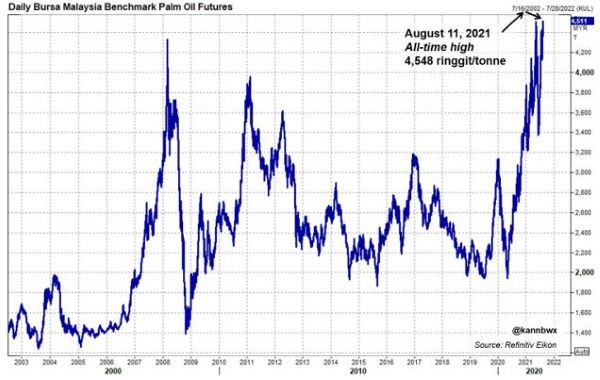

MARKET SUMMARY 8-11-2021

Malaysian palm oil prices traded at all-time highs and helped bring buyers back into the soybean oil market. The edible oil markets have been in the front of traders’ minds for the past year, as edible oils have been in high demand for food uses as well as fitting into the “green” energy market. Malaysian palm oil futures traded to all-time highs on August 11, notching a new record close at 4,511 ringgit/ton as forecasts lowered palm oil stocks by 7.3% for the end of July. This total was much larger than expected, and prices surged 7.4% higher to eclipse the new record high. The strong buying in palm oil carried over into the soybean oil market, which gained over $1.00 a pound in the more actively traded deferred contracts. The soybean oil market has come under some profit taking since posting a high in June, but the surge higher in palm oil values, as well as on-going concerns regarding the Canadian Canola crop, may have brought soybean oil back on the buyers radar.

Like what you’re reading?

Sign up for daily TFM Market Updates and stay in the know:

https://info.totalfarmmarketing.com/market-updates

CORN HIGHLIGHTS: Corn futures started the day firmer with overnight gains for 5 or more cents as longer-range forecasts continue to suggest limited rain for the northwestern regions of the Midwest. September futures closed at 5.56-1/4, up 7 cents and December up 6 at 5.59-1/4. Position squaring in front of tomorrow’s USDA report may have been a noted feature as well. Most analysts are anticipating a decline to corn yield from 179.5 bushels per acre to near 177. Should this occur, it would keep carryout tight at 1.246 bb for the year ahead. Current year projected carryout is 1.082 bb. Supporting prices today was also less rain in the extended forecast. This week, weather has been a mixed result with much needed rainfall in parts of the central Midwest but again lacking significant coverage in the western regions. On the one hand, this helps to solidify the potential for high yield in parts of the country. On the other hand, it is unlikely that areas that have been dry for an extended length of time will see much yield potential increase even if moisture does fall in the next few weeks. The market will pay attention to tomorrow’s projected world carryout as expectations are for a reduction in the Brazilian corn crop. Last month’s estimate of near 92 million metric tons is expected to eventually be reduced to 86 million metric tons in line with Conab’s estimate yesterday.

SOYBEAN HIGHLIGHTS: Soybean futures ended the session mixed, with August down 42 cents, September down 1-1/4 closing at 13.47 and November up 3-1/4 to finish the session at 13.40. The last trading session for August is Friday, and after sharp gains yesterday, it is likely traders are adjusting positions or exiting prior to tomorrow’s report as well as Friday when they must be out or will be required to make or take delivery. For the fifth day in a row, the USDA announced export sales of more than 100,000 mt. (minimum for daily reporting requirement). Today was a sale of 132,000 mt to China for the 2021/2022 marketing year. We like that these numbers are occurring, but they’re still not necessarily significant in size and apparently have not impacted new crop soybean prices much. Sometimes it is hard to tell; however, as recent rains have certainly been beneficial to a big portion of the crop and because of exports, prices did not break. Yet, from a big picture perspective, we cannot move away from the fact that it looks like Brazil may be tapped out of old crop inventory and that the world will need to come to the US for their needs over the next five to seven months. Expect tomorrow to indicate stocks for the year ahead at near 150 million bushels, in our analysis, significantly tight. Trying to estimate bean yield can be nearly impossible. Tomorrow we will see a first significant attempt other than a trendline projection. The pre-report estimate indicates a yield of 50.3 bushels. Last month’s figure was 50.8. Soybean oil firmed today, as palm oil reached new contract highs, continuing to echo tight world vegetable supplies. This has been exasperated by dry weather in Canada limiting canola production.

WHEAT HIGHLIGHTS: Sept Chi unchanged from yesterday, closed at 7.27 and Dec down 1/4 cent at 7.39 1/4. Sept KC wheat down 4 cents at 7.10 1/4 and Dec down 4 cents closing at 7.22. Grains made it pretty clear today that they weren’t going to be too volatile either direction and held support levels ahead of tomorrow’s USDA report. It was likely minor profit taking ahead of the report, as global markets are still bullish for wheat. Paris milling futures put in another contract high today as world wheat cash prices continue to be on the rise. Falling production in US, Russia, Europe, and Canada are still on the front of all traders’ minds. New concerns about weather in Argentina and flooding in China could start to impact their production and quality as well. It’s expected tomorrow the USDA will lower both US production and global production by lowering Russian and Canadian numbers primarily. Current USDA projection for Russian wheat is 85 mmt, and it’s not difficult to find estimates closer to 75 mmt. It’s unlikely that the USDA lowers their number below 80 mmt, but a decrease is certainly in order. Canadian wheat is currently set at 31.5 mmt by the USDA, and some analysts think that crop could drop below 24 mmt, so again, adjustments needed for both crops. However, once all is said and done, it’s still believed a record global crop will still be projected.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.