. More will be needed soon otherwise expectations for warmer temperatures and lack of rainfall in mid-July could mean problems for this year’s bean crop. We have made the argument there is no room for error in 2021 production due to historically tight supply. November futures are at a crossroad as the market is 1.10 from its recent highs but also well above the 11.00 mark where futures were trading in March. Our point is that volatility is likely to remain high. There is significant downside risk yet at the same time it would not take much to shoot prices into new highs.

WHEAT HIGHLIGHTS: Sept Chi down 3 3/4 cents at 6.22 1/4 & Dec down 3 cents at 6.30 1/2. Sept KC wheat up 3/4 cent at 5.84 1/2 & Dec up 1/4 cent, closing at 5.95 3/4. After a nasty day in the wheat sector yesterday, today saw a slight recovery. MNPLS wheat led the pack as spring wheat conditions fell to just 16% good/excellent, the worst rating in over 20 years. Some believe that MNPLS wheat could still retest $9.00+ price levels this year. With 69% of the spring wheat crop headed, it’s hard to imagine how much these few and far between rains are going to help, if at all. Winter wheat crop now 45% harvest, with Kansas at 62% and Illinois at 87%. Northwest Plains continue to get skipped for moisture and are victim to drought, with Washington wheat rated at 20% good/excellent and Oregon only rated at 12% good/excellent.