MARKET SUMMARY 8-24-2022

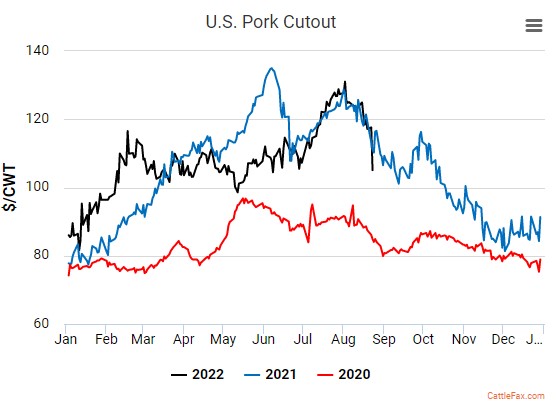

Hog futures saw strong price volatility on Tuesday as prices tried to recover, only to drop $5.00 off the session high as retail values tumbled. The optimism of a price recovery to start the session on Tuesday was quickly swept away when retail carcass values were posted in the morning. An $11.14 drop in retail values triggered strong selling pressure in a nervous hog market. The selloff was led by a $47.37 drop in the pork belly cut and a $10.66 drop in the picnic shoulder. The selling pressure continued into the afternoon close, losing an additional $2.00, closing the carcass value that day at 104.51, the lowest price for pork retail carcasses since May. The weakness led to additional follow-through selling in lean hog futures on Wednesday, as prices broke to its lowest point in nearly eight weeks. The concerns will be the near-term trend in pork values, and if they can find stability. The drop in carcass values helped lead to an $11.00 drop in the October futures since peaking at $101.650 on August 11 as prices are trying to find a near-term low.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures wasted little time advancing on the overnight trade adding 10 cents by early morning. After the pause session, prices continued higher as more concern regarding dry weather in parts of the Midwest and elsewhere in the world and coupled with what appears to be thoughts the Ukraine/Russia war will escalate had traders on the offensive. However, prices ran out of gas finishing 5-3/4 higher in September and 2 higher in December. While still higher, the slide from strong gains this morning may have come from better Pro Farmer tour data as well as traders taking gains as futures moved close to upside technical targets. September ended the session at 6.65-3/4 December at 6.57-3/4 both a dime or more off their highs. Crude oil gaining more than 1.00 was supportive.

Today’s ethanol grind figure also had a favorable tone at 100.2 mb putting the cumulative year-to-date figure at 5.24 bb. The current USDA estimate is 5.35 bb, likely at least 50 mb too low. The Pro Farmer tour will wrap up tomorrow with results in IA and Minnesota. The first couple days of the tour set the tone confirming variability to the crop. Expect more stable numbers as the tour wraps up, yet the over tone is this year’s late planted crop that has struggled with spotty weather will be challenged to meet the USDA current recommendation of 175.4 bpa. Elsewhere in the world, concerns with wheat production in India, Europe, and now China could lead to more corn usage. China is said to be struggling with major drought conditions persisting for more than two months, yet most of the drought seems to be south of key corn growing areas.

SOYBEAN HIGHLIGHTS: Soybean futures closed lower today after starting the day with sharp gains, along with bean oil, while meal stayed positive. China made another purchase but there was no news to drive the market, so profit taking appears to be the culprit for the fading prices. Sep soybeans lost 6 cents to end the session at 15.60-3/4, and Nov lost 4 cents to 14.57.

Beans were poised to continue their run higher today but a combination of profit taking, options expiration, and a higher US dollar seem to have thrown a wet blanket on the rally. In addition, the US said that it struck bunkers used by Iranian backed forces in Syria, which may have spooked the market a bit. Other than this, the fundamentals are still bullish with private exporters reporting another sale to China of 517,000 mt of soybeans for delivery during the 22/23 marketing year. So far, the Chinese drought and heatwave appear to be affecting their wheat crop most significantly, but it wouldn’t be a stretch to believe that their soybean crop is in danger as well, causing the recent increase in purchases. In the US, huge crush margins have kept basis firm with St. Louis rallying and now 245 over Nov futures. While the ProFarmer crop tour has so far painted a bullish picture regarding the corn yield, many analysts see potential for record large soybean production granted decent weather. Again, though, if China has issues with soybean production, the strong US production may not be enough, and global supplies may get dangerously tight. Nov beans closed a penny below their 100-day moving average and met resistance at the top of their Bollinger Band at 14.76. There also appears to be the formation of a double top near the 14.85 level.

WHEAT HIGHLIGHTS: Wheat futures had another good day of solid gains as technical signals are looking more positive, giving traders more confidence to buy into the market. Additionally, some of the same issues facing the market we have previously discussed are still being talked about. Sep Chi gained 12-1/4 cents, closing at 7.95 and Dec up 12-3/4 at 8.13-1/4. Sep KC gained 13-3/4 cents, closing at 8.96-1/4 and Dec up 14-1/4 at 8.93-1/4.

Though showing substantial strength overnight, corn, soybeans, and wheat all faded throughout the day. By the end of the session, beans were lower, corn eked out a positive close, and wheat actually led the way. All three US wheat futures classes closed higher for the fourth day in a row. There is not a lot of fresh news to report, but some of the same things we have mentioned early this week are still on the minds of traders. The drought in China is of concern, with their heatwave (now lasting over 70 days) being the longest and most widespread on record. Europe is no exception with some saying it is facing the worst drought in 500 years. There is also talk that India may need to import wheat due to dry conditions. Japan and Taiwan are also tendering for wheat, and it is reported that at least a portion will be fulfilled by the US. Ukraine is also in the news with today being their independence day – there is some concern that Russia may launch new attacks. Recently the daughter of one of Putin’s aides was assassinated, which also has tensions on the rise. Here in the US, some rains in southern areas could improve overall soil conditions for planting the 2023 winter wheat crop.

CATTLE HIGHLIGHTS: Disappointing cash trade pressured the live cattle market, but feeders stayed mixed as the corn market cooled its rally. Aug live cattle slipped 0.300 to 141.325, and Oct was 0.825 lower to 143.775. Feeders saw mixed trade with front end support as Aug gained 0.325 to 181.225, and Sept added 0.575 to 183.025.

Cattle futures were under pressure as the October contract is testing support at the 20-day moving average. The disappointing price action on Wednesday leaves the market vulnerable to additional selling pressure for Thursday’s open. Cash trade has been the trigger for the selling pressure as light southern trade was triggered on Tuesday in the cash market at $142, which was steady with last week’s averages. Northern trade is remaining quiet as values are expected to be steady with last week. The steady tone is disappointing the market after seeing cash values trend higher in recent weeks. The August board has been tied to the southern cash trade and added some premium to pull in line with expiration at the end of the month. October futures are at a premium to the cash trade, leaving it vulnerable to selling pressure. Retail values were mixed at midday as choice carcasses gained 0.43 to 263.23 and select was 0.25 lower to 238.55. The load count was light at 68 midday loads. Retail values are trending lower on the week, but Choice is still holding good value above the $260 level. August feeders expire on the 25th and are tied to the cash market. The feeder cash index traded 0.10 lower to 180.60. A quieter tone in the corn market and the strong cash market supported the feeder market overall. Corn futures were mixed but traded well off session highs. The feeder market is testing lower support levels, but lower prices may be an opportunity to lock in supplies. The technical picture has turned more negative and could open the feeder market to further pressure, especially if grain prices resume their rally. The cattle market looks supported by the fundamentals and the longer-term view still looks friendly, but the market may be seeing some seasonal weakness which could limit the near-term view, but the uptrend is still intact.

LEAN HOG HIGHLIGHTS: Lean hog futures saw additional strong selling pressure, fueled by a drop in retail carcass values on Tuesday as prices pushed to 8-week lows. Oct lost 2.525 to 90.375, and Dec hogs fell 2.050 to 84.225.

October hog futures gapped lower on follow through technical selling after Tuesday’s weak close, as prices closed below the 200-day moving average. The technical picture on hog charts is very disappointing and could lead to additional long liquidation. The price gap from July 5 at 89.750 looks like a downside target, as well as near-term contract lows. The selling pressure was triggered by a strong drop in retail carcass values on Tuesday. Closing carcass values on Tuesday dropped 12.53 to 105.08, including a $48.59 drop in the pork belly cut. Retail trade was more stable at midday, but still pressured, losing 0.57 to 104.51, keeping the trend intact. Since last Thursday’s close to midday today, carcass values are trading $14.40 lower. Today’s midday load count was moderate at 141 loads. The retail market is looking at a shift in demand after the Labor Day holiday, and that seems to be pricing itself in. Weekly export sales will be released on Thursday morning and could help provide some price stability. The cash trade is still supportive, as midday direct cash trade was 4.86 higher to 126.14 and a 5-day rolling average of 123.14. The Lean Hog Cash Index was softer on the day, slipping 0.80 to 119.18. The index is still trading at a strong premium to the Oct futures, closing at 28.805 premium over the futures on the close. The hog market is volatile, which could be part of the bottoming process, and the market is still in search of that low. The hog market is quickly moving into an oversold market, and the strong cash premium could provide support. The question for the market is will the cash price move towards the futures or will the future rise to meet the cash.

DAIRY HIGHLIGHTS: The dairy trade gave back some of yesterday’s gains as pressure in the spot trade put a lid on the recent rally. In Wednesday’s spot trade, butter lost 5.50c back to $3.00/lb while spot cheese fell 0.75c and closed down at $1.8175/lb. There may be some caution after the rally as Monday’s Cold Storage report showed cheese inventories at all-time highs. It could be hard for cheese to rally this time of year with inventories at those levels. The Class IV market pulled back as well after expanded limits yesterday took some contracts up over 80c in one session. The market is still searching for a sense of direction right now. Class III is still chopping around near the $20.00/cwt level.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.