MARKET SUMMARY 8-20-2021

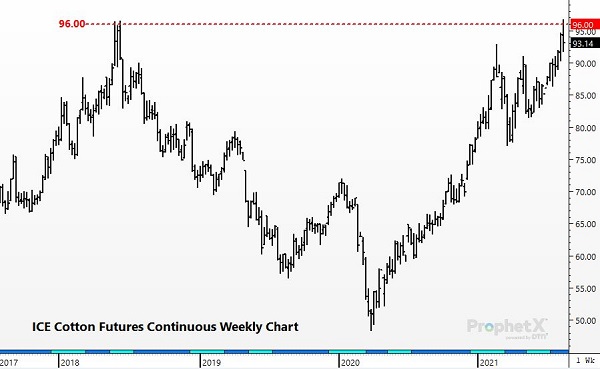

Cotton futures are challenging four-year highs as weather concerns challenge the U.S. crop. Cotton futures have been climbing steadily higher since early 2020, as overall production and dryness in the South has weighed on the cotton crops, but the recent impact of tropical depression Fred help push price to the multi-year highs. Heavy rainfall in parts of Georgia, Virginia, the southeast and mid-Atlantic, which analysts say could affect the crop as most of the Cotton Growing Belt has already received a lot of rain. The heavy rain could affect the overall crop quality. At these levels, prices are at a crossroads. Ongoing strength could push prices to levels not seen in years, and challenge the $100.00 level. There are still questions about the cotton crop overall. The USDA lowered production by more than a half a million bales on its most recent report, but many analysts are skeptical of the adjustments given crop ratings. There are still some questions that need to be answered, but the breakout in cotton prices provides the producers great pricing opportunities.

Like what you’re reading?

Sign up for daily TFM Market Updates and stay in the know:

https://info.totalfarmmarketing.com/market-updates

CORN HIGHLIGHTS: Corn futures closed at $538-3/4 in September, down 11-1/4 and $5.37 in December, finishing the session at 13-3/4 cents lower . For the week, December corn closed 36 cent lower, led by the end of week pressure. The state-by-state numbers for the Pro Farmer tour are as follows: Minnesota at 177.4 vs. USDA at 166. Iowa at 190.7 vs. USDA at 193, Illinois at 196 vs USDA at 214, Nebraska at 182 vs USDA at 186, Indiana at 193 vs. USDA at 194, Ohio at 185 vs USDA at 193, and South Dakota at 151 vs USDA at 133. After the market close, Pro Farmer released their projection for corn yield at 177 bushel/acre, a number higher than the USDA. In addition, Pro Farmer added 910,000 acres to harvested acres based on FSA data, total crop at 15.11 billion bushels. These totals will be heavy compared to the USDA August report numbers. Weaker energy prices, rain in the forecast, technical weakness and lack of export activity all weighed on futures this week. In addition, midday losses grew on the announcement of the U.S. Environmental Protection Agency is expected to recommend to the White House lowering the nation’s biofuel blending mandates below 2020 levels, in what would be a blow to the biofuels industry. After the announcement, ethanol RIN prices traded lower, and this brings potential demand concerns forward for the corn used for ethanol, helping push corn prices to the lows of the day. The demand concerns regarding ethanol stays as a blanket on top of the market. With harvest quickly approaching with doubt if end users or importing countries are overly concerned with acquiring supplies in the months ahead. From a historical perspective, it is not unusual for the market to come under pressure at this time of year. The next USDA report is due out on September 9. This will shed more light on crop expectations with a more comprehension in the field survey than the August report, which was farmer surveyed.

SOYBEAN HIGHLIGHTS: Soybean futures had a rough week, finishing with a loss in September, closing at $12.93-3/4, down 29-1/4 cents, and $12.90-3/4, dropping 29-1/4 cents in November. For the week, November soybeans gave up 74-1/4 cents. The Pro Farmer tour that probably really didn’t show the market much from expectations with pod counts, but after the market close released their yield projects. Pro Farmer estimated soybean yield at 51.2 bu/a, higher than the most recent USDA numbers. Total crop is estimated at 4.436 billion bushels. World vegetable oils, including palm oil and soybean oil, all went on the defensive this week and likely were the spearhead to lower prices for soybean futures. In the U.S., an announcement by the Environmental Protection Agency to recommend the White House to lower the nation’s biofuel mandates below 2020 levels added to the selling pressure. This would come as a blow to the biofuels industry, and weighed on soybean oil markets, which traded sharply lower and closed at their lowest levels in nearly two months. This issue seems to be a dark cloud hanging over the grain markets in general. Uncertainty with the crop could provide support. Also, the market will be watching weekend weather very closely. Rainfall is forecasted across the Grain Belt and could be key in finishing this year’s soybean crop. As we mentioned in previous reports, demand should remain strong, but will take the form just in time for inventories rather than significant booking in advance.

WHEAT HIGHLIGHTS: September Chicago wheat closed down 13-1/4 cents at 7.14-1/4 and December closed down 14-1/2 cents at 7.28-1/4. September KC wheat closed down 13-1/2 cents at 7.02 and December closed down 12-1/2 cents at 7.15-3/4. September Minneapolis wheat closed up 1-1/2 cents at 9.18-1/2 and December closed down 2-1/4 cents at 9.02-1/4. Today’s selloff was not exclusive to wheat. A combination of rains in the forecast for key growing regions, the US dollar index at 10-month highs, and news that the EPA is looking at lowering fuel blending mandates have taken their toll on the grain markets today. Both September and December Chicago wheat closed below their 21-day moving average. US wheat is still overpriced compared to other global markets. Despite these factors, the fundamental outlook for wheat is still bullish. China may still be in demand of wheat after the massive flooding they had earlier this year. While most of their crop was already harvested before the floods, the impact on their logistics and storage may have long reaching consequences. Additionally, we are still seeing dryness in parts of the Russian spring wheat area, as well as wet conditions in the northeast parts of Europe, slowing their harvest and increasing concern about quality. Low ending stocks numbers are also a bullish factor, which should help support wheat in the long run.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.