MARKET SUMMARY 9-22-2021

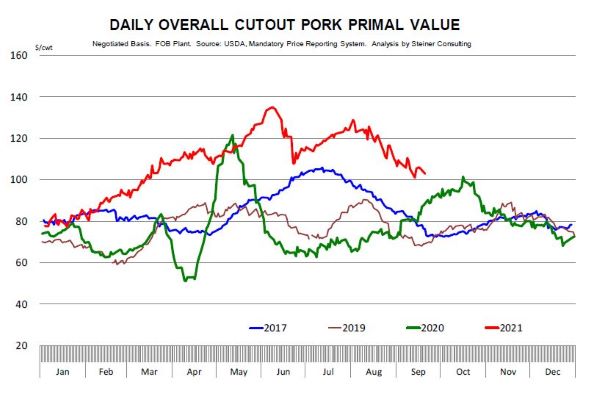

Pork cutout values have tumbled off the highs for the year but may be finding some stability. The key fundamental in the lean hog futures market is the value of the pork carcasses. Prices have steadily dropped off the high from earlier in the year and weigh on lean hog futures. Pork carcasses were trading over $130 in June, when hog futures markets were also trading over the $100 level. The strong demand was led by good domestic demand and an active export market. A large portion of the export demand was led by China and its demand for pork supplies. Since the peak, export demand has tailed off, especially in China, as the domestic pork values have slipped, and their supplies have built. In the U.S. demand has stayed supportive, but COVID concerns have brought some caution into the U.S. market. Pork values have given back over $30 of value but recently have seemed to find some footing at the support of the $100 level. Historically, this is still a good value for pork products, trading well above previous years and market averages. If pork values hold in this area, that should be longer term supportive of hog prices as we move into the end of the year and 2022.

Like what you’re reading?

Sign up for daily TFM Market Updates and stay in the know:

https://info.totalfarmmarketing.com/market-updates

CORN HIGHLIGHTS: Corn futures ended the session with gains of 4 to 8-1/2 cents as December lead today’s rally, closing at 5.25-1/2. Firmer wheat and soybeans prices helped corn futures close on a strong note. Positive ethanol margins were supportive, as were firmer crude oil prices and a rebound in the stock market. A small vote of confidence with one of China’s embattled corporations, Evergrande, was noted as apparently they negotiated a debt payment. A growing consensus is suggesting this company’s problems may be more concerning for China rather than world markets. Our bias is more cautious as big problems in one country can have a serious ripple effect on all of us. In recent weeks, softer corn prices and stronger energy have help put ethanol margins in the black. Also helping to support ethanol is lower production, as some plants are idle waiting for new crop corn, thereby reducing the supply of ethanol. This was reflected in the corn used for ethanol production last week at 94 mb, down over 1.1 mb from the previous week. Harvest will grow stronger in the days and weeks ahead as the crop continues to rapidly mature. Tar spot issues are more evident this year than any time in recent memory, complicating late season maturity. Final yield could be reduced as late season disease issues are being reflected in some early yield reports.

SOYBEAN HIGHLIGHTS: Soybean futures gained 3-0 to 9-0 cents as January futures lead today’s gainers, closing at 12.91-3.4. November closed 8-3/4 cents firmer, ending the session at 12.82-3.4. A rebound in the stock market, stronger energy prices, short covering in corn and wheat were all noted in today’s gains. Soybean oil futures had an impressive showing today, gaining more than 100 points, posting its highest price in four sessions on the heels of strong palm oil prices. Soybean meal finished mostly steady. Harvest is picking up steam but will remain slow in parts of the central and eastern Midwest, as rain continues to push through this region. Yield results are variable with some impressive numbers being reported in southern Illinois and Indiana; yet, we would argue that early feedback results are mostly mixed with some crop better than anticipated and some disappointing. It is too soon to draw a conclusion with only 6% of the crop harvested as of Sunday; however, feedback to date would suggest an across the board better than expected crop is not likely. The technical trend remains weaker with the 200-day moving average at 12.68 in November futures acting as support.

WHEAT HIGHLIGHTS: Dec Chicago wheat gained 15-1/2 cents today, closing at 7.05-3/4 and March gained 15 cents, closing at 7.16. Dec KC wheat gained 15-1/2 cents today, closing at 7.06 and March gained 15 cents, closing at 7.14-3/4. With a nice recovery in most markets today, wheat followed. Next week we will get the USDA’s September 1 Stocks report. On this report, the USDA historically tends to find more wheat feeding and lower stocks. That may not be the case this year as higher prices may have curbed wheat as a feed in the US. Ironically, reports continue to circulate that China has used more wheat in their rations this past season. While there has not been much fresh news in wheat and no strong influences on price, the strength of the dollar is probably limiting exports in all grains, but especially in wheat. Winter wheat plantings have started in Argentina, and La Nina could keep southern Brazil and northern Argentina drier than normal this season. Here in the US, there is a chance of rains in the southern plains next week; this is a very important rain event for the winter wheat crop there, as dry conditions could limit seedings and germination. In southern Russia, beneficial rains are expected to fall later this week. Russian analyst, SovEcon, raised their estimate of the country’s wheat crop 200,000 mt to 75.6 mmt, citing better yields in Siberia.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.