MARKET SUMMARY 9-21-2021

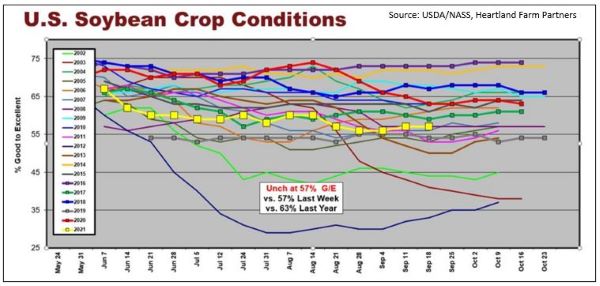

As harvest starts for the U.S. soybean crop, the market will be watching if USDA crop ratings relate to the possible yield. USDA released crop ratings Monday afternoon and left soybean rating unchanged at 57% good to excellent. This is one of the lowest ratings over the past few years, with only 2019 being lower. Last year, crop ratings were 63% good to excellent, but this year’s crop has dealt with major weather challenges. The hot, dry start in June strongly affected the crops, especially in the western and northern half of the corn belt. August brought some rains, which were beneficial in stabilizing the crop and bolstered the last few weeks of ratings. The harvest window is starting, with 8% of the soybeans harvested last week, and the true tell will be the yield results from producers bringing in this year’s crop.

Like what you’re reading?

Sign up for daily TFM Market Updates and stay in the know:

https://info.totalfarmmarketing.com/market-updates

CORN HIGHLIGHTS: Corn futures were on the defensive with futures declining on prospects for good harvest weather, market jitters due to uncertain economic conditions in China, and funds gradually liquidating positions. Sharp losses in wheat were also noted. December futures closed 4-3/4 cents weaker at 4.17 and March down 4-3/4 at 5.25. Since the high last Thursday, December futures have lost 22-1/2 cents. Yesterday’s Weekly USDA Crop Ratings showed corn 59% Good-to-Excellent, up 1 point from last week. Harvest was 10% complete versus 4% last week and 8% a year ago. Corn dented 93% vs 87% last week and 94% a year ago: mature corn at 57% vs 37% last week and 56% a year ago. Declining wheat prices continue to weigh on corn futures, yet when comparing cost, December Chicago wheat futures are near 1.75 higher than December corn futures, suggesting little to no expectation of substituting wheat for corn in feed rations. Firm basis for near-term delivery suggests demand, especially from ethanol plants, is enticing farmers to get at harvest as quickly as possible.

SOYBEAN HIGHLIGHTS: Soybean futures weakened on the overnight with follow-through selling on a good harvest forecast and jitters regarding China’s economic outlook. Yet, prices rallied by midday, ending the session firmer with talk that China is in the market, potentially for as much as five cargoes of soybeans, which could be in the area of 1.5 million bushels. Futures traded under the 200-day moving average early in the session, which may have opened the floodgates to heavy selling, yet traders took it as a cue to buy as selling interest basically dried up. We are concerned that the overall trend remains sideways to lower since prices peaked in mid-July. The contract high was in early June when November futures peaked at 14.80. The retracement so far, near 15% off the contract high which suggests that prices could work lower targeting the 12.00 area or about a 20% drop in value. We stay with a friendly bias based on the world’s appetite for soybeans, tight supply, and the need for big production in the US and South America. For now, however, the path of least resistance for the near-term is lower prices due to harvest pressure.

WHEAT HIGHLIGHTS: Dec Chicago wheat lost 10-1/2 cents today, closing at 6.90-1/4 and March lost 10-1/2 cents, closing at 7.01. Dec KC wheat lost 9-1/2 cents today, closing at 6.90-1/2 and March lost 9-1/4 cents closing at 6.99-3/4. Yesterday’s losses seemed to carry through today in the wheat market. Russian winter wheat areas have been dry for planting but have some chances of rain this week. Ukraine could also see some rains. For 10 consecutive weeks, Russian export prices have gone up. US Wheat plantings are 21% done vs 18% average and 12% last week. Winter wheat is 3% emerged. Today’s US weather map shows some rains in the eastern Midwest and southern Plains, areas where SRW wheat will be planted. Conversely, western Plains HRW wheat areas will be drier over the next seven days. Total Inspections are down 11% from a year ago at 283.4mb. The managed funds are short Chicago wheat. The insurance price on winter wheat is 7.08 per bushel, compared to 4.90 last year.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.