Information produced by ADM Investor Services, Inc. and distributed by Stewart-Peterson Inc.

Wheat prices overnight are up 18 in SRW, up 21 1/2 in HRW, up 24 3/4 in HRS; Corn is down 1; Soybeans up 7 3/4; Soymeal up $1.25; Soyoil down 2.29.

Markets finished last week with wheat prices up 29 3/4 in SRW, up 22 in HRW, up 16 1/2 in HRS; Corn is up 18; Soybeans up 52; Soymeal up $2.27; Soyoil up 0.06.

Markets finished last year up 3% in SRW, up 11% in HRW, down -4% in HRS; Corn is up 14%; Soybeans up 14%; Soymeal up 16%; Soyoil up 13%.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Chinese Ag futures (MAR 23) Soybeans up 51 yuan; Soymeal up 44; Soyoil unchanged; Palm oil up 20; Corn up 9 — Malaysian palm oil prices overnight were up 79 ringgit (+1.89%) at 4253.

There were changes in registrations (93 Soybeans, -88 Soymeal). Registration total: 2,788 SRW Wheat contracts; 0 Oats; 154 Corn; 181 Soybeans; 993 Soyoil; 59 Soymeal; 310 HRW Wheat.

Preliminary changes in futures Open Interest as of December 30 were: SRW Wheat down 2,275 contracts, HRW Wheat up 2,326, Corn up 7,841, Soybeans up 4,565, Soymeal up 3,439, Soyoil down 1,524.

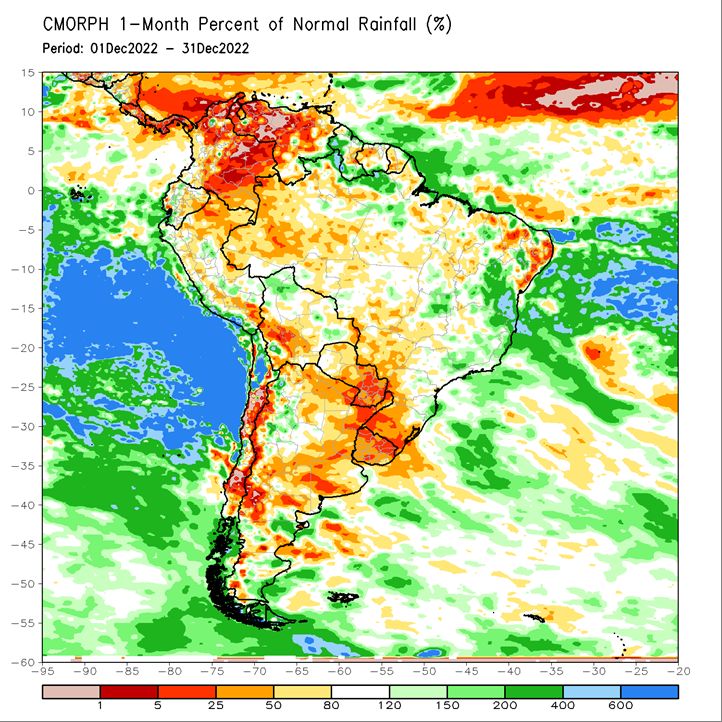

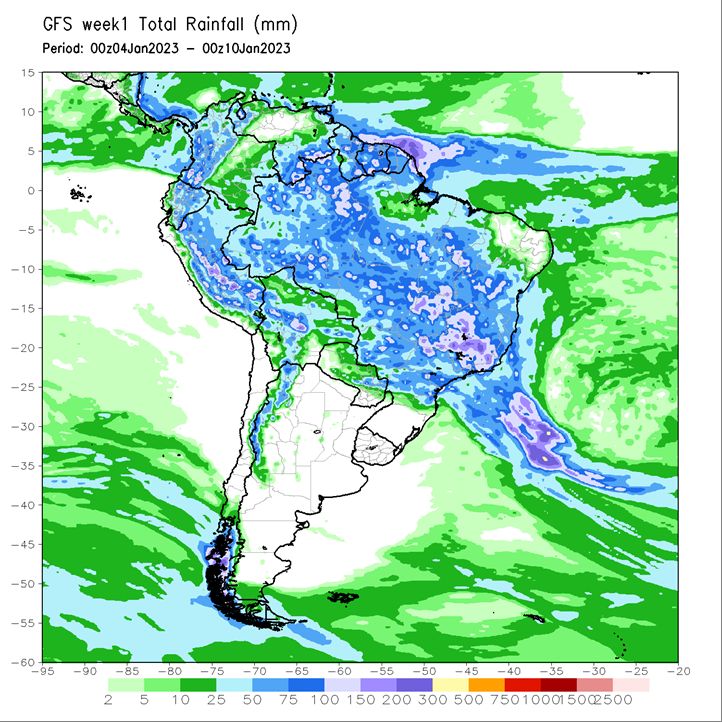

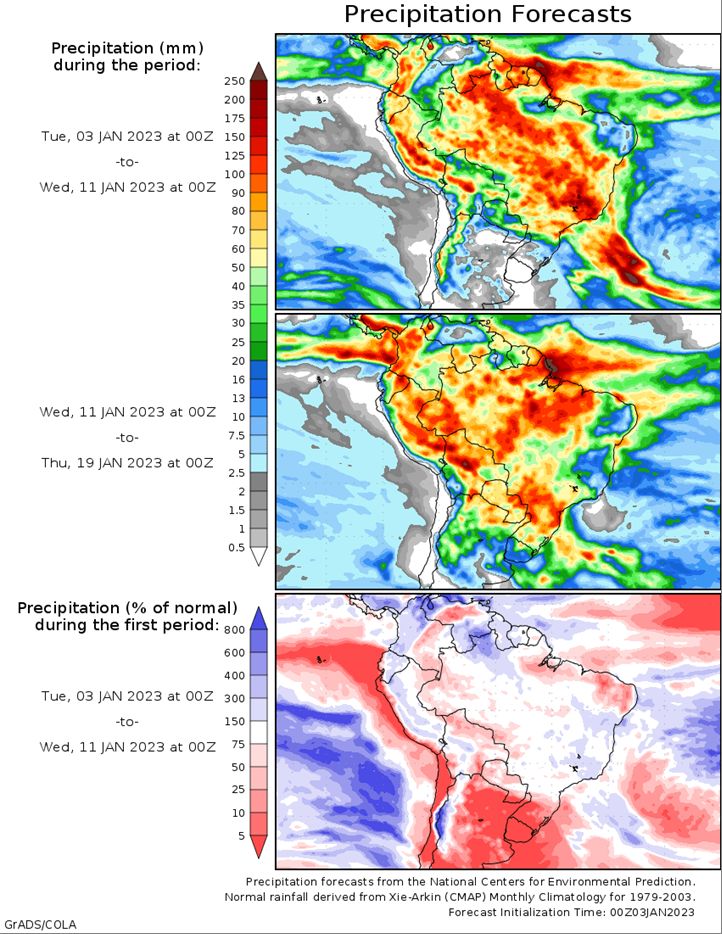

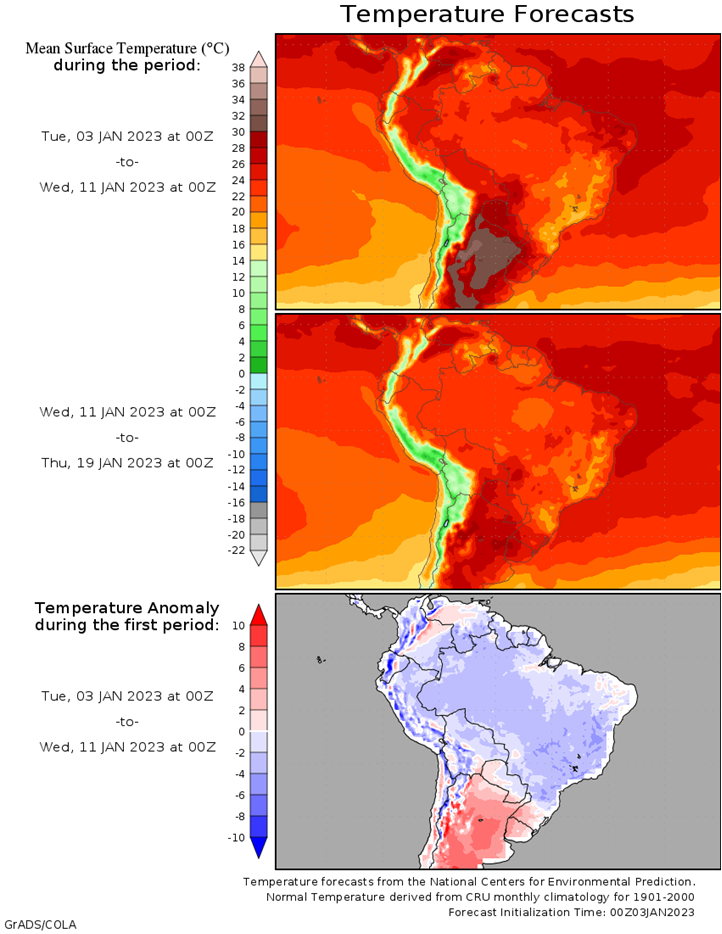

Brazil Grains & Oilseeds Forecast: Rio Grande do Sul and Parana: Scattered showers north Tuesday-Wednesday. Mostly dry Thursday-Saturday. Temperatures near normal through Wednesday, near to below normal Thursday-Saturday. Mato Grosso, MGDS and southern Goias: Scattered showers through Saturday. Temperatures near normal through Saturday.

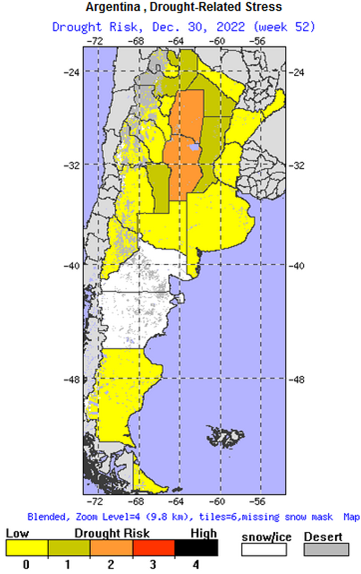

Argentina Grains & Oilseeds Forecast: Cordoba, Santa Fe, Northern Buenos Aires: Isolated showers Tuesday. Mostly dry Wednesday-Saturday. Temperatures near to below normal Tuesday-Wednesday, near to above normal Thursday, above normal Friday-Saturday. La Pampa, Southern Buenos Aires: Mostly dry through Saturday. Temperatures near to below normal Tuesday-Wednesday, near to above normal Thursday, above normal Friday-Saturday.

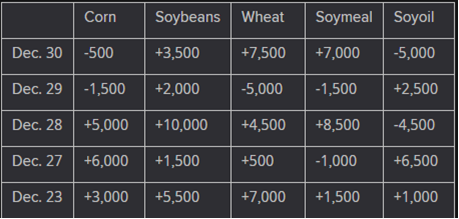

The player sheet for Dec. 30 had funds: net buyers of 7,500 contracts of SRW wheat, sellers of 500 corn, buyers of 3,500 soybeans, buyers of 7,000 soymeal, and sellers of 5,000 soyoil.

TENDERS

- SOYBEAN SALE: Private exporters reported the sale of 186,000 tonnes of soybeans to unknown destinations for delivery in the 2022/23 marketing year, the U.S. Agriculture Department said.

PENDING TENDERS

- RICE TENDER: South Korea’s state-backed Agro-Fisheries & Food Trade Corp. issued an international tender to purchase an estimated 113,460 tonnes of rice to be sourced from the United States. The deadline for submissions of price offers is Dec. 29.

US BASIS/CASH

- Spot CIF bids for barges loaded with soybeans and shipped down rivers to exporters at the U.S. Gulf firmed on Friday, rebounding from a decline on Thursday.

- Robust short-term demand for U.S. soybeans on the export market supported the gains in the nearby CIF bids.

- But bids for deferred months were weaker as overseas buyers were expected to be focused on cheaper supplies from the harvest in Brazil and Argentina, which will be in full swing by then.

- FOB offers for soybeans followed a similar pattern, rising in nearby months but falling in deferred time periods.

- The CIF market for corn continued to weaken, as export demand for U.S. offerings of the grain was expected to remain cold.

- CIF soybean barges loaded in December were bid at 155 cents over January, up 8 cents from Thursday.

- Trades for January soybean barges were reported at 135 cents over futures, 141 cents over futures and 142 cents over futures. That compares with 137 cents over futures and 138 cents over futures a day earlier.

- FOB offers for soybeans loaded at the U.S. Gulf in January gained 5 cents to 160 cents over January futures. But offers for February and March elevations fell by 6 cents and 3 cents, respectively.

- CIF corn barges loaded in December were bid at 105 cents over March futures, 4 cents lower than a day earlier.

- Export premiums for January loadings of corn dropped 1 cent to 132 cents over March futures.

- CIF bids for soft red winter wheat loaded in December held steady at 120 cents over futures.

- FOB offers for soft red winter wheat loadings at the Gulf during March, the closest time period available, were unchanged at 135 cents over.

- Spot CIF bids for hard red winter wheat barges were unchanged at 157 cents over futures. FOB offers for January also were unchanged, at 180 cents over futures.

- Spot basis bids for corn and soybeans were mostly steady to softer in the U.S. Midwest on Friday in subdued trade ahead of a three-day weekend, with freight shortages slowing grain movement in some northern states, merchandisers said.

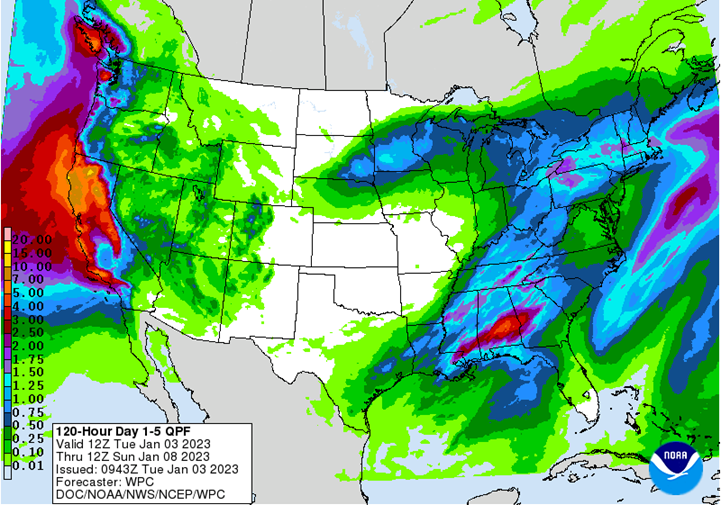

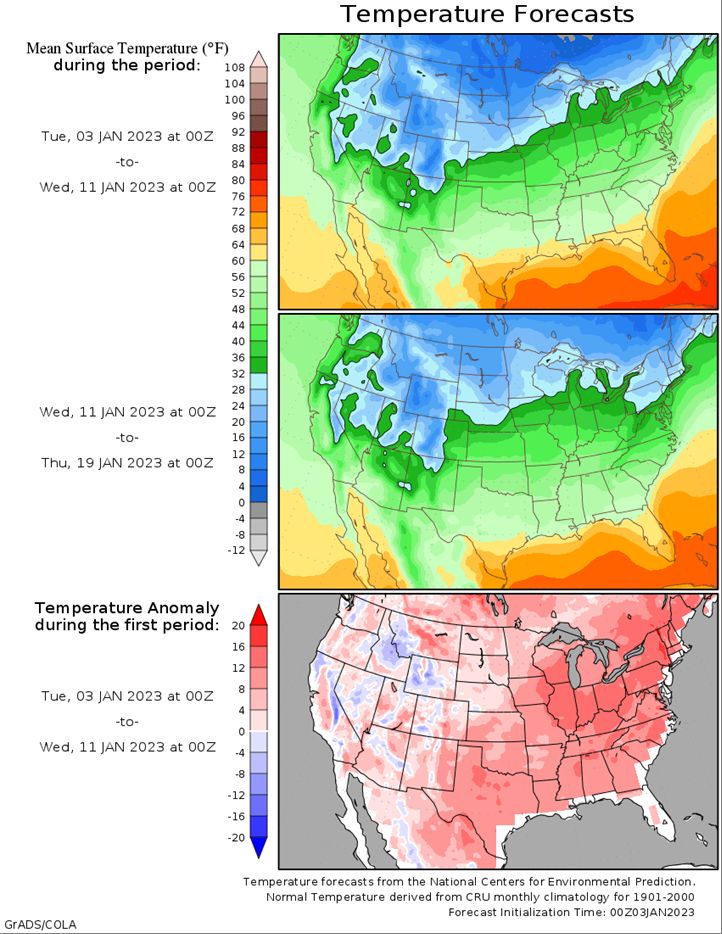

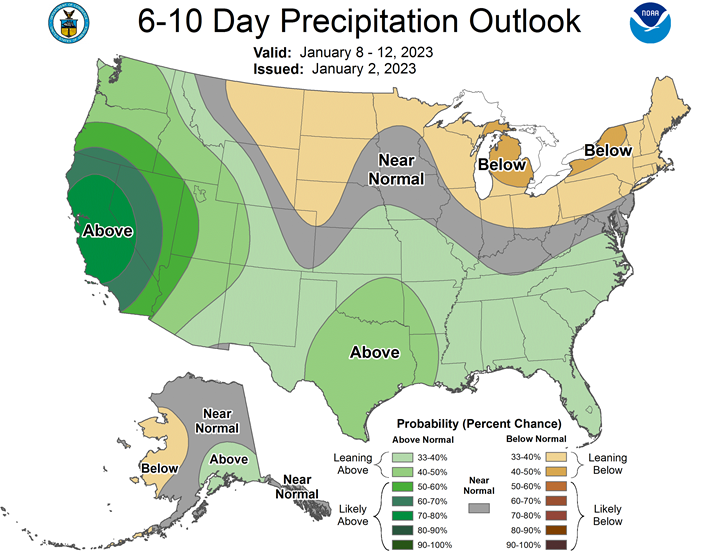

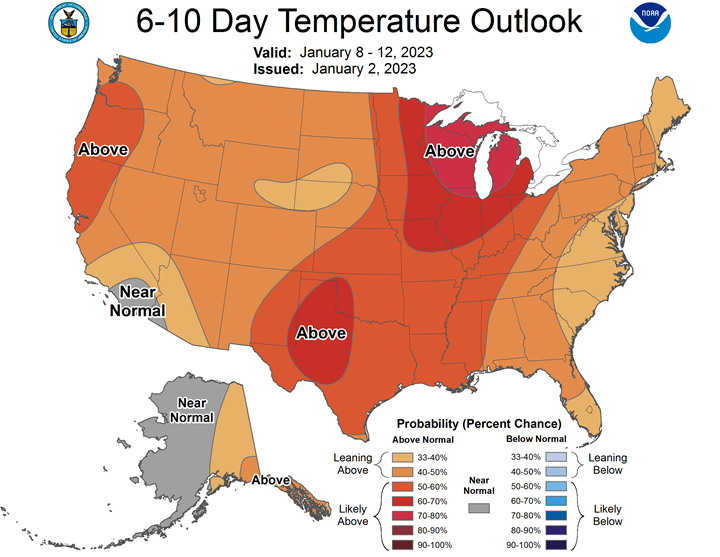

- Union Pacific Corp said it embargoed rail traffic on its lines in Iowa, Minnesota and Wisconsin starting Dec. 29 due to recent severe weather and forecasts for snow and ice over the next week. Along with Union Pacific, CSX Corp warned of delays earlier this week. (Full Story)

- The rail corn basis fell 3 cents Friday at the Evansville, Indiana, terminal and 5 cents at an elevator in Council Bluffs, Iowa. But the basis firmed 10 cents at Toledo, Ohio.

- The soybean basis fell 15 cents at a Des Moines, Iowa, processing plant. A few locations have rolled their soybean basis to post against the March futures as January nears its Jan. 13 expiration.

- Spot basis offers for soymeal were mostly steady in the U.S. Midwest on Friday, drawing underlying support from freight shortages that have curbed availability of the feed ingredient, merchandisers said.

- Union Pacific Corp said it embargoed rail traffic on its lines in Iowa, Minnesota and Wisconsin starting Thursday due to recent severe weather along with forecasts for snow and ice over the next week. Along with Union Pacific, CSX Corp warned of delays earlier this week.

- Meanwhile, soymeal brokers have begun rolling their basis offers to post against March futures contract as the January contract nears its Jan. 13 expiration.

- Spot basis bids for corn were mostly steady to weaker in the U.S. Midwest on Friday ahead of a three-day weekend, and grain handlers in northern states continued to struggle with rail freight delays exacerbated by last week’s winter storm, merchandisers said.

- Union Pacific Corp and CSX Corp warned of shipment delays this week.

- The spot corn basis fell on Friday at processing sites in Cedar Rapids, Iowa, and Blair, Nebraska, as well as at ethanol plants in Annawan, Illinois, and Council Bluffs, Iowa. But the basis firmed by a nickel at a Toledo, Ohio, elevator.

- Spot basis bids for hard red winter (HRW) wheat held steady in the southern U.S. Plains in subdued trade on Friday ahead of a three-day weekend, dealers said.

- U.S. markets will be closed on Monday in observance of New Year’s Day, with trade resuming on Tuesday, Jan. 3.

- Protein premiums for hard red winter wheat delivered by rail to or through Kansas City rose by 25 cents a bushel on Friday for wheat with 11.8% protein, while premiums for all other grades were unchanged.

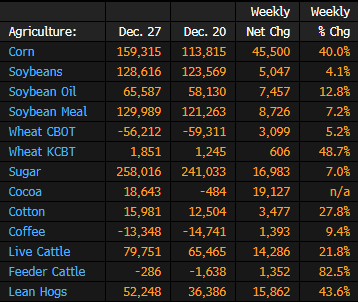

CFTC Money Managers’ Commodity Positions for Dec. 27

Sovecon raises 2022/23 Russian wheat export forecast

Sovecon, a leading Black Sea agricultural markets research firm focused on Russia and Ukraine, has increased its 2022/23 Russian wheat export forecast by 0.2 million tonnes to 44.1 million tonnes, it said on Friday.

Sovecon expects record or near-record monthly export volumes in the second half of the July-June season. Shipments will be supported by relatively high global prices, the weakening of the rouble, and the pressure of record stocks on the domestic market.

Ukraine’s Grain Exports Drop 32% Y/y in Season So Far

Ukrainian grain exports in the season that began July 1 totaled 22.8m tons as of Monday, down 32% y/y, according to the Agriculture Ministry.

- Total includes:

- 8.4m tons of wheat, down 48% y/y

- 1,6m tons of barley, down 70% y/y

- 12.6m tons of corn, up 9% y/y

WHEAT/CEPEA: Brazil may become an important global exporter

Brazil can become an important player in global wheat trades in 2023. Currently, the country is a major importer, but the sector can take advantage of the opportunities brought by the lower supply in Argentina and logistical problems at the Black Sea and increase its participation in world shipments. Projections indicate that Brazil may become the 10th biggest exporter of wheat in the 2022/23 season.

Although the 2022/23 wheat supply continues to move up for the fourth year in a row, global stocks may reduce for the third consecutive season. In the last three crops, while the world consumption increased 5.8%, the production rose by 2.5%. In the same period, global transactions increased 8.5%. As a result, the stock/consumption relation may change to 34.1%, the lowest since 2014/15.

As for this season (the harvest has finished in the Northern Hemisphere, while it is about to finish in the South), the USDA forecasts a reduction in the production for the European Union, India, Pakistan, Ukraine and Argentina. In global terms, the supply is expected to increase 0.2%, at 780.6 million tons.

On the other hand, due to covid-19, high prices and the competition with corn, the wheat demand from China, India, Iran, Ukraine and the US may be limited. Therefore, in world terms, the demand is expected to total 789.5 million tons, 0.5% less than in the crop before. Still, global transactions are likely to increase almost 2%, at 208.6 million tons, representing 26.2% of the world production, the biggest relation in history.

As a result, contracts with due dates up to the first semester of 2024 are firm at CME Group, indicating that the market needs another good crop in 2023/24 to balance global inventories.

In Argentina, the production is forecast so far at 12.5 million tons, the lowest since 2013/14, affected by unfavorable weather conditions. Therefore, Argentina is likely to export only 7.5 million tons, against 16.3 million tons in the last season.

As for Brazil, according to Conab, due to the big crop, shipments may total 3 million tons (from August/22 to July/23), 1.5% below that verified in the last season – however, these numbers are likely to be readjusted. Conab says imports may total 6.1 million tons between August/22 and July/23, 0.3% more than in the previous crop.

This year has started with one of the highest volumes available in history. It is an important scenario, since international prices are high and Brazil may face difficulties to import wheat in the first semester.

Brazil may continue producing more wheat in 2023, specially because of high prices in both domestic and international markets. Thus, the volume imported to meet the domestic demand may continue reducing, while the exportable surplus is expected to increase.

Brazil Planted Area May Double Without Clearings: Ag. Minister

Brazil’s new government will open doors for sustainable agriculture production through rising investments, says the new Agriculture Minister Carlos Favaro.

- If Brazil’s planted area increase by 5% a year over degraded pastures, the nation may double its grain area in 20 years without killing a single tree, he says on its first speech at the post

- From 30m to 40m hectares of damaged pastures may be used for agriculture applying technology

- Favaro says he’ll work to rebuild relations with global community that have been hurt by the disrespect to the environment

- We’ll have the world’s most sustainable agriculture production”

- Fighting hunger in Brazil will be the ministry’s first challenge

- Minister also has the goal to pacify the relation between President Luiz Inácio Lula da Silva’s government and agribusiness, which massively supported the reelection of Jair Bolsonaro

- Agriculture Ministry will develop policies for small, medium and big farmers

Argentina FX Devaluation Spurred 6.4m Tons of Soybean Trades

A five-week currency devaluation that expired on Dec. 30 spurred farmers to sell 6.4m metric tons of soybeans to crushers and exporters, according to the Buenos Aires Grain Exchange.

- NOTE: It was the second temporary devaluation for farmers after a similar measure in September

- Soy crushers/exporters sold $3.16b on the FX market during the program

Argentina 2023 Crop Exports Seen Bringing $33.4b to Central Bank

Crop exporters are forecast to sell $33.4b on the FX market in 2023, compared to $44.1b this year, the Rosario Board of Trade said in a weekly newsletter.

- The forecast is preliminary and could easily change depending on how weather conditions affect production

- In 2021 crop exporters sold $38.1b, the first time the figure had surpassed $30b since 2012

Malaysia’s Dec. 1-31 Palm Oil Exports 1,456,986 Tons: Amspec

Shipments fall 2.8% m/m from 1,498,862 tons exported during Nov. 1-30, according to AmSpec Agri.

- Full-year exports drop 6.65% to 15.43m tons y/y

Brazil’s new ag minister to develop USDA-like agency

Brazil’s incoming agriculture minister plans to turn the national supply and statistics agency Conab into a body akin to the United States Department of Agriculture (USDA), Reuters reported after speaking with the minister by phone on Friday.

Carlos Favaro, who will take office on Monday, also said the government will resume stockpiling food staples like corn, rice and beans to fight hunger in Brazil, a major food exporter, using Conab as the agency to execute that policy.

Favaro said overhauling Conab is a priority. That means turning it into “an information agency” that will put out crucial data to guide market agents and government actions going forward.

In a short period of time, he said, Conab would begin releasing reports on crop inventories, forward sales, weather forecasts and export flow data, which it currently does not.

“It is important for the industry to know how much grain is available,” he said citing lack of information on export flows and existing grain stocks. “Conab reports are for crop forecasts only.”

Regarding the plan to resume stocking up on corn, rice and beans, Favaro noted the government’s reserves were depleted, representing a threat to food security.

“It is shameful that Brazil is a record food producer while people are queuing up to buy bones and going hungry,” he said.

Shoring up the government’s food stocks, supporting crop sales and improving Brazil’s infrastructure capabilities will also help grain processors in times of scare supplies, he added.

Brazil is a mass producer of commodities like soybeans and corn, which are partly exported and partly processed internally to make livestock feed.

Under Favaro’s plan, the new government will also be able to at least double the budget for agriculture research agency Embrapa.

He said Embrapa’s research priorities will include developing technologies to reduce on-farm carbon emissions and new fertilizer offerings to reduce Brazil’s import dependence, among others.

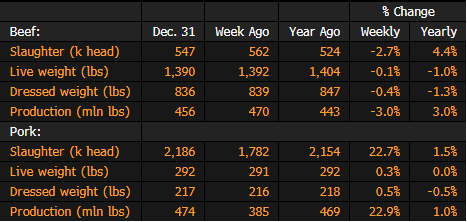

US Beef Production Falls 3% This Week, Pork Up: USDA

US federally inspected beef production falls to 456m pounds for the week ending Dec. 31 from 470m in the previous week, according to USDA estimates published on the agency’s website.

- Cattle slaughter down 2.7% from a week ago to 547m head

- Pork production up 22.9% from a week ago, hog slaughter rises 22.7%

US November Agricultural Prices Paid and Received

SOUTH AMERICA

UNITED STATES

This commentary is provided by ADM Investor Services, a futures brokerage firm and wholly owned subsidiary of ADM Company. ADMIS has provided expert market analysis and price risk management strategies to commercial, institutional and individual traders for more than 50 years. Please visit us at www.admis.com or contact us at sales@admis.com to learn more.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by Archer Daniels Midland Company. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS.

| CONFIDENTIALITY NOTICE

This message may contain confidential or privileged information, or information that is otherwise exempt from disclosure. If you are not the intended recipient, you should promptly delete it and should not disclose, copy or distribute it to others. |